If capital markets were an amusement park, investing in stocks would be like riding the tilt-a-whirl, whereas bonds would be more like the kiddie rides. That’s usually the case, anyway. In 2022 year-to-date, both have been delivering relatively stomach-churning returns. With rising interest rates, bond prices have been falling, even as stock prices have been recoiling from their own assortment of global risks.

What’s up with both assets being down simultaneously? An informed perspective helps us understand: This combination may be unusual, but it’s not unprecedented. It’s also no reason to give up on your carefully structured bond portfolio, try to time the bond markets, or otherwise abandon a well-diversified investment strategy.

What’s Going On?

First, let’s describe what the excitement is all about in the bond markets. As inflation reached 40-year highs earlier this year, the Federal Reserve sought to combat it by raising the Federal Funds Rate, which in turn can impact other interest rates. At least in theory, when the economy is running too “hot,” higher lending rates can help cool it down. As such, the Fed is likely to continue raising rates for the foreseeable future, come what may in the stock markets.

We hope the efforts work. In the meantime, year-to-date bond market performance has been painful. Long-term Treasury bonds lost over 21% in the first half of the year, which surpasses their previous record loss of 17% in the 12 months ending March 1980. Intermediate-term Treasuries (similar to those anchoring Vista portfolios) are down significantly less, down 6% returns year-to-date.

Despite the setbacks, we remain convinced you can better position yourself to achieve your financial goals by trusting your plan already in place for staying broadly diversified among stocks and bonds. Let’s explore some of the reasons why this is so.

Relative Scales

Even though this has been a historically bad half-year for bonds, “bad” bond performance and volatility still pales in comparison to stocks. For example, as we’ve pointed out in past periods of rising rates (here in 2015 and again in 2017), going back to 1926, the lowest 12-month return for U.S. stocks was –65%. Even the worst bond returns year-to-date (or essentially ever) haven’t come close.

The Nature of Bonds

Also remember, the word “bond” is synonymous with “promise.” (As in, “My word is my bond.”) This is one way in which high-quality bonds differ from stocks, which carry no similar promise to shareholders. This is also one reason bonds typically behave differently from stocks, with their returns coming from two sources:

- Yield: The bond’s underlying interest payments, or yields, which are generally fixed.

- Price: The bond’s price fluctuations in secondary markets where they’re bought and sold after issue.

In a seesaw relationship, as future bond yields rise, existing market prices fall—and vice-versa. This means the losses we’ve seen year-to-date can be thought of as price fluctuations that don’t change the underlying interest payments you’ve been promised as a bondholder. And provided the bond doesn’t default—another reason why we favor the safest bonds—not only do bondholders continue receiving interest, but they can expect to receive their principal back at maturity. If rates are higher at that time, those proceeds can be reinvested at the prevailing higher rates.

Short-Term Pain, Long-Term Gain

That’s another reason current prices are no reason to lose faith in bonds: the painful near-term rate hikes bring lower current bond returns, but higher expected ones moving forward.

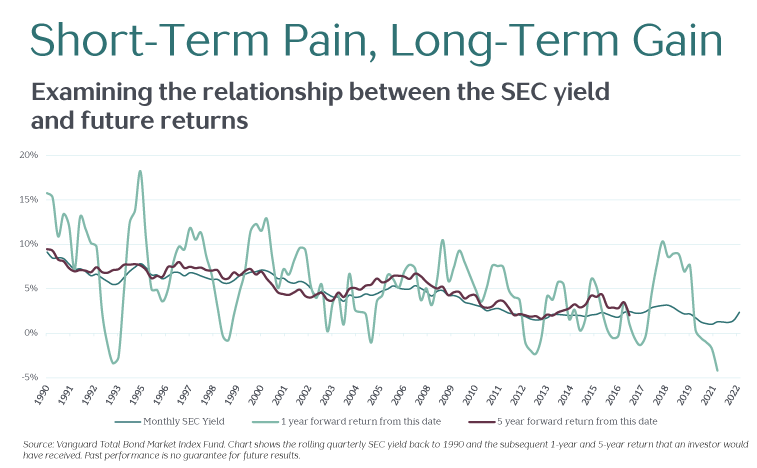

Consider the chart below, which shows us rolling quarterly SEC yields for the Vanguard Total Bond Market Index back to 1990, and their subsequent returns 1 and 5 years forward. Among other things, this depicts the smoothing effect time should have on a bond portfolio’s performance. In other words, annual returns can be volatile, but over time, they tend to align with the SEC yield at the time of purchase.

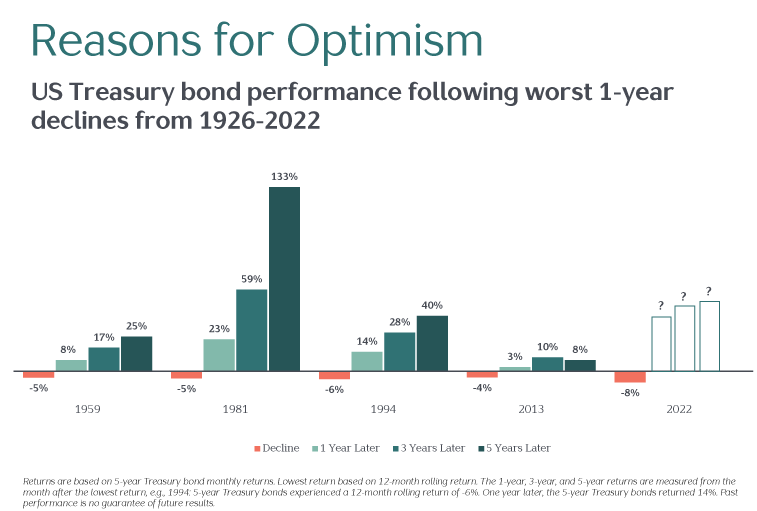

If history is any guide, this means we can be optimistic going forward with the recent uptick in yields. For example, using historical data for 5-year U.S. Treasury bonds, we looked back at some of the worst 1-year bond declines from 1926 through April 2022. In all instances, bond returns were positive in the subsequent 1, 3, and 5 years.

Diversification Remains Alive and Well

Some may also be questioning whether bonds can still offer diversification benefits. After all, stocks and bonds don’t typically deliver negative returns at the same time, as they have been lately. Since 1926, stocks have delivered negative returns about 25% of the time across rolling 1-year periods. Bonds have gone negative less often—about 10% of the time. How often have stock and bond 1-year downturns coincided? Just 2% of the time.

This means current conditions are unusual, but not unprecedented, nor do they negate the underlying fundamentals of portfolio construction. And again, with the recent rise in rates, we can expect good news for long-term bond investors moving forward—all the more reason to sit tight for now.

Investing Is a Breeze

If you’re still not convinced, ask yourself: Would moving away from your existing investment plan and portfolio offer better odds of success? A mountain of data suggests otherwise. For example, just 11% of active mutual funds that sought to profit by predicting changes in interest rates outperformed their benchmark over the 20-year period ending December 2020.

Those don’t seem like odds worth taking. Instead, we suggest accepting that, once again, future expectations are already reflected in today’s prices for stocks and bonds alike. Instead of trying to predict and speculate on the Fed’s next moves, your time and energy may be better spent enjoying the summer breezes. Like today’s bond prices, they won’t last forever.