With the recent increase in inflation, you may already be adjusting some of your spending habits to offset the higher prices on goods and services. Should you also alter your investment portfolio to defend against inflation?

It may make sense to enjoy a penny saved by driving less often or ordering ordinary coffee instead of lattes for a while. But we would advise caution before overhauling your investment portfolio. When we scrutinize the most popular ploys for dodging inflation—such as buying gold, commodities, or energy stocks—we find they haven’t lived up to the hype about their protective powers. Plus, many of the factors we’ve already incorporated into our Vista portfolios are there precisely to help your investments remain resilient to inflation over time.

Expected vs. Unexpected Inflation

It helps to start with understanding how inflation works. When you read about inflation, it’s usually cast as the thief, snatching away your wealth. In reality, inflation comes about in two ways: expected and unexpected.

Expected inflation: A touch of expected inflation actually fuels economic growth. That’s why governments often take preventive action if inflation drops too low and turns into deflation. It’s also why markets bake some level of expected inflation into their pricing. Inflation’s expected 5-year break-even rate (as of early June 2022) was at 2.9%, which is remarkably similar to the CPI’s average long-term historical rate going back to 1926.

So, what’s the best way to ensure you have the highest chances to outpace inflation over the long run? History shows owning publicly traded stocks, real estate investment trusts (REITs), and bonds give you the highest probability to beat inflation over 1-, 5-, and 10-year periods, with stocks and REITs giving you a 94% and 100% probability, respectively, of outpacing inflation over all rolling 10-year periods from 1973 to 2022.

However, just simply outpacing inflation doesn’t necessarily mean you’re going to have enough growth in your investments to fund your lifestyle in retirement. Bonds, for example, outperformed inflation 98% of the time over those same 10-year rolling periods, but a 100% bond portfolio would most likely not have the level of growth required to reach your retirement goals.

So, if we look at the magnitude of real returns (that is, net returns after inflation), stocks and REITs really separate themselves as the asset classes that give you not only the best odds of beating inflation, but also the highest positive real returns as well. Over that entire period from 1973 to 2022, stocks and REITs had annualized real returns of 6.7% and 6.4% respectively, compared to just 2.4% for bonds and 0.4% for short-term Treasury bills.

Unexpected inflation: Stacking the odds in your favor for long-term positive real returns is one thing, but what about the recent spike in inflation we’ve seen? The Consumer Price Index (CPI) rose 8.6% from May 2021 to May 2022, and that type of shock to the system was unexpected. And because it can rapidly degrade your spending power, it’s important to have parts of your portfolio designed to hedge against these kinds of jolts as well.

Expecting the Unexpected (and Protecting Against It)

As usual, it’s best if you’ve made your defensive moves in preparation for, rather than in reaction to, inflationary upsets. And when it comes to protecting against unexpected inflationary shocks while also maintaining long-term growth potential, we believe there is no better hedge than Treasury Inflation-Protected Securities (TIPS).

Regarding TIPS: Unlike “ordinary” Treasuries, TIPS pay more as inflation rises. As such, they are a relatively stable asset with some long-term expected returns. However, their inflation-protection component can work against you when inflation is low. We described that phenomenon in Trouble with TIPS. As we covered in What’s an Investor to Do About Inflation, it often makes good sense to diversify into a combination of TIPS, paired with other bond funds not indexed to inflation.

Concentrating on Alternative Assets: Gold, Commodities, and Energy Stocks

Many people wonder whether gold, commodities, and energy stocks should take a more prominent role in protecting portfolios against unexpected inflation. While these assets’ returns have sometimes increased with higher inflation, there are definite drawbacks to holding each in a long-term strategy. Let’s take a look at these next.

Gold Is a Slippery Substance

First, it’s important to remember gold has no underlying intrinsic value. Unlike a company, government, or real estate venture whose stocks, bonds, or properties you might invest in, gold creates nothing of substance against which to benchmark its worth. It does not provide any goods or services. It produces no underlying cash flow. Instead, its price is based solely on what others will pay for it at any given time. Gold’s lack of intrinsic value has played out in several concerning ways.

Gold vs. inflation: Over the past 44 years, gold has failed to outpace inflation more than half of all 1-, 5-, and 10-year rolling periods. In fact, over the same time frame, you had a slightly better chance of outpacing inflation by investing in 1-month Treasury bills (a proxy for cash).

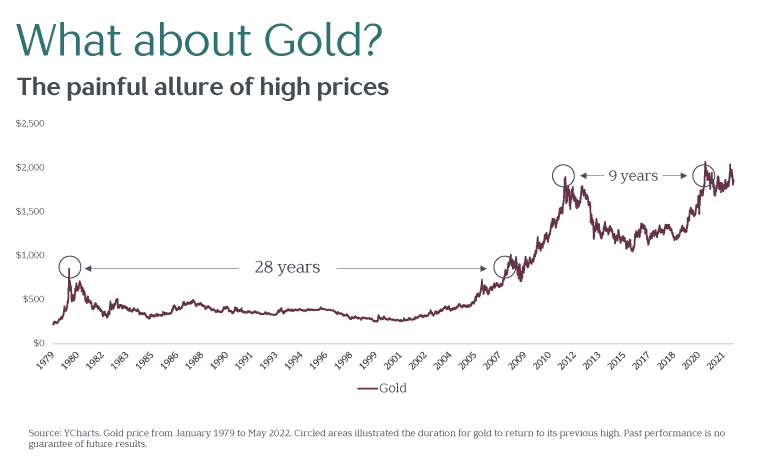

Gold recovery times: Gold has risen in popularity from time to time, and some of these times have coincided with a spike in inflation. However, when gold has become popular historically, there have been very prolonged periods of flat or negative returns. Take the inflationary spike of the early 1980s, for example. If an investor had purchased gold to hedge against inflation then, it would have taken 28 years to get back to the same level once inflation subsided. And that’s just in nominal terms. After accounting for inflation, the real price of gold still fell by 50% over that 28-year period.

We saw a similar story back in 2011 as gold became the hot commodity when the US government’s credit rating was downgraded. It took 9 years for gold prices to recover after that spike as well.

When you own a commodity that doesn’t produce cash flows along the way, it can be a long and bumpy road as you wait for the market to hopefully bid the price back up to recoup your investment losses.

The Wild World of Commodities and Energy Stocks

What about commodities and energy sector stocks? These assets have stood up well against unexpected inflation over the last three decades. They’ve also been outperforming year-to-date, with commodities up 31% and energy stocks up 19% as of June 16.

However, there’s a big catch: These same assets have exhibited extreme volatility along the way. A Dimensional Fund Advisors analysis of commodities and energy stocks found “the assets’ nominal returns have been around 20 times as volatile as inflation, and more than half of their nominal-return variation has been unrelated to inflation.”

In other words, while they’ve performed well lately (which probably explains their popularity), that’s as likely a coincidence as a dependable hedge against unexpected inflationary shocks.

As for commodities, as is the case with gold, we would rather own the companies profiting from the use of commodities versus the underlying commodities themselves. And, for energy stocks, we already own them as part of a globally diversified portfolio, and we want to avoid concentration risk by overweighting a certain sector in response to short-term market fluctuations.

Investing for the Ages

So, where do we go from here? Because we cannot predict when inflationary shocks will occur, we construct low-cost, globally diversified portfolios built to persist across periods of high and low inflation.

With respect to chasing after particular assets, it’s important to consider not only how each has performed in isolation, but also how it has fit into a portfolio’s inflation-adjusted total returns. Are concentrated positions in gold, commodities, and/or energy stocks expected to contribute to or detract from your ability to stay on course toward your greater financial goals over the long run? This is the real question.

We believe an appropriate mix of stocks, bonds, and REITs gives us the best chance for defending against inflation, while keeping your portfolio on track toward earning satisfying real returns over time. Adding a TIPS allocation can help further hedge against unexpected inflationary shocks.

Beyond using these basic building blocks to defend against inflation, there are all sorts of other reasons for holding a low-cost, globally diversified portfolio of stocks, bonds, and REITs. As such, whether higher inflation lingers or lifts anytime soon, our Vista view remains the same.