Here at Vista, we’ve found at least one benefit to having been around for a while: We’ve seen a lot of market history unfolding in real time—including past periods when investors were bracing for seemingly imminent inflation. Not unlike today!

Inflation Risks, Then and Now

Here’s an excerpt from our July 2009 quarterly client letter, when the world was digging out from the Great Recession. Sounds familiar, doesn’t it?

The second quarter of 2009 was a strong one for investors. Thanks to a worldwide market rebound that began in March, our clients’ portfolios now have positive year-to-date returns. Investors’ relief, however, is tempered by the fear of what may result from the Government’s unprecedented stimulus efforts: Inflation.

In 2009, fears of runaway inflation rates were never realized. The year ended on a deflationary note, with a –0.4% average annual U.S. inflation rate, followed by a 1.6% average annual U.S. inflation rate in 2010. Give or take a point or two, inflation rates have remained relatively stable ever since.

Still, that was then. What about today? The recent U.S. government stimulus packages coupled with pent-up consumer demand led the Consumer Price Index (CPI) to rise 4.2% in April relative to its April 2020 rate. It was the biggest 12-month increase since 2008. In May, the CPI topped itself again by rising 5% relative to its May 2020 rate. [Source]

Is inflation about to run rampant, or will history repeat itself and ultimately deliver another non-event? We don’t know. In fact, anyone who claims they do know had best check in with their hubris. Multibillionaire and long-time investor Warren Buffett once wisely quipped, “I don’t read economic forecasts. I don’t read the funny papers.” [Source]

Explanations vs. Predictions

That said, we do know a few things. Most importantly, we know we must prepare well in advance for inflationary periods, rather than wait for their arrival before we react. One big reason to prepare for, rather than react to, rising inflation is because today’s data points tell us nothing about what to expect over the long run.

First, it may be misleading to read much into the current one-year glance back. As a recent Wall Street Journal piece explains: “[A] year ago Covid-19 was causing havoc for the economy in addition to corporate profits.… The 4% comparison could provide an exaggerated snapshot of price pressures because it is from a deflated base in April 2020.” [Source]

We would suggest the Federal Reserve Economic Data’s (FRED’s) 10-Year Forward Breakeven Inflation Rates serves as a better marker for future expected inflation. According to FRED, mid-June markets were pricing future expected inflation at 2.4%. This is a bit higher than the last decade’s average, but well within historical norms, and not far off the Fed’s average target of 2%.

Investment Strategies for the Long Run

While FRED is the best indicator of the market’s current inflation expectations, even it is no predictor of where inflation is actually headed. While we can usually explain how and why past inflation has occurred in hindsight, the explanations do not offer a dependable model for predicting future inflation. Why? Because there will always be unexpected inflation or deflation that occurs due to future factors no one sees coming. (The COVID-19 global pandemic is a prime example.) This very dilemma has long guided our investment strategies. It’s why we focus on structuring our portfolios to endure nearly any possible outcome. In a word, this means diversification.

Stocks: What investors should care about over time is their real return, which is the rise or fall of their portfolio’s actual purchasing power after accounting for inflation. Throughout the long history of capital markets, stocks have been the most powerful asset class to combat inflation and achieve positive real returns. Going back to 1926, the S&P 500 has had an annualized real return of 7.2%, turning $1 of purchasing power into $752 of real purchasing power over that 94-year period. Conversely, one-month Treasury bills, which are often touted as the safest investments out there, had a real return of 0.4% over that 94-year period, turning that same $1 of purchasing power into a mere $1.49. Stocks can be volatile over the short run, but a broadly diversified stock portfolio is one of your most powerful anti-inflation defenses to ensure you maintain your purchasing power over time.

TIPS: An allocation to Treasury Inflation-Protected Securities (TIPS) should also serve as an effective hedge in inflationary times. While the real returns from “regular” U.S. Treasury bonds decline in the face of higher inflation, TIPS’ interest payments rise along with rising inflation, so their real returns remain relatively constant. For example, since the lows of March 2020 through May 2021, U.S. intermediate TIPS were up 17%, while their regular U.S. Treasury counterparts increased by around 1%. This reinforces the importance of diversifying across all asset classes, so you can capture positive returns when they show up, not chase them after the fact.

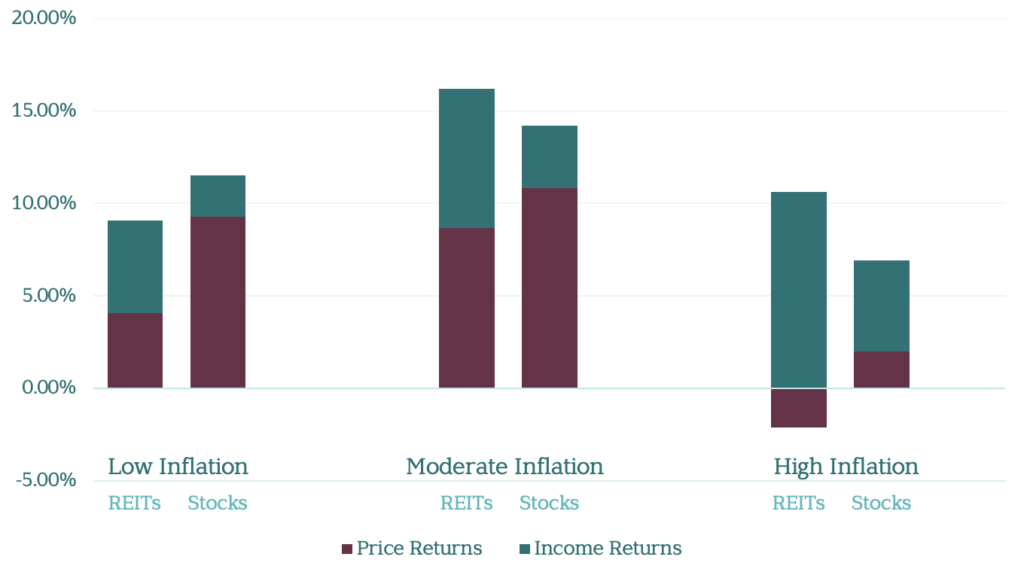

Real Estate Investment Trusts (REITs): At Vista, we also diversify a portion of our stock portfolio into REITs. As you can see in the chart below, rising prices (i.e., inflation) have generally led to substantially higher rental incomes, enabling REIT returns to outpace stock returns during high-inflationary times. REIT dividends may also offer inflation-busting advantages, having outpaced inflation in all but two of the past 20 years. [Source]

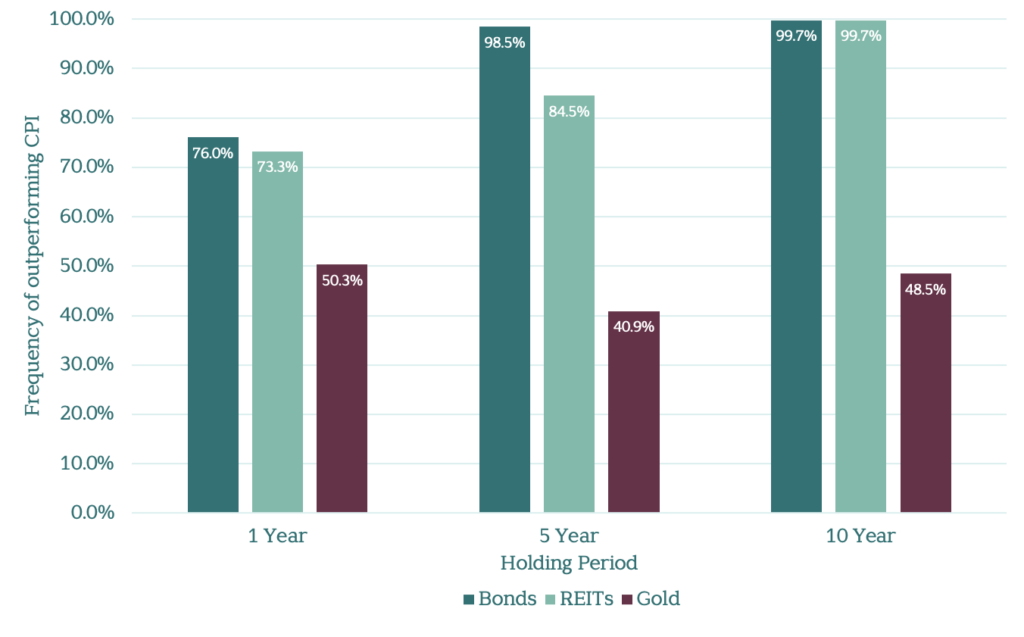

How often do bonds, REITs, and gold outperform the consumer price index (1978-2020)?

Source: DFA Returns Web, including Bloomberg Barclays Aggregate Bond Index, Dow Jones U.S. Select REIT Index (USD), and Gold (Spot Price) from 1978 to 2020

No Hold on Gold: Some suggest holding gold as another inflationary hedge. We do not. At least over holding periods of 1 to 10 years from 1978–2020, stocks, bonds, and REITs have all been more reliable to outpace inflation. Equally important, gold prices are speculative, with no direct role to play in a disciplined portfolio. Put another way, if you hold a stock, bond, or piece of property, you’re investing in a potentially beneficial product or service. If you buy a piece of gold, you own a lump of metal. As an investor, you’re better off investing in the companies that put gold to good use, rather than investing in the raw material itself.

REIT Returns Compared to Stock Returns During Different Inflation Periods (1972-2020)

Source: DFA Returns Web and Reit.com, including S&P 500 and FTSE All Equity REITs Index

Key Takeaways

Bottom line, we don’t believe anyone can accurately forecast whether inflation will linger, grow, or dissipate in the future. As such, we position our portfolios to harness positive real returns in all inflationary environments. We diversify across global stocks, as they are your best bet to generate positive real returns over the long run. But we also layer in TIPS and REITs to hedge against shorter-term unexpected inflationary shocks. Broadly speaking, in an uncertain world, diversification remains your best bet to prudently grow your real wealth over time.