Let’s face it, few summer blockbusters can compete with the thrill of a hot IPO rolling out in real time. The most promotable ones tease their audience with action-packed trailers, dramatic opening bids, and a high-speed, post-launch ride that leaves viewers at the edge of their seats. It’s not surprising, then, when you read about an exciting new IPO, you may wonder whether you should get in on the action.

What’s our take? We certainly have nothing against IPOs. After all, if companies never went public, there would be no public shares to trade and no public market in which to trade them. That said, while IPOs are essential to investing as we know it, we do not believe they are good investments at the outset.

Let’s explore why.

An Exciting Enigma

Undoubtedly, IPOs often make for interesting news—especially compared to the unremarkable business of buying and holding the type of tax-efficient, broadly diversified stock and bond portfolios we favor. And lately, there has been a lot of IPO news to report.

More IPOs to Go Around: In 2021 alone, there have already been nearly 700 IPOs as of mid-August, and the year isn’t over yet.

Oregon-Grown Action: For Oregonians in particular, there have been several tempting IPOs brewing close to home:

- Vancouver, WA, marketing data broker ZoomInfo and biotech startup Absci recently went public.

- Portland-based vacation rental giant Vacasa is scheduled to follow suit this fall through a Special Purpose Acquisition Company (SPAC) transaction.

- Then there’s Dutch Bros, our popular purveyor of caffeinated delights. As reported by The Oregonian in August, “Dutch Bros…hopes to raise $100 million by selling stock on Wall Street,” which would make it the first Oregon-based IPO to raise this sum since 2004.

Entertaining Opening Bids: An IPO’s first-day returns also are fodder for extra attention, especially when the numbers are particularly sensational. For example, people noticed when Airbnb (ABNB) and DoorDash (DASH) jumped by 113% and 86% on their respective IPO launch days, as well as when Weber Grills (WEBR) and Robinhood (HOOD) stumbled on theirs.

The outsized returns for Airbnb and DoorDash were also a bit misleading, as most investors had very modest first-day gains. As reported in Kiplinger: “Consider Airbnb’s December 10 debut. The first trade was at $146/share, or 115% above its $68 offering price, and closed at $145. Although headlines touted an eye-popping 113% gain, investors who bought at the opening price had a loss of 1%.”

Now, that’s entertainment. Unfortunately, it’s not investing.

False Hopes and Great Expectations

Beyond general stock-picking challenges, the IPO market is particularly brutal to individual investors.

Yes, IPOs have exhibited outsized stock returns on the first day their shares become available. For example, University of Florida Finance Professor Jay Ritter found, among 8,775 IPOs from 1980 to 2020, first-day trading averaged a satisfying first-day equal-weighted return of 18.4%.

But guess who usually earns those returns? Hint: Not you.

The Kiplinger piece continues: “Banks that underwrite IPOs set the offering price and dole out most shares at that price to their best customers, such as hedge funds and mutual funds … Most people can’t buy shares of an IPO until it starts trading. And that means they can’t benefit fully—if at all—from big first-day gains.”

Stock Picking by Any Other Name

It’s true, plenty of people have profited from participating in winning IPOs. Why shouldn’t you? First, picking particular IPOs is no different from any other form of stock picking. Whether an individual stock is decades old or brand new to the market, it’s possible to come out ahead by taking a concentrated position in it. But it’s unlikely, relative to embracing a broad market approach.

Rather than rolling the dice on one holding, an investor’s best odds are found by building a tax-efficient, globally diversified portfolio and sticking with it over time. That way, you’re always positioned to earn whatever the market has to offer, wherever good fortune happens to strike next.

A Day Late Becomes Dollars Shorter

Since most investors aren’t privy to an IPO’s first-day performance, we can exclude those numbers to provide a more accurate snapshot of how most IPO investors fare during the first year of trading.

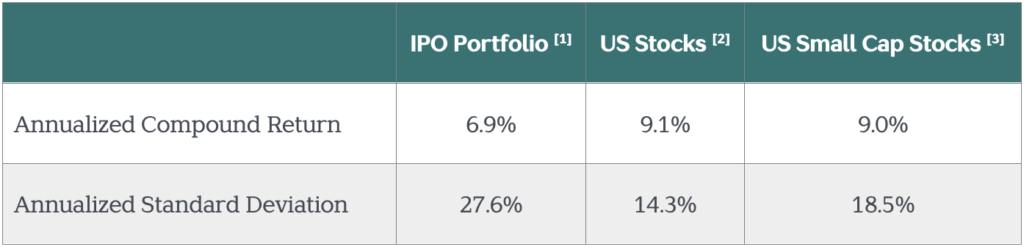

In a study conducted by Dimensional Fund Advisors, a hypothetical portfolio of IPO stocks significantly underperformed a broad benchmark over the nearly 30-year period from 1992 to 2018. As seen in the table below, the IPO Portfolio had annualized returns of 6.9% as compared to 9.1% and 9.0% for US Stocks and US Small Cap Stocks, respectively. The IPO Portfolio also exhibited higher levels of volatility relative to its broad market counterparts.

Source: Dimensional Fund Advisors and Bloomberg

[1] IPO Portfolio consists of US IPOs issued over the previous 12 months, weighted by market value and rebalanced monthly.

[2] US Stocks represented by the Russell 3000 Index.

[3] US Small Cap Stocks represented by the Russell 2000 Index.

Professor Ritter expands on this data, estimating about half of newly minted IPOs deliver negative returns over their first five years.

Are you still contemplating whether to buy some Dutch Bros stock if it goes public?

Sip on the stuff all you want. But we would suggest thinking twice before investing directly in it, lest you end up with beans for your effort.