The first state to make Labor Day an official holiday and to vote entirely by mail, Oregon recently celebrated another first. Starting January 1, 2020, Oregon will be the first state in the nation to offer a refundable tax credit for contributions made to its 529 College Savings Plan.

The refundable tax credit will replace the current tax deduction for plan contributions and offers Oregonians a unique opportunity to take advantage of both the tax deduction and credit simultaneously over the next four years.

How it Works

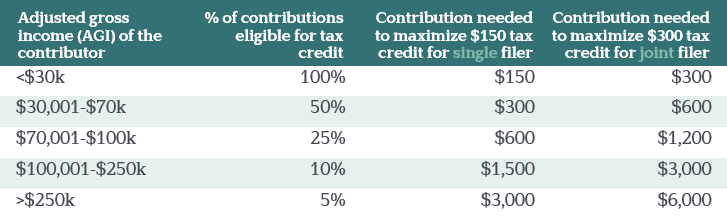

Designed to promote college savings for more Oregonians, the new Education Savings Credit gives savers a state income tax credit up to $150 for single filers and $300 for joint filers, subject to income limitations.

Currently, Oregonians receive a deduction on their state taxes for contributions made to the plan, up to $2,435 for single filers and $4,865 if filing jointly in 2019.

Contributions made in 2019 and prior in excess of the annual deduction amount can still be carried forward another four years as a tax deduction, as long as the balance in the Oregon College Savings Plan account is greater than the deduction amount at the end of the year in which the deduction is being made.

The deadline to make contributions to a 529 College Savings Plan and to still qualify for the current deduction is December 31, 2019.

Deductions and Credits

In any given year, a tax deduction is subtracted directly from income, which reduces the overall income subject to taxation.

A tax credit, on the other hand, comes into play by reducing the amount of tax owed.

There are two types of tax credits—nonrefundable and refundable. A nonrefundable credit can potentially reduce your tax liability to $0, whereas a refundable credit, like Oregon’s Education Savings Credit, could not only reduce a tax bill to $0, but come back in the form of a refund.

Getting Credit for College Saving

What does this mean for you?

Consider a couple that contributes $25,000 to their new baby’s Oregon 529 Plan account in 2019. They would receive a tax deduction of $4,865 on their 2019 taxes and could carry forward a deduction of $4,865 every year for the next four years, as long as their child’s 529 Plan balance exceeds the deduction amount at the end of each tax year.

This same couple could also receive up to $300 in the form of a tax credit starting in 2020 for additional contributions to the plan, subject to income limitations.

The bottom line?

Oregonians saving for college could receive deductions and credits worth over $700 per year in years 2020—2023.

A Brighter Future

While the maximum potential tax benefit Oregon residents receive for contributing to a 529 Plan is being reduced, Vista’s outlook on the plan remains favorable.

The tax perk, coupled with other recent upgrades, is a win for college savers.