Real estate is the third largest asset class in the world, behind stocks and bonds. It is a diverse asset class, including office buildings, apartments, storage facilities, industrial warehouses, hospitals, and cell towers, to name a few.

It can be difficult for everyday investors, however, to obtain diversified exposure to real estate. This is why publicly traded mutual funds and exchange-traded funds that hold real estate investment trusts, or REITs, can play an important role in a diversified portfolio.

REITs are legal entities that own, finance, and manage real estate properties. REITs are required to distribute 90% of their taxable income to shareholders, helping generate income for portfolios while allowing for capital appreciation. Because their historical returns have not always been closely correlated with either stocks or bonds, REITs can also dampen overall portfolio volatility.

Just like stock and bond mutual funds can hold hundreds or thousands of securities, REIT funds — often comprised of many individual REITs — offer diversified exposure to thousands of properties around the world.

Location, Location, Location

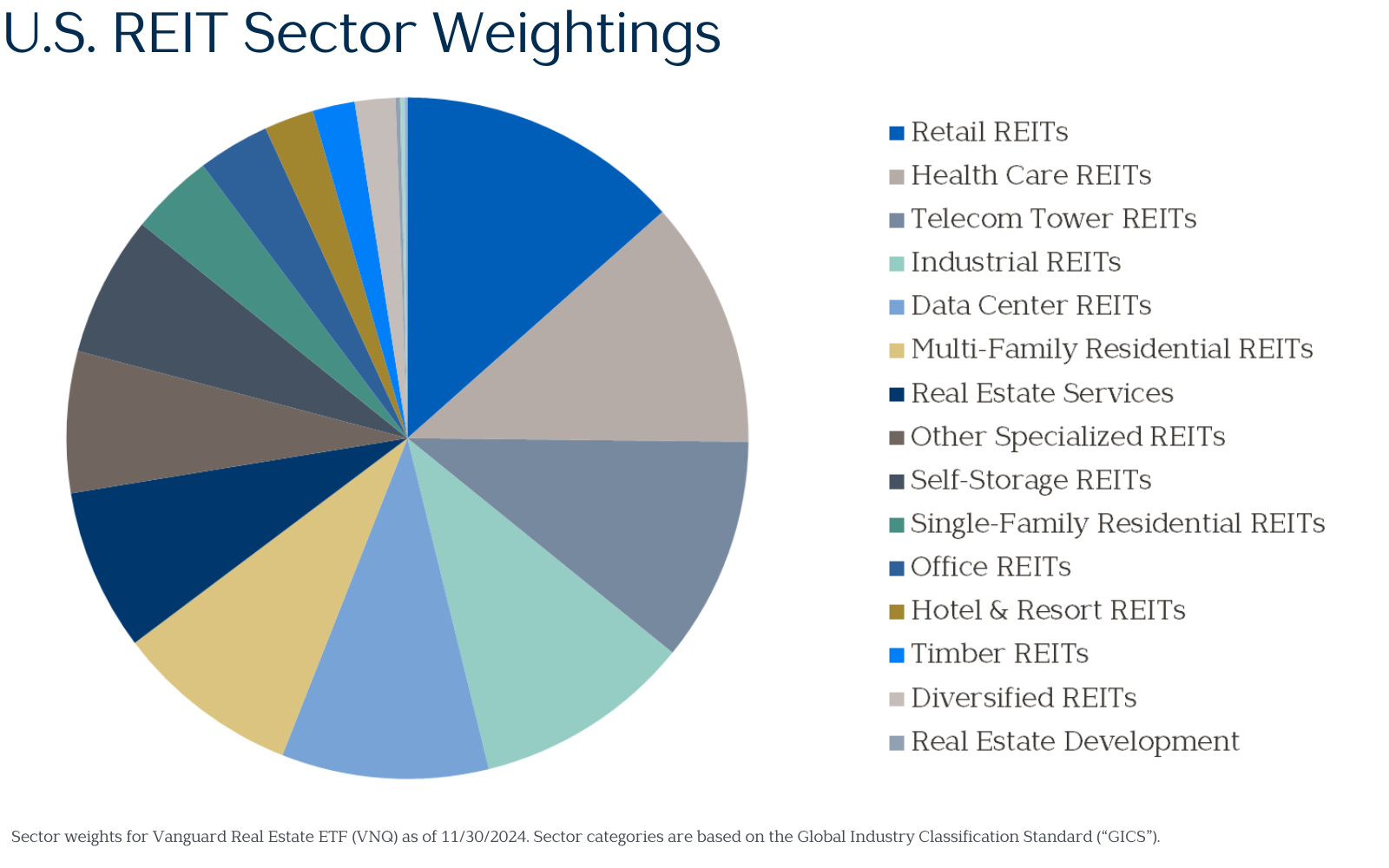

Today, there are more than 900 publicly traded REITs operating in more than 40 countries around the world, with a combined market capitalization of roughly $2 trillion. In the U.S. alone, there are approximately 580,000 REIT-owned properties in 17 different sectors, as outlined below:

Through our portfolios, Vista clients gain exposure to a diverse range of properties, from Washington Square Mall in the Portland metro area to the Empire State Building in New York City, as well as data centers in Asia, hotels in Europe, and many more.

Performance in Perspective

REITs have faced performance headwinds the past several years. Inflation hit a 25-year high in 2022 at 9%, leading many central banks to increase their benchmark interest rate. Higher interest rates can lead to financing challenges and drive property values lower.

The COVID-19 pandemic also negatively impacted office and retail REITs, with the transition to remote work pushing vacancies to record highs.

As of November 2024, the performance of both U.S. and international REITs was negative for the trailing three years and was significantly lower than the U.S. stock market over the prior decade. It’s no wonder investors are asking if REITs still deserve a place in their portfolios.

It is important to remember, however, that extended periods of underwhelming performance aren’t unique to REITs or real estate; in fact, many other important asset classes have periodically disappointed investors.

For example, U.S. small cap value stocks — the highest returning major asset class since 1926 — posted an annualized loss of 10% for the 10 years ending in 1938. Similarly, long-term U.S. government bonds — historically one of the safest asset classes — returned just 0.5% per year from 1960–1970. Even the S&P 500 Index has suffered several decade-long periods of negative performance in its history.

While the recent period of REIT underperformance has been challenging for investors, it wasn’t too long ago that investors were clamoring for more REITs. At the end of 2019, U.S. REITs had returned 11.1% per year over the prior 20 years, dramatically outpacing the S&P 500 Index by 5% per year.

REITs’ more recent performance woes have led to lower valuations and more attractive yields. Their continued lack of correlation with stocks and bonds, and potential for inflation protection, are additional reasons to remain optimistic.

Vista’s Approach to REITs

At Vista, we use highly diversified, low-cost mutual funds and exchange-traded funds to provide clients with broad exposure to REITs across U.S. and international markets.

A globally diversified portfolio that allocates to different asset classes, sectors, and geographies can help effectively manage risk and capture the attractive returns markets have historically delivered. U.S. and international REITs are a small, yet important, part of that effort.

The key to successful investing isn’t about predicting which asset class, industry, or geography will perform best next year. It’s about sticking to an appropriate asset allocation, minimizing costs and taxes, and maintaining long-term perspective when it inevitably seems uncomfortable to do so.