A New Year is upon us, which means Wall Street’s “Where to Invest Now” guides are in full circulation. Strategists will be making their predictions for where the S&P 500 will end the year and news headlines will blare “10 Best Stocks for 2025” and “Top Picks from Top Pros.”

While many investors frantically shift their portfolios in response, we encourage you to do nothing but to sit back, relax, and chuckle as we review the results of last year’s prominent Wall Street forecasts.

Flawed Forecasts

Forbes “10 Best Stocks for 2024”1 featured winners Taiwan Semiconductor (+92%), Booking Holdings (+41%), and tech giant, Apple (+30%). But those gains were offset by losses from Monster Beverage (-9%), Zoetis (-17%), and software leader Adobe (-25%). Collectively, Forbes’ ten picks returned 14%, a full 10% less than the return of the U.S. total stock market index.

Barron’s recommended its “10 Favorite Stocks 2024,”2 which included the rising shares of Alphabet (+35%), Berkshire Hathaway (+27%), and MSG Sports (+24%). But in a strong year for the stock market, four of Barron’s favorites lost money, including U-Haul (-4%), PepsiCo (-7%), and Barrick Gold (-12%). What dented the collective return of Barron’s picks most, however, was the performance of car rental giant Hertz, which crashed -65%. All told, Barron’s ten favorites gained just 2%, while the U.S. stock market surged 24%.

Kiplinger guided investors to Japan in its “Stock Picks for 2024,”3 to find bargain stocks that were “really cheap” relative to U.S. companies. Collectively, Kiplinger’s favored picks Toyota (+9%), Honda (-4%), and Tokyo Electron (-14%) fell -3%, far worse than a broad index of Japanese stocks (+7%), which itself far underperformed the 18% gain of the global stock market. The silver lining for followers of Kiplinger’s advice? Their recommended picks would seem to be even more of a bargain now.

A Consensus Failure

The financial media’s inability to offer accurate predictions shouldn’t come as a surprise. Decades of academic research have shown how difficult it is to outperform the broader market by “stock-guessing”. Yet each year, analysts and financial media double down on the idea that they can outsmart the market.

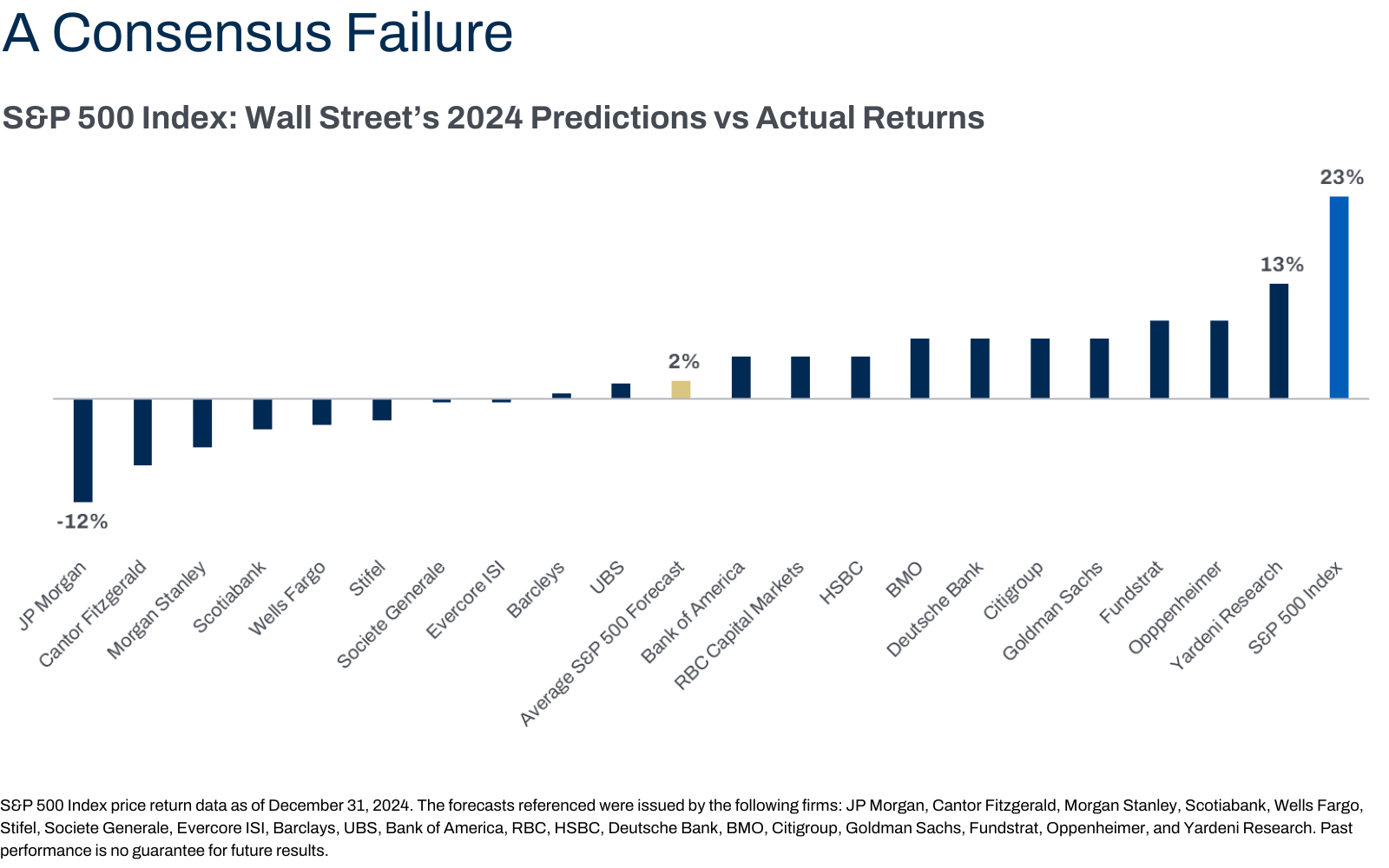

Last year was a particularly rough one for Wall Street’s major investment strategists. Below, we review twenty major firms’ 2024 S&P 500 targets, issued in late 2023.

The average Wall Street forecast suggested a modest 2% gain in the S&P 500 Index—wildly off from its realized 23% price return. The worst forecast, issued by since-fired JP Morgan Strategist, Marko Kolanovic, missed the mark by 35%!

No Crystal Ball Required

Whether it’s stock picks, sector tilts, or country recommendations, Wall Street’s track record of predictions is woeful at best. Yet the cycle continues. Last year’s misses fade from memory, only to be replaced by a fresh batch of predictions and new “experts” to follow.

The financial industry encourages investors to be active, to chase the latest hot stock, or to outsmart the market with “tactical” moves. So, as you encounter this year’s batch of Wall Street experts urge you to “act now” on their predictions, remember the best way to win the investing game is to avoid playing theirs altogether.

The most effective strategy is often the simplest: stay diversified, keep costs low, and stick with a prudent plan. No crystal ball required.

———-

Sources:

1Brock, Catherine. “10 Best Stocks for 2024.” www.forbes.com/sites/investor-hub/article/best-stocks-for-2024/

2Bary, Andrew. “Barron’s 10 Favorite Stocks for 2024.” https://www.barrons.com/articles/alibaba-berkshire-chevron-alphabet-favorite-stocks-to-buy-b018c686

3Constable, Simon. “Stocks To Consider For The New Year.” www.kiplinger.com/investing/stocks/stocks-picks-for-2024