Last month, the Federal Open Market Committee raised the fed funds rate a quarter point to a range of 1.50% to 1.75%. It is the first hike this year and the sixth since 2015 when the Fed began reversing the accommodative measures implemented in the wake of the Great Recession.

Even though bond prices decline as interest rates increase, there is a quantum of solace. The rate hike is ultimately a positive development for long-term, balanced investors.

The increases are a sign the economy is healthier and less dependent on the extraordinarily low interest rates needed during the depths of the global financial crisis. For investors like us, it also means better long-term return prospects for our bond portfolios.

Going forward, we will earn more interest as the funds we own replace their maturing bonds as well as when we reinvest income. Over time, the effect of compounding income—earning interest on interest—at increasingly higher rates will more than compensate for the initial price decline.

Why We Invest in Bonds: The Original Mission

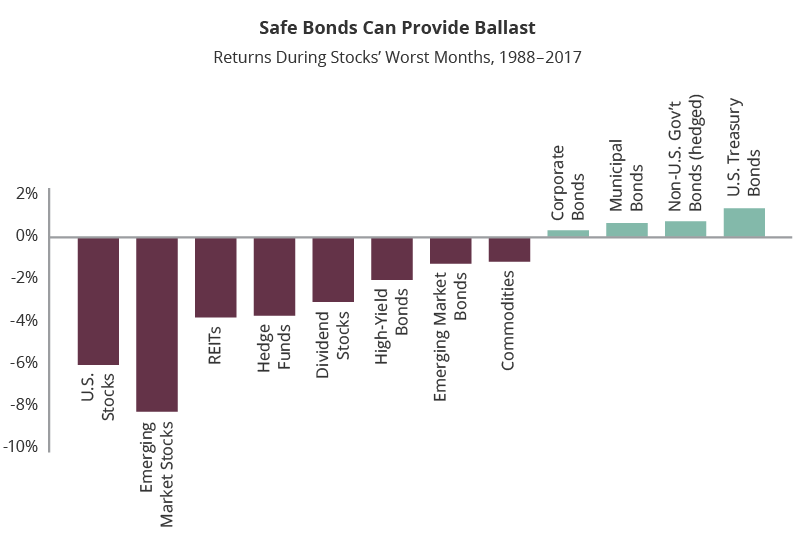

It is constructive to revisit why we invest in bonds in the first place. The primary role of bonds in a balanced portfolio is to provide safety and capital preservation when they are needed most—during the inevitable periods of stock market distress. If stocks are the growth engine propelling balanced investors toward their desired financial destinations, then bonds are the suspension which smooth the unavoidable bumps in the road, ensuring occupants remain in the vehicle throughout the journey.

Diamonds may be forever, but historically, U.S. Treasury bonds have been the most effective counterbalance to sharp stock market losses. They have consistently been at their best when stocks were at their worst. The high credit quality and robust liquidity of Treasuries make them the most popular “safe haven” when stock investor confidence plunges.

The Role of TIPS: Inflation’s Dr. No

Treasury Inflation-Protected Securities (TIPS) offer the same high quality and also protect bondholders from the corrosive effects of inflation. The principal values of TIPS are adjusted for changes in inflation (CPI), sheltering investors from price increases. And since the coupons on TIPS are based on the inflation-adjusted principal values, interest payments also adjust. In addition, the performance of TIPS is not perfectly correlated with the returns of nominal Treasury bond returns, enhancing portfolio diversification.

The Role of International Bonds: The World is Enough

High-quality, currency-hedged international government bonds also meet Vista’s safety criteria. Historically, they have behaved like U.S. Treasury bonds. What’s more, interest rate fluctuations of multiple markets offset one another to some extent, resulting in smoother returns over time for global bond investors (currency-hedged). This means international bonds hold up when needed most (like U.S. Treasuries) and offer diversification from U.S. Treasury bonds.

The Role of Municipals: Bonds for Goldfinger

For investors in high tax brackets who must own bonds in taxable accounts, municipals can also be a sensible part of a diversified bond portfolio. While they generally pay less than comparable-dated Treasuries, their income payout is free from federal income taxes (state also, if issued within a bondholder’s state of residence). This means the after-tax yield of municipal bonds can often be higher than comparable-dated Treasury yields for investors in the upper tax brackets. Importantly, with low historical default rates muni bonds possess low-risk characteristics like Treasury bonds.

Neither Shaken nor Stirred

Together, these globally diversified, high-quality components form a bond portfolio capable of weathering rising interest rates while giving us an essential shock absorber. Perhaps the greatest benefit of being a disciplined, long-term investor with a diversified, balanced portfolio is that change (like we are experiencing now) is not something to be feared—it is something that has already been anticipated in advance. As new events unfold, faithful execution of the existing plan gives us our martini moment—and license to chill.