Recent stock market turbulence has again captured investors’ attention.

On February 5th, the Dow Jones Industrial Average plummeted 1,175 points, the largest one-day point drop in history. Just three days later, the Dow again plunged over 1,000 points.

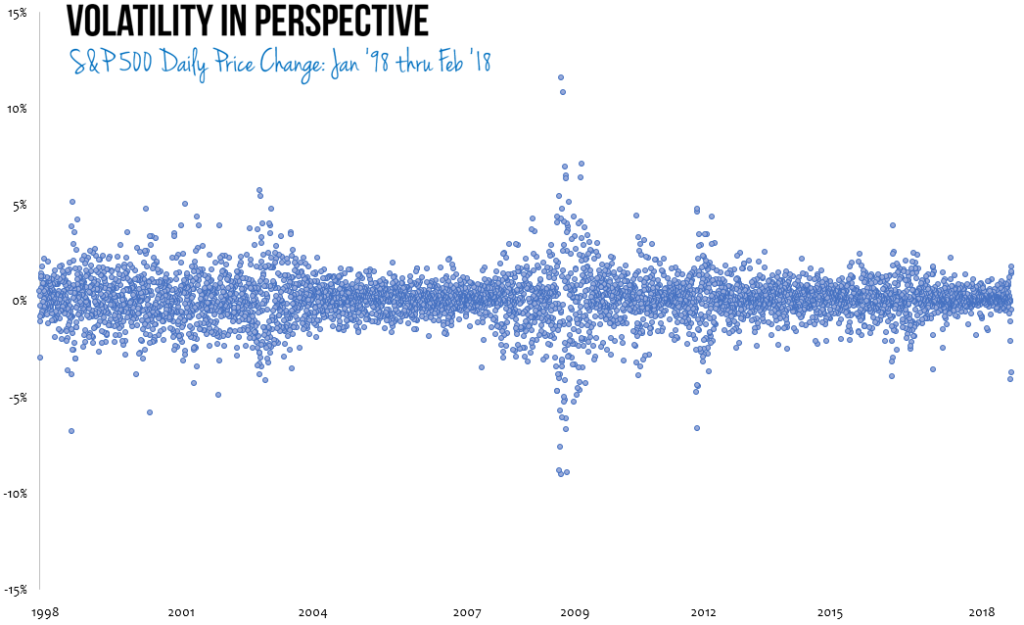

Keen observers recognize, however, that a 1,000 point drop just isn’t what it used to be. With the Dow near 25,000, these were drops of about -4%—unpleasant, yes, but hardly notable from a historical perspective.

In fact, such days have occurred 1-2 times per year over the past 20 years. Days when stocks surge by +4% or more have occurred just as frequently, an important reminder that volatility works both ways.

Two final stats: Over the past 20 years, 46% of all trading days have seen negative returns for U.S stocks. That’s right—losses have occurred nearly half of all days! Yet over this period, $100,000 invested would have grown to $420,000.

The takeaway? Market volatility is the rule, not the exception. Capturing the attractive returns capital markets offer requires discipline and patience. Just as airlines provide seatbelts because turbulence is part of the journey, we build portfolios to withstand bumpy conditions.

That’s why the best advice today isn’t “Bail out!” but rather, “Buckle up.”

Simple, but not easy.