Q: Will Rising Interest Rates Hurt Stock Prices?

A: While the future is unknown, historical research has shown that changes in interest rates have been largely unpredictable. Similarly, attempts to get out of markets before stocks fall, and re-enter markets before stocks go up, have not proved fruitful for most investors. Still, many investors want to know what will happen to equity returns if interest rates go up (or down).

Wei Dai, Ph.D., a senior researcher at Dimensional Fund Advisors, recently examined the historical relation between U.S. stock market data and changes in interest rates. Since interest rates for different maturities, for example one-year rates and five-year rates, do not move in lockstep, Dai looked at the relation between stock returns and the Fed Funds rate, as well as 1-, 5- and 10-yr Treasury rates to see if there was a discernable relation between them.

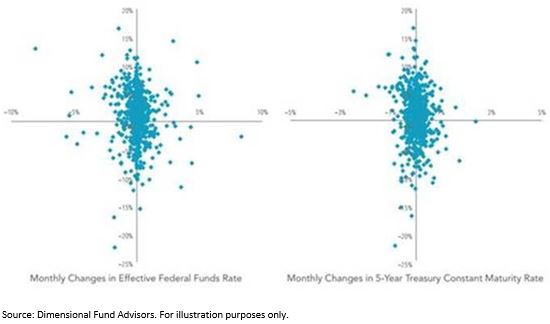

She found none, as the scatter plots below show:

What each of the above two graphs compare is the relation between changes in bond yields, on the horizontal axis, and monthly changes in stock market returns, shown on the vertical axis.

Looking at the Federal Funds Rate as an example (above, left), in months when rates increased, stock returns were as low as -15% and as high as 14%. In months when rates fell, the range of stock returns was from -22% to 16%. The pattern for changes in 5-year Treasury rates was similar.

If changing rates could predict stock returns, we would expect to see a clear pattern in the above charts. Instead, we see a lot of noise clustered around the central axis, or 0%. This means there is no particular direction in the relation between stock returns and interest rate changes.

Instead of seeking to predict the unpredictable, we believe investors are better served by constructing an appropriate mix of stocks and bonds tailored to their long-term goals and objectives, then exercising the discipline to stick with it when it seems uncomfortable to do so.