This summer, I worked as an intern for Vista Capital Partners and am honored to have been hired as a Client Service Associate. Over the past few months, I did a lot of listening and reading. I learned that successful investing doesn’t have to be so complicated…or so stressful.

Financial headlines – from warnings about “imminent” market crashes, all the way to prophecies of the ‘next big stock’ – we’ve seen them all. But how can an investor keep afloat in this sea of uncertainty?

The answer to this question starts with an understanding of why these headlines are so good at influencing investor decisions. This is where behavioral finance takes center stage. Behavioral finance explores how psychological biases and emotions influence investors’ decisions and how these insights can guide more disciplined and effective investing.

Oftentimes, these biases lead investors to make decisions that aren’t always in their best interest. Here are a few key biases to be aware of:

Confirmation Bias: Tendency to seek out information that supports our existing beliefs and ignore contradictory evidence.

Overconfidence: Overestimating our own knowledge and abilities, leading to riskier decisions.

Herd Behavior: Following the crowd rather than making independent, informed choices, often resulting in impulsive actions.

Anchoring: Relying too heavily on the first piece of information we receive, which can skew our perception of value.

The last key bias to be aware of – and the highlight of this article – is loss aversion. Loss aversion is the tendency to fear losses more than we value gains, often leading to irrational decisions like selling investments in a downturn to avoid perceived losses.

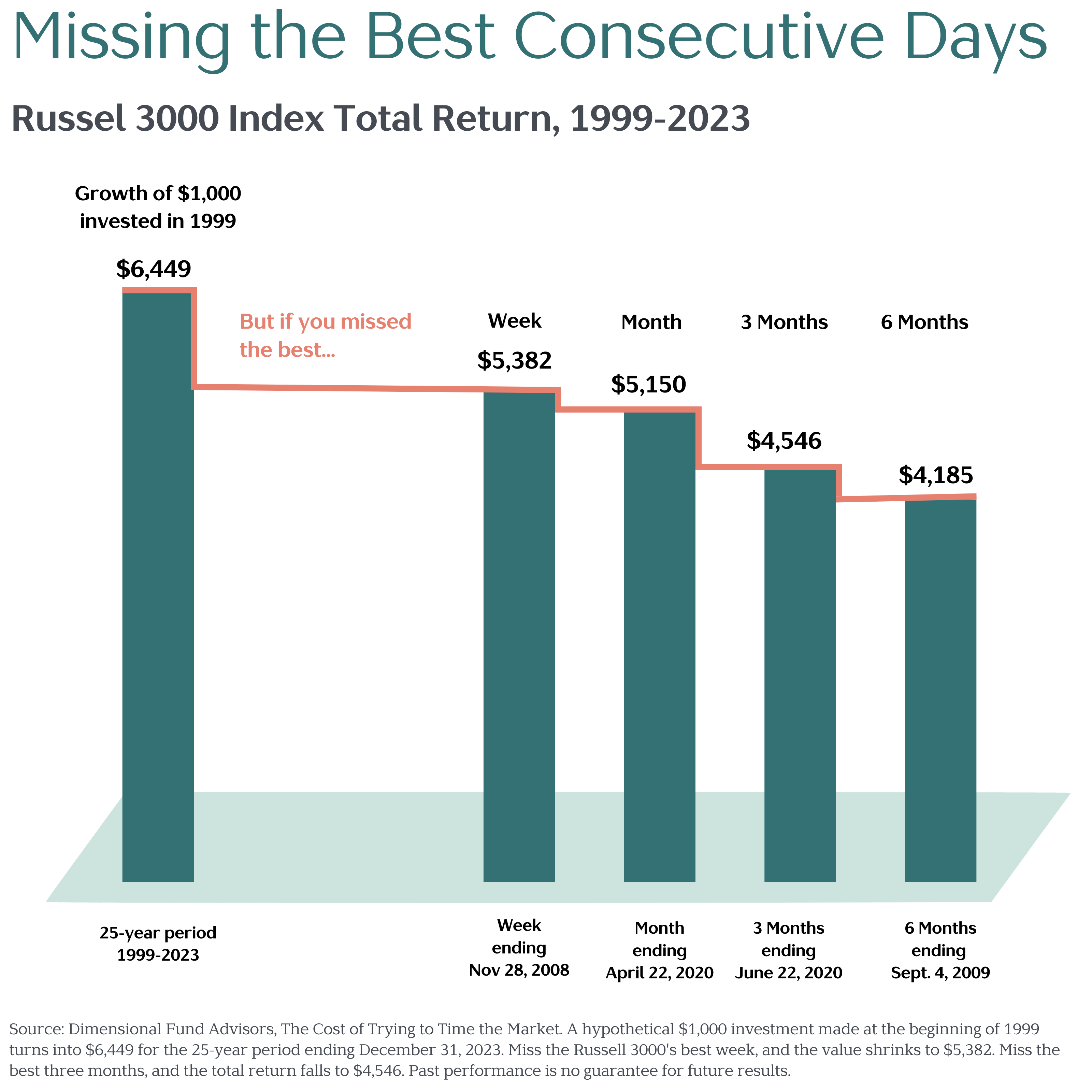

To understand how damaging loss aversion can be to a portfolio, let’s look at the example below:

In the figure above, we can see that if someone invested $1,000 in 1999 and didn’t take out that investment until 2023, that $1,000 would have turned into $6,449. However, if the same investor missed the best 6 months of performance by getting out of the market, that $1,000 would have grown to just $4,185.

Discipline Is Key

History has shown the best way to avoid these biases is by having a well-formulated plan and sticking with it. A disciplined approach – making decisions based on evidence, not emotions—provides investors their best chance of success.