Editor’s note: This article was originally penned in September 2017 by our late colleague Gordie Gorsuch. Although we have updated the data and observations, Gordie’s timeless advice lives on.

There’s a famous saying in Tibet: If a problem can be solved, there is no use worrying about it. If it can’t be solved, worrying will do no good. The same can be said of investing. Every day there’s a new headline with a new problem. From recurring speculation of an impending crash to concerns about higher volatility to claims that August is a bad month for stocks—it’s easy to see why investors are worried. But is all this worry warranted? And, more importantly, is it worthwhile?

We think the answer is no. We’ve seen many of these fears come and go. And while we don’t know what the future holds, experience tells us many of these concerns are undue and worrying will simply do no good.

Here are a few of the common concerns we hear today, and reasons why you shouldn’t worry.

Higher Interest Rates Will Cause Stock Prices to Fall

The current Federal Funds rate is between 5.25% and 5.5%, matching its highest level since 2001. The 10-year Treasury rate has increased almost tenfold since its 2020 lows, while short-term rates have increased nearly fortyfold. Despite this, the S&P 500 has risen over 80% during the same period, setting multiple record highs.

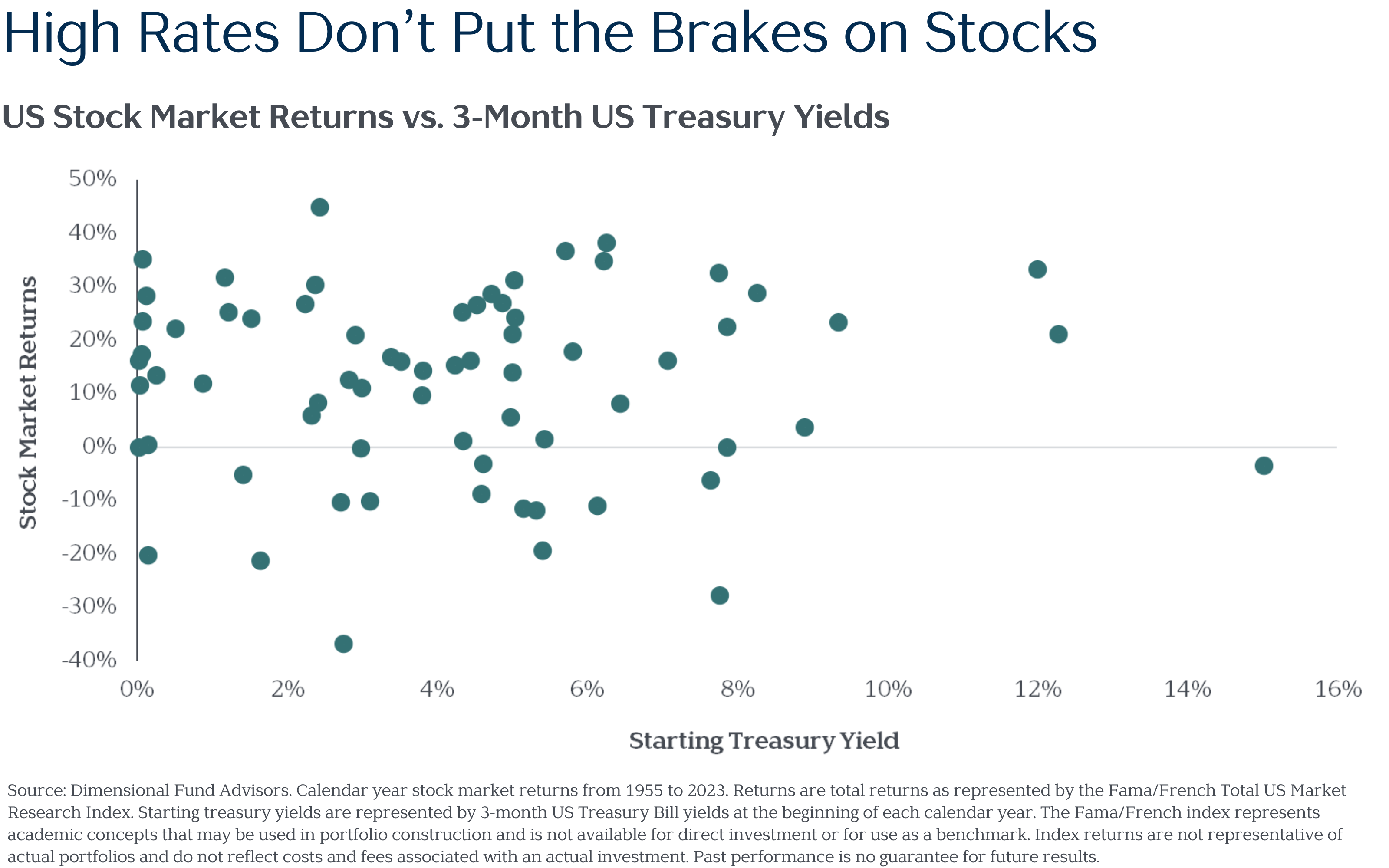

Research confirms that there is no predictable link between changes in interest rates and stock returns. Plotting annual US stock returns against short-term Treasury yields highlights the lack of a meaningful relationship between the two. The same applies when we look at long-term treasury yields – no matter the beginning yield of 10-year treasury bonds, on average, stock market returns have been positive in the subsequent 1-, 5-, and 10-year periods.

Interest rates provide little insight into predicting stock returns. This is perhaps unsurprising, considering that interest rates are just one of many factors reflected in discount rates for future cash flows.

Markets Are at All-time Highs and Won’t Last

The fear of a looming stock market crash isn’t a new one. Investors often believe a market correction is around the corner when stock returns seem to have been too good for too long. Don’t the new all-time highs increase the odds of negative future returns?

No. As we’ve written before, a new market high doesn’t tell us much about future stock market returns. What we do know for certain, however, is that in the months and years following a new record, stock markets have historically gone on to reach even higher levels far more frequently than they’ve pulled back. Remarkably, U.S. stocks have hit a new market high about every fourth month since 1926.

Betting on a market crash after a new high simply hasn’t paid.

The Curse of a Diversified Portfolio

A diversified portfolio is the surest path to long-term investment success—so why can owning one be so hard? Because well-diversified portfolios are comprised of numerous asset classes, meaning part of your portfolio is guaranteed to perform worse than another every year. So far this year, real estate is the culprit. Publicly traded real estate investment trusts (REITs) invest in thousands of different properties globally across multiple sectors such as healthcare, data centers, offices, apartments, retail, warehouses, etc. Recent concerns about commercial real estate, such as high interest rates and increased office vacancies, have contributed to challenges in the REIT space, which is reflected in their current prices.

The pain of underperformance has left many investors asking, “Is it time to move away from REITs?” Our answer is no. It’s normal to always despise part of your portfolio. We’ve shared before that owning temporary underperformers—even outright losers—is inherent to owning a diversified portfolio. While periods of pain will pop up for every asset class, combining them together can result in a portfolio with higher long-term returns and less risk than a concentrated portfolio.

Don’t Worry, Be Happy

If history has taught us one thing, it’s that there is no use worrying about what we can’t control. We don’t know for certain what tomorrow’s markets will bring, so we focus on the important work of constructing all-weather portfolios tailored to the unique needs of each client, staying diversified, driving down investment costs and keeping a lid on taxes.

Will markets stumble in the future? It’s not a matter of if, but when. Will we know the exact cause or timing? Of course not, which is precisely why our portfolios incorporate—before a dime of our client’s life savings is ever invested—the inevitability of market downturns.

Time and energy spent worrying is better directed toward planning for the inevitable and accepting the unavoidable. By controlling what we can, we aim to keep you on the surest path to investment success while liberating you from the stress of today’s market fears. Our goal is not only to build better portfolios, but to help build happier and more prosperous lives.

So don’t worry, be happy. And enjoy the rest of your summer.