In the realm of finance, few strategies have garnered as much acclaim as value investing.

Documented by Nobel laureate Eugene Fama and his colleague Ken French in the early 1990s, the value premium—the positive difference in returns between value stocks and growth stocks—has been hailed for decades as a cornerstone of prudent investing.

From Wonderful to Woeful?

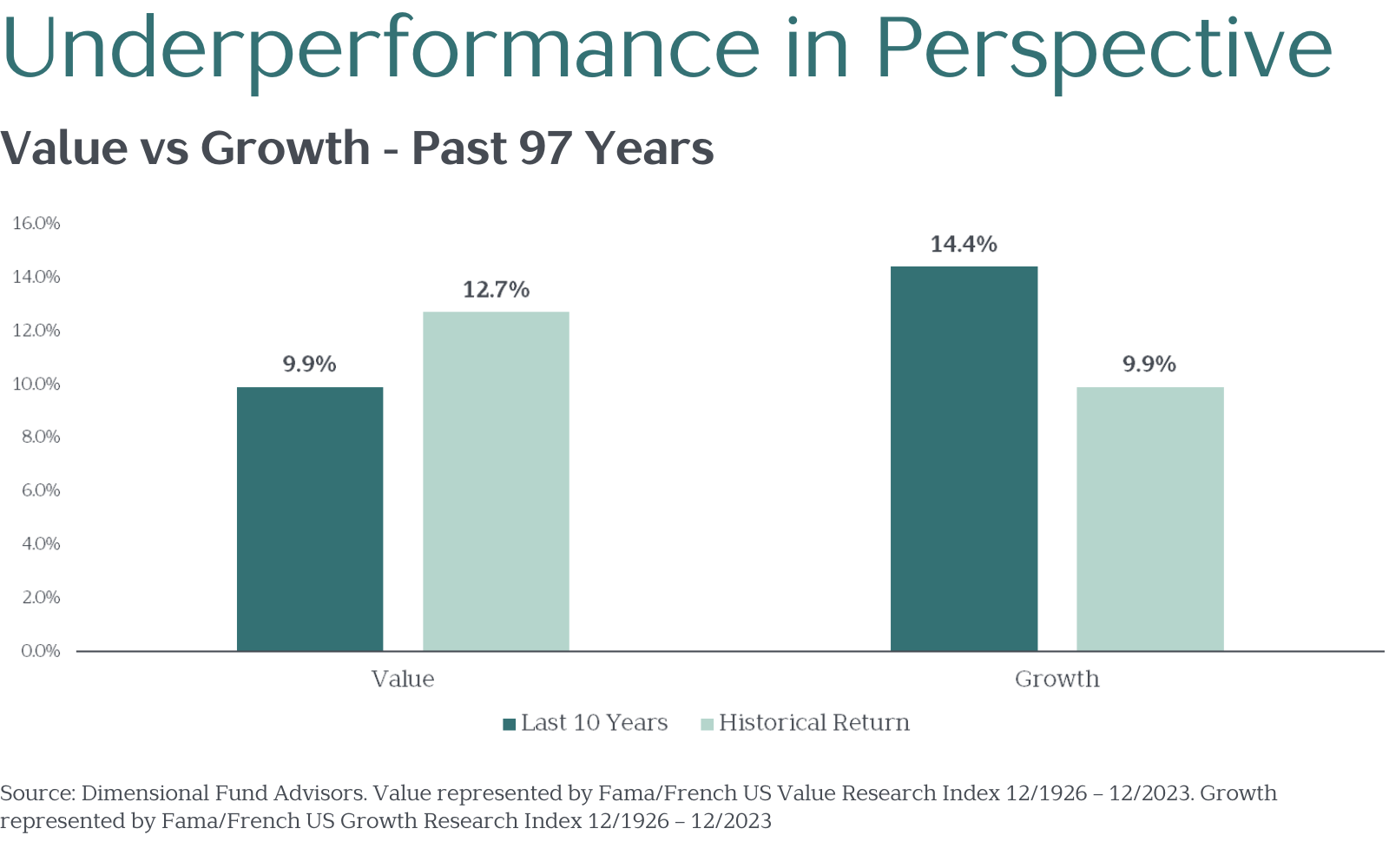

Long term historical data in the U.S. shows that value stocks have returned an annualized 12.7% per year while growth stocks have returned 9.9% per year. This difference of nearly 3% per year is what’s referred to as the historical value premium.

Over the past decade, however, value stocks have returned “just” 9.9% per year, while growth stocks have returned 14.4% per year. Quite simply, the value premium has turned negative—value stocks have underperformed growth stocks by nearly 5% per year.

This has led many to declare that value investing is dead.

Putting Things in Perspective

While skepticism is an important investor trait, we believe claims of value’s death are overblown.

First, we must remember that every risky asset—whether U.S. stocks, international stocks, growth stocks, value stocks or real estate—has gone through a long period of underperformance.

Remember the “Lost Decade?” That was the 10-year stretch from January 2000 through December 2009 when the S&P 500 Index returned nearly -1% per year. One dollar invested turned into 91 cents.

Similarly, from January 1965 to December 1974, the U.S. stock market underperformed cash by more than 4.5% per year. Should investors have given up on stocks following that painful decade of underperformance?

Not likely. The point is, a disappointing stretch of returns for any asset class is to be expected. That is the nature of risk, and why risky asset classes have historically delivered higher long-term returns than riskless Treasury bills.

Looking at the history of the value premium, 22% of all rolling 10-year periods have been negative. So, despite value’s long-term return advantage over growth, temporary, albeit painful, periods of underperformance are not uncommon. The past decade has certainly been one of these periods.

Despite value’s recent decade of underperformance, it is worth repeating that they’ve returned nearly 10% per year. This is certainly attractive from an absolute perspective. But it’s relative to growth stocks—the performance of which has been driven by the remarkably positive results from a small group of companies—that observers claim value is dead.

Past Performance and Valuations

How should the recent returns for value and growth stocks shape our expectations for the future?

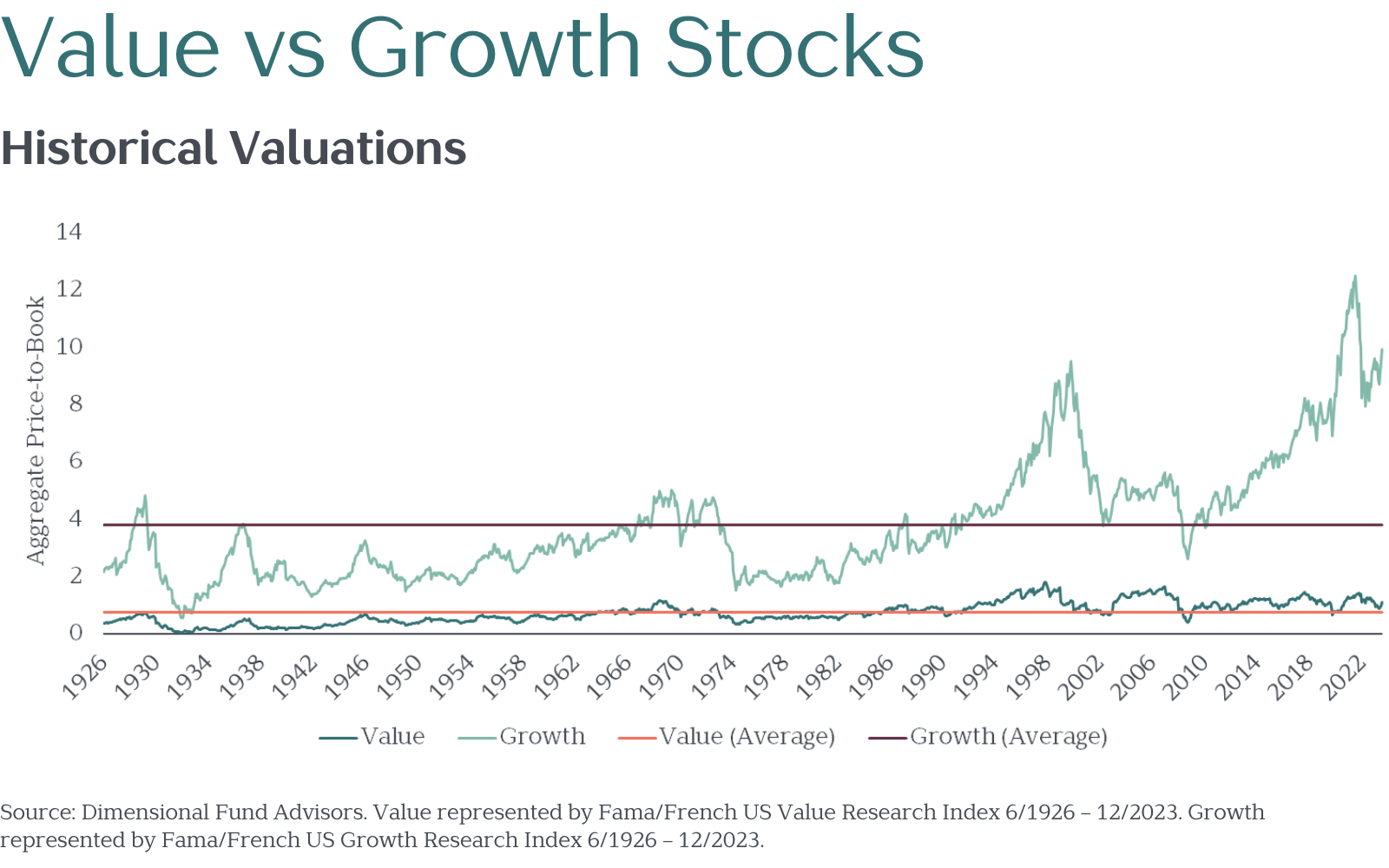

The answer lies in understanding valuations. A valuation is a relative measure of the price paid for an asset as compared to some underlying unit of value, such as earnings, cash flow, or book value.

One such measure is the price-to-book ratio, which measures how much investors are willing to pay for a company’s net assets, or underlying book value. While today’s price-to-book ratio has little predictive value for next year’s returns, valuations do matter over the long-term. Low valuations have tended to pave the way for higher future returns, while high valuations have tended to lead to lower future returns.

The following graph compares aggregate price-to-book ratios for value and growth stocks against their respective history.

As seen in the graphic below, growth stocks are relatively expensive compared to their historical average, whereas value stocks are in line with their own average.

Given that valuations – not recent returns – are the best predictor of long-term future returns, investors today should perhaps be more optimistic in their expectations for value stocks, certainly relative to those of growth stocks.

Reasons for Optimism

Historically, some of the best periods for value investing have immediately followed years in which the value premium has been its lowest.

Consider March 1940, when the value premium was -16.8% per year over the prior three years. Just three years after that, value stocks had recorded their best 3-year stretch ever, delivering a 30% annual premium over growth stocks.

More recently, at the end of June 2020, the three-year value premium was strongly negative, -17% per year. By the end of April 2023, however, value stocks had staged a remarkable comeback, outperforming growth stocks over that three-year stretch by 11% per year.

Finally, while these examples have all focused on the United States, the value premium has been alive and well in international and emerging markets. Over the past 30 years, value stocks have outperformed growth stocks by 4.6% per year in emerging markets and by 3.4% per year in developed international markets.

It is with this longer-term and more global perspective that recent claims of value’s death seem not only greatly exaggerated, but as real reasons for optimism.