Last month, I met with a couple who found themselves in a real pickle.

After decades of saving into their 401k’s and exercising company stock options, they’d amassed quite the nest egg. They began paying more attention to their portfolio, growing nervous as a result of the occasional large swings in its value. Toward the end of 2022—which turned out to be the worst year since 1937 for a traditional “balanced” stock and bond portfolio—they couldn’t stomach it anymore. They sold their investments in favor of cash.

At the time I met them, a year had passed since that emotional decision. With global stock markets notably higher, they found themselves emotionally paralyzed. Should they get back in now? Or should they wait for stocks to retreat to lower levels before recommitting to the long-term approach they wished they hadn’t abandoned?

Chasing Profits, Diminishing Returns

Sadly, this couple isn’t alone. Too many investors fall prey to emotions in thinking they can successfully “time the market.”

As common as a New Year’s fitness resolution, market timing is a short-term strategy that seeks to get out of stocks in advance of declines and re-enter markets before upswings. Just as likely to fizzle out, however, market timing too often prevents investors from fully capturing the rewards markets have delivered over time.

According to a new study by Morningstar1, investors’ performance-chasing behavior costs them dearly–reducing earned returns by more than 20% relative to what markets delivered.

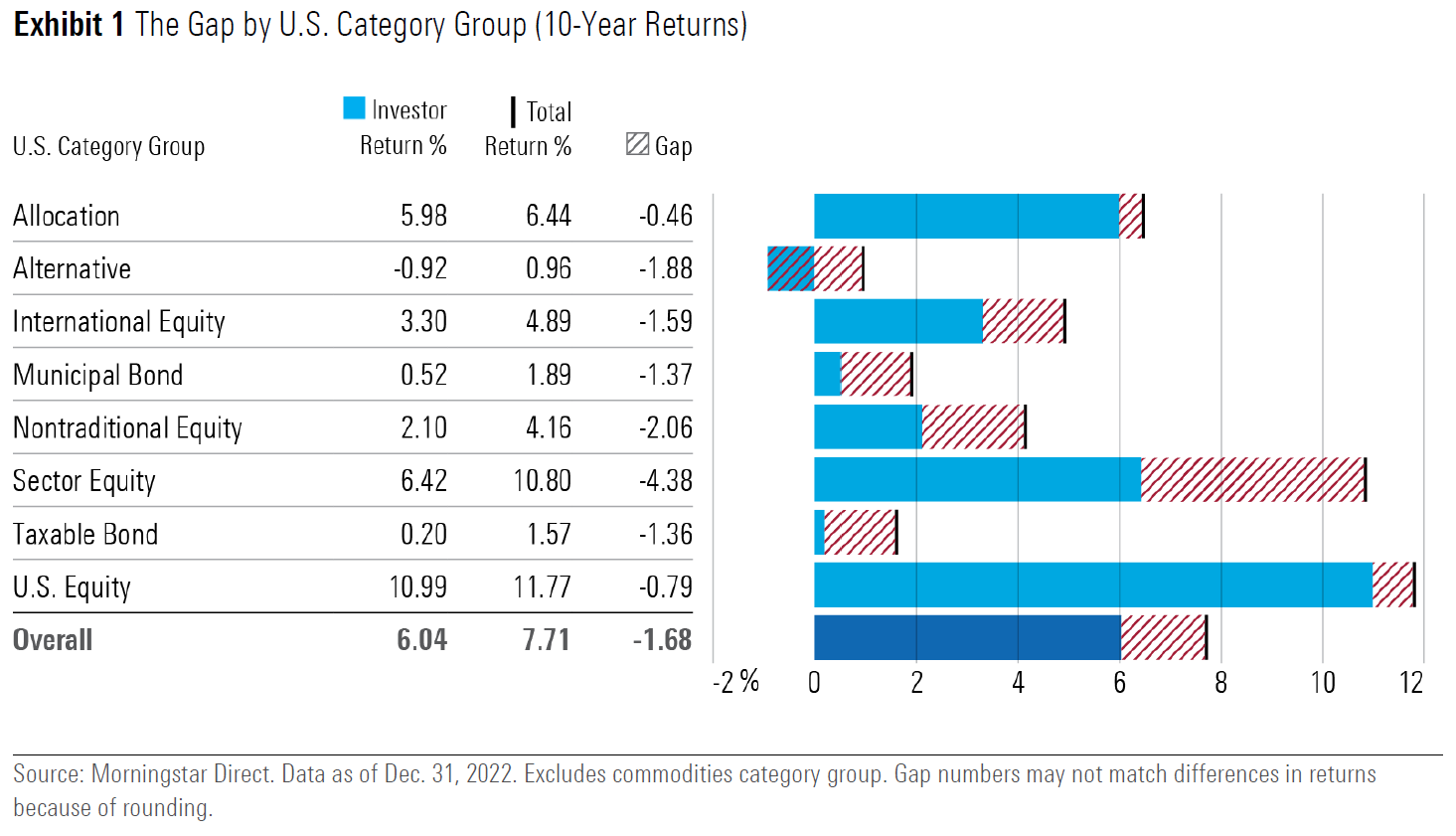

Over the decade ended December 31, 2022, the average mutual fund in Morningstar’s study earned 7.7%, per year. The average dollar invested in those funds, however, earned just 6% per year. That’s an annual performance gap of 1.7%, reflecting the cost of investors’ timing decisions.

The graphic below illustrates the performance gap for the various investment sub-categories in Morningstar’s study.

While the overall performance gap was 1.68% per year—more than 20% of the funds’ total return—the behavior penalty was smaller in some categories and larger in others.

A few observations:

- The timing penalty was smallest in the “allocation” category, perhaps indicating investors with a balanced stock/bond approach may be less prone to reacting to the inevitable ups and downs of investing.

- The performance gap was the largest in more niche categories, such as sector funds, the greater historical volatility of which seems to encourage poor behavior.

- The average investor in the “alternative” category—which includes managed futures, long-short equity, and options strategies—realized negative returns during a period in which the average U.S. stock fund returned nearly 11%. Ouch!

Discipline is Key

The idea of market timing is certainly appealing: Buy an investment at or near the trough, sell at or near the peak, and move on to the next one. The problem is that only in hindsight are those peaks and troughs clearly visible.

Morningstar’s study shows that markets move too sporadically and trends are too unpredictable to be consistently exploited by market timers. Those without a long-term plan or emotional discipline fall prey to the impulse to “do something” in their portfolios, when the evidence shows it is better to stay put.

——-

1 Mind the Gap 2023: A report on investor returns in the United States. Morningstar. July 31, 2023.