‘Tis the season for giving, and whether you’re a seasoned philanthropist or just starting your charitable journey, here are five strategies to help you maximize your impact and minimize your taxes before the year ends.

#1: Donate Appreciated Assets

Consider donating appreciated assets held for at least one year. In doing so, you can deduct the full market value of the asset and sidestep the capital gain taxes otherwise owed on the unrealized appreciation. Furthermore, 501c3 tax-exempt charities don’t pay taxes when they sell the appreciated asset, which maximizes the value of the asset and the impact of your gift.

#2: “Bunch” Your Charitable Donations

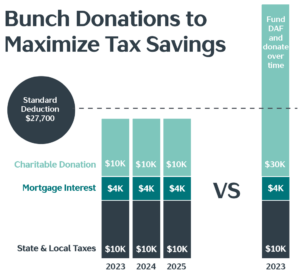

With the 2023 standard deduction at $13,850 for single filers and $27,700 for couples, consider “bunching” donations. This approach entails concentrating a few years’ worth of donations into one year, enabling you to surpass the standard deduction for a meaningful reduction in your tax liability. Repeat this cycle every few years to alternate between taking the standard deduction and itemizing your taxes.

#3: Utilize a Donor Advised Fund (DAF)

Donor Advised Funds, or DAFs, are charitable accounts established for supporting causes you care about. You can fund a DAF with cash or appreciated assets, and initiate grants to charities over time.

Because donations to a Donor Advised Fund are irrevocable gifts, the donor receives an immediate tax deduction for the full market value of the asset.

Assets contributed to a Donor Advised Fund may also remain invested, rather than being sold for cash, while awaiting ultimate transfer to your selected charities. This can be a benefit for donors who bunch many years’ worth of expected donations at once.

#4: Explore Qualified Charitable Distributions (QCDs)

If you’re 70 ½ and older, you can donate up to $100,000 per year, tax-free from an IRA directly to charity through a Qualified Charitable Distribution (QCD).

QCDs can be a smart move if you don’t itemize, only have IRA assets, and have begun taking Required Minimum Distributions. Any amount donated to charity with a QCD counts toward satisfying RMDs up to $100,000 per year.

The tax benefits can be significant, as these distributions would otherwise be reported as ordinary income, taxed at the highest rates, and considered in calculating future Medicare premiums. QCDs completely bypass your tax return—they are neither an income withdrawal nor a deduction—and go directly to charity.

#5: Consider Donating Privately Held Interests

Privately held business assets often have substantial appreciation that could result in a large tax bill when ultimately sold. As with contributions of publicly traded securities, donors can bypass the capital gains tax they would otherwise pay if they instead sold the asset first and donated the proceeds.

Donations of privately held business interests to a Donor Advised Fund require extra due diligence, including a qualified asset or business appraisal, so it is important to involve professional advisors early in that process.

Organizations such as Schwab Charitable, which sponsors the largest Donor Advised Fund in the country, have experience facilitating these contributions and, alongside your Vista advisors, can guide donors through the requisite steps and timelines.

We’re Here to Help

Remember, there is no one-size-fits-all approach. Reach out to your team at Vista to discuss your philanthropic goals and, together, we’ll work to figure out the best way to achieve them. Happy giving!