Interest in values-based investing has been on the rise as investors around the world prioritize the impact of how their money is invested. In 2020, in response to growing client demand and the evolution in available investment offerings, Vista launched our Impact Portfolio.

The goal of the Impact Portfolio is to provide an investment solution that is aligned with clients’ environmental sustainability values without sacrificing sound investment principles.

As interest in “impact” investing has grown, however, so has the social and political backlash related to it. In the following Q&A, we seek to reintroduce Vista’s Impact Portfolio, answer many of the questions we’ve fielded, and clarify a few myths and misconceptions.

Q: Is Vista’s “Impact Portfolio” the same as “ESG” investing?

No. The term “ESG” often refers to investment decisions based on Environmental, Social, and corporate Governance criteria.

Vista’s Impact Portfolio does not screen investments on social or corporate governance issues, but rather on measures of environmental sustainability. Environmental sustainability is primarily measured by a company’s current, and potential for, greenhouse gas emissions.

Q: What is the Impact Portfolio’s reduction in greenhouse gas emissions?

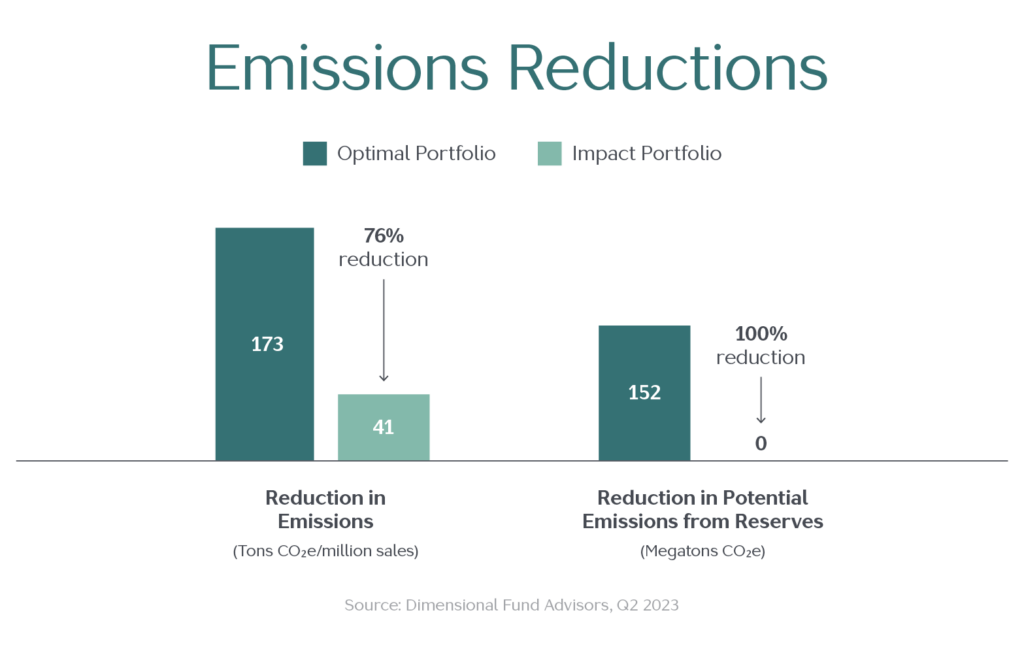

As of June 30, 2023, and as compared to a typical Vista portfolio not constructed with considerations of environmental sustainability, the Impact Portfolio reduced greenhouse gas emissions by more than 70% while eliminating all potential emissions from fossil fuel reserves.

Emissions reductions are measured by tons of CO2 emitted per million dollars of company sales. Fossil fuel reserves refer to coal, oil, and natural gas holdings, which can lead to greenhouse gas emissions when consumed in the future.

To put the numbers above into perspective, one ton of CO2e is equivalent to the emissions generated from consuming 113 gallons of gasoline.

Q: How do we know if the environmental data reported is reliable?

Most publicly traded companies provide climate-related information in their audited financial reports. For example, as of June 30, 2021, nearly 80% of publicly traded companies in mutual fund manager Dimensional Fund Advisors’ database self-reported their emissions data. Regulations to require all companies to provide climate risk disclosures have been proposed by the Securities and Exchange Commission.

Fund managers typically source company emissions data from well-known data providers such as MSCI and Institutional Shareholder Services (ISS). These providers generally use a combination of a company’s self-reported data with their own modeled emissions estimates.

Q: Which companies are excluded from the Impact Portfolio?

As of June 30, 2023, Vista’s Impact Portfolio held over 11,000 individual company stocks around the globe. This is roughly 4,000 fewer companies than are held in our Optimal Portfolio, a diversified portfolio constructed without regard for environmental sustainability.

While the exclusion of individual companies depends on a variety of factors and is subject to change, most exclusions occur in the energy (oil and gas) and utilities sectors.

Not all companies with lower sustainability scores, however, are excluded. To maintain broad diversification, certain companies may be “underweighted” relative to their total market capitalization, while those with higher sustainability scores are relatively “overweighted.”

Q: Is the Impact Portfolio constructed using individual stocks?

The Impact Portfolio is constructed using diversified mutual funds and exchange traded funds, which hold thousands of individual securities. The environmental sustainability screens utilized are applied at the portfolio level, meaning Vista delegates the screening and weighting methodology to the managers of the funds (ex. Dimensional Fund Advisors) used in the portfolio.

Q: In addition to greenhouse gas emissions, are other sustainability screens applied?

Yes. Other considerations include land use and biodiversity, toxic spills and releases, operational waste, and water management. In addition, a company’s use (or production) of coal, palm oil, factory farming, child labor, tobacco, and civilian firearms is considered.

Utilizing such screens is intended to align with the United Nation’s definition of sustainability, which is “to meet the needs of the present without compromising the ability of future generations to meet their own needs.”

Environmental data is sourced directly from the companies and audited for accuracy much like financial statements.

Q: Does the Impact Portfolio sacrifice performance expectations?

As the Impact Portfolio is based on the same key principles we’ve always believed in—asset allocation, diversification, low costs and taxes, and discipline—our performance expectations are similar to those of portfolios constructed without environmental sustainability considerations. Over the long-haul, we don’t expect its performance to differ significantly from other well-diversified portfolios we manage for clients.

Because the Impact Portfolio’s holdings differ, however, from portfolios managed without regard for environmental sustainability, investors should expect periodic performance differences as market conditions favor certain companies, industries, and geographies over others.

A Sophisticated Offering for Sustainability-Minded Investors

Vista’s Impact Portfolio is constructed with environmental sustainability considerations at the forefront, without sacrificing the important investment principles of diversification, low costs, and tax-efficiency.

Our goal in building the Impact Portfolio is to offer investors a portfolio that minimizes greenhouse gas emissions while seeking to deliver a successful long-term investment experience.

If you would like to learn more about the Impact Portfolio, please contact your Vista team.