If you’d like to move to be closer to family or enjoy an active, sun-filled retirement, how much should taxes, cost of living, and other financial considerations factor into your decision?

It’s our observation happiness is more than money, so when you’re deciding where to live in retirement, life decisions tend to outweigh financial implications.

This is not to say financial considerations do not matter. They do. But how much?

Taxing Decisions

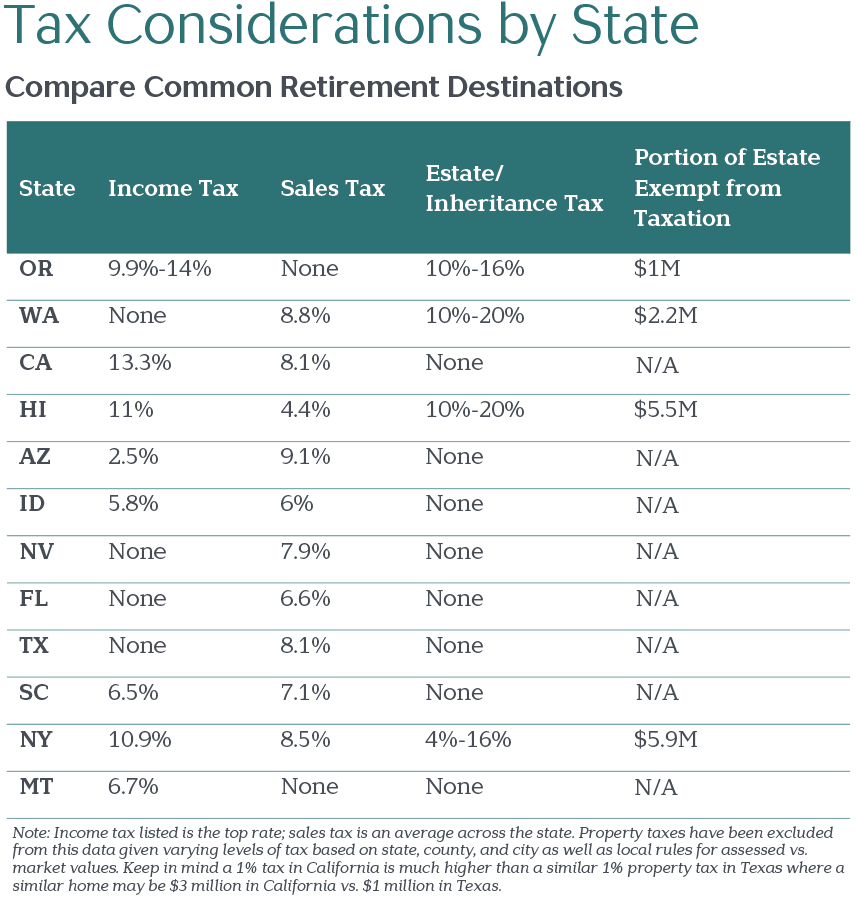

While several states have low or no income tax, those same states might have sales tax, other local taxes, and/or hefty estate or inheritance taxes.

From a “maximizing inheritance” perspective, it may come as a surprise that where you live is often less important than where you die.

California, Arizona, and Florida, for instance, don’t have estate taxes, but Oregon and Washington do—to the tune of 10% to 20% above an exempt amount, which can eat into the value of assets left to heirs.

Sources: 2023 State Income Tax: Tax Foundation; State and Local Sales Tax: Tax Foundation; 2022 Estate Tax Data: Tax Foundation and Urban Institute.

An Example

Let’s consider two hypothetical clients, Joe and Susan, who want to compare remaining in Oregon versus moving to Washington, California, or Florida.

Joe and Susan are each 65 years old, have amassed a $5 million balanced stock and bond portfolio split evenly between a taxable account and a retirement account, receive annual social security benefits of $30,000 and $15,000, respectively, and plan to consume goods and services costing $225,000 per year, adjusted annually for inflation until they pass away at age 95. It should be noted the annual level of spending is in addition to any taxes owed on income, dividends, and capital gains.

After factoring in federal and state income tax and exemptions, any sales tax, or estate/inheritance tax that Joe and Susan face in each of four possible retirement locations, their median ending estate value is projected to be:

Oregon: $3.47 million

Washington: $3.54 million

California: $3.12 million

Florida: $3.97 million

Keep in mind, the figures above are projected median ending values—the singular middle outcome in a wide range of potential ending values, which, of course, depend largely on the performance of their investment portfolio over a thirty-year period. That said, if a larger estate for beneficiaries is the goal, Florida might be viewed as the clear winner.

Joe and Susan have many other considerations to weigh, however, including: What lifestyle can $225,000 afford in the various states? Do they have deep roots in Oregon? Where are the grown children and grandkids? How is traffic and/or access to their favored activities? Many of these questions are likely not answered with a spreadsheet alone.

So Where Do People Retire?

Everywhere you look, a new publication promises to reveal the best places to live in retirement.

Tax-friendly Florida—with moderate winters, good healthcare, and ample recreational opportunities—often ranks high on these lists.

But with cost of living important to so many, South Carolina, North Carolina, Texas, and Tennessee are moving up the rankings.

Interestingly, Oregon ranked #12 and Washington #5 on a recent list of places high earners (those who make more than $200,000 annually) like to retire1, though Portland tops the list of U.S. cities where the tax rate jumps most on taxable income between $100,000 and $250,000.2

These rankings make it easy to compare locations based on factors such as median home prices, climate, air quality, doctors per capita, walkability, crime rates, natural hazard risks, and yes – taxes.

Seize the Day

No matter where you live, there’s bound to be a drawback or two.

If you’re considering a move in retirement and want an objective sounding board, or simply want to put some numbers behind a decision to stay put, your team at Vista can help.

It’s worth remembering, however, that much of what contributes to a richer, more joyful life simply can’t be measured.

—-

1 Michael S. Fischer. “12 States High Earners Are Flocking To.” Think Advisor. August 11, 2022. 12 States With the Greatest Inflow of High-Income Households | ThinkAdvisor

2 Jo Constantz. “Portland Tops Cities Where High Earners Face Biggest Tax Hit.” Financial Advisor. June 1, 2023. Portland Tops Cities Where High Earners Face Biggest Tax Hit (fa-mag.com)