Source: LIFE Magazine. For illustration purposes only.

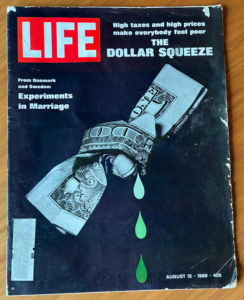

Every August, along its Heritage Trail Highway, the state of Michigan hosts a state-wide 150-mile garage sale. While visiting the Great Lakes State last summer, I stopped in Forestville (population 121), and there among a jumble of magazines, cassette tapes, vinyl records, and postage stamps, I spotted a LIFE magazine from August 15, 1969.

For this window into American history, I negotiated a price of just $1, quite the steal considering the cover price was 40 cents, or $3.20 in inflation-adjusted dollars. As a value investor, I was proud of my bargaining skills; as a native of Greece born in 1997, I was thrilled to get my hands on a time capsule revealing the financial and economic realities of American LIFE in 1969.

Remarkably, I see many similarities (and a few key differences) between then and now. And, I think, there are a few lessons for investors today.

Socioeconomic Themes and Variations

So, what was life like in August of 1969?

If the magazine’s advertisements are any indication, there was plenty of smoking and drinking going on. The U.S.A. had also just scored a big Cold War victory with Apollo 11’s lunar landing but was still mired in the Vietnam War. President Nixon was serving his first term, and Watergate was not yet on anyone’s radar.

Socioeconomically, the primary themes were similar to those today: high inflation, recessionary threats, a costly war, burdensome taxes, and high government disapproval.

Inflation: Like today, inflation in 1969 was a growing concern. Who or what was to blame? According to a handy chart in LIFE, 78% believed it was Vietnam War costs and 70% pointed to Federal spending. Similarly, recent stats suggest 80% blame inflation on the war in Ukraine, while 84% believe Federal spending is a culprit.1

Recessions: America experienced a mild 12-month recession beginning in December 1969, which coincided with rising rates and fiscal tightening on wartime spending deficits. Two painful recessions followed in 1973-1975 and 1980-1983. Knowing that, would you have become an investor in August 1969? You might be surprised to learn the S&P 500 Index grew at an annualized rate of 8.8% from 1969-1983, with $1 invested more than tripling in those 14 years.

Taxes and Politics: Tax rancor was also a familiar refrain. Several stories in LIFE described middle-class struggles with rising prices and heavy tax burdens, which many blamed on inflation and government overreach. Most Americans gave the Nixon Administration poor marks on everything from the economy to federal spending to taxes (but then reelected him by a landslide in 1972).

Spending: Despite the challenges, the pursuit of the American Dream seemed alive and well. Most people still sought to buy a home, put their kids through college, acquire the latest gadgetry (back then, a color TV), and achieve a comfortable retirement.

A Lifetime Investment Perspective

I can understand why today’s high inflation, recession fears, geopolitical turmoil, and political unrest may leave some feeling hesitant to invest, whether that’s starting out for the first time or sticking with a current program.

But as I learned in LIFE, today’s challenges resemble those felt in 1969. In the 50+ years since, investors have had to endure eight recessions, ten changes in presidential administrations, several costly wars, and resisted countless other reasons to get out of the market. However, $10,000 invested in the U.S. stock market in 1969 would be worth more than $1.7 million today.

Today’s investor enjoys several advantages not available to those in 1969. For one, competition has driven investment costs—such as trading commissions and fund expense ratios—to mere fractions of what they were back then.

And broadly diversified index funds hadn’t yet been created in 1969. Today investors can hold a basket of more than 3,500 publicly traded U.S. stocks for a scant 0.03% annual expense ratio. Innovations like this were unobtainable (and perhaps unimaginable) in 1969. Today, they’re just a few clicks away for anyone.

Indeed, if my found slice of 1969 LIFE tells me anything, it’s how much I should look forward to being an investor for the next 50 years. The ability to harness the power of global capital markets, manage risk through diversified investment options, and benefit from much lower costs should allow me—and a whole generation of investors—to have a successful investment experience.

———————

1 Taylor Orth and Carl Bialik. “What Americans know — or think they know — about inflation?” YouGov. November 04, 2022.