By the time Thanksgiving rolls around, many people are eager to support the charities and nonprofits closest to their hearts.

And while it may be tempting to pull out a checkbook and donate with cash, you may be leaving money on the table in doing so.

Instead, maximize your gifts—and feel great about giving—with the following non-cash strategies for charitable giving.

#1 Donate Appreciated Non-Cash Assets

Donating appreciated non-cash assets such as stocks (including privately held company stock) or real estate held for more than one year is one of the most effective ways to maximize charitable impact and minimize taxes.

This strategy eliminates the long-term capital gains tax you would incur if you first sold the assets then donated the proceeds. The result? More for the charity to further its mission and greater tax savings for you.

#2 Consider Qualified Charitable Distributions (QCDs)

Individuals over the age of 70 ½ can donate up to $100,000 in IRA assets directly to charity each year.

This strategy is great for those who do not itemize—and it’s even better for those subject to annual RMDs who do not itemize.

While you don’t get a tax deduction for the amount donated, distributions are not considered taxable income—and they go toward satisfying your RMD for the year.

This approach offers the same net effect as an itemized deduction with a bonus benefit: a lower IRA balance, which reduces future RMDs.

#3 Leverage Donor Advised Funds (DAFs)

If you itemize deductions, you might consider donating appreciated stock because you can deduct the full market value of the gifted stock while you (and the charity) avoid paying tax on the underlying gain.

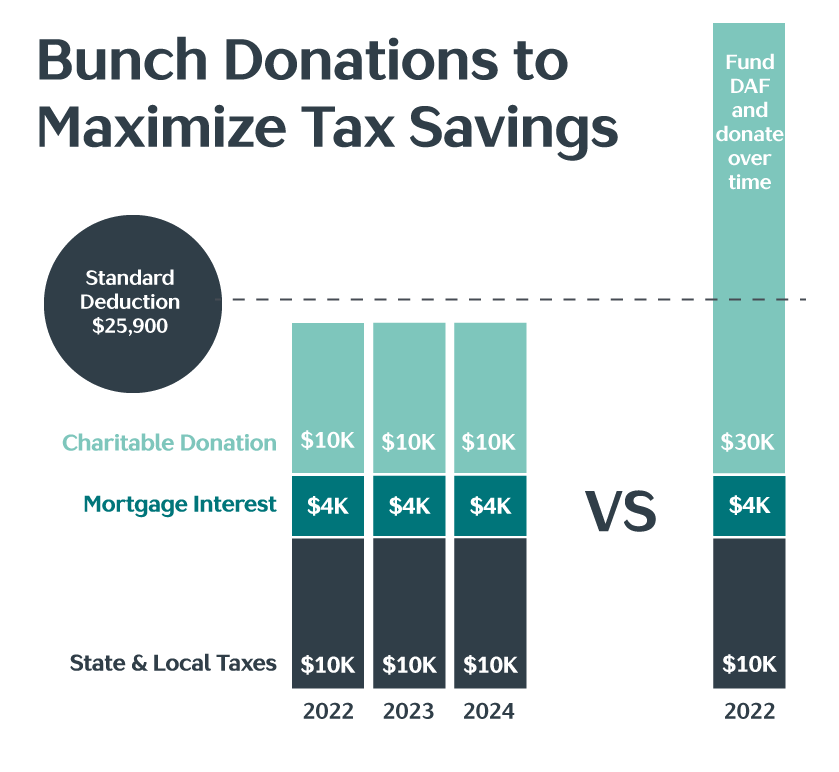

Not itemizing and no RMD? You can “bunch” several years’ worth of charitable donations using appreciated stock into a Donor Advised Fund (DAF).

“Bunching” involves proactively grouping multiple years of charitable donations into one year to exceed the standard deduction threshold. You then take the standard deduction in subsequent years—yielding higher deductions and greater tax savings.

Keep in mind: Deductions for gifts of appreciated securities are limited to 30% of adjusted gross income.

You can also contribute privately held business interests or real estate to a DAF. However, this can be a complex process that requires special steps, such as a qualified appraisal, which can be time-consuming.

#4 Oregon Cultural Trust

The Oregon Cultural Trust is a little-known way to double charitable giving up to $1,000 per year. Contributions must be completed by December 31 and can be made with appreciated stock as well as with a QCD.

If you’re already giving to an organization on the list of qualified charities under the Cultural Trust, this is a way to double up your donation at no “cost” to you.

Let’s say you donate $1,000 to OPB (one of the approximately 1,500 charities on the Cultural Trust’s list) via appreciated stock. Your federal and state tax rates are 30% and 9%, respectively. The effective value of this deduction is $1,000 multiplied by your federal tax rate, or $300. You also get a state tax deduction of $90 ($1,000 multiplied by 9%).

You can then make a matching gift of $1,000 (the maximum allowed) to the Cultural Trust. You get a federal deduction for this gift ($300, as calculated above). You also get a dollar-for-dollar state tax credit for this gift.

The end result? Your additional donation to the Cultural Trust—which doubled your gift to arts and culture—didn’t “cost” you anything.

#5 Oregon IDA Initiative

The Oregon IDA initiative is a unique way to “pay” 90% of your Oregon state taxes using appreciated stock. It helps you get the most from your assets—and make a difference in the lives of fellow Oregonians.

Contributors to the Oregon IDA get the biggest tax benefit out there. A full 90% of your donation of appreciated stock is directly subtracted from your state tax liability, while the remaining 10% can be written off as a charitable contribution on your federal tax return.

Under the initiative, only a limited number of tax credits are made available each year. This year, it’s $7.5 million, and those credits are going fast, so it’s best to act quickly.

Maximize the Joy of Giving

This season, take advantage of these planning opportunities to increase the impact of your dollars donated and make a dent in your taxes, too.

We’re happy to discuss your philanthropic goals and how you can most advantageously fund them.