At least active investment managers are consistent, we’ll give them that.

The term “active” refers to efforts to outperform markets through security selection and market timing. Examples include exiting sectors or markets ahead of big drops. Or favoring “defensive” industries and companies during market downturns, only to shift into more aggressive trades once the coast has cleared.

Active managers have long claimed these tactical trades enable them to outperform—and that the best opportunities to do so arrive during bear markets like we’ve experienced this year. With markets down 15% to 30% around the globe year-to-date, have actively managed funds delivered?

The most recent data is consistent with past findings: Active fund managers have struck out again.

Keeping Score with SPIVA

Since 2002, S&P Dow Jones has published its “index vs. active” U.S. scorecard, or SPIVA®. The goal of this SPIVA scorecard is to compare the performance of actively managed mutual funds against their index benchmarks over various time periods.

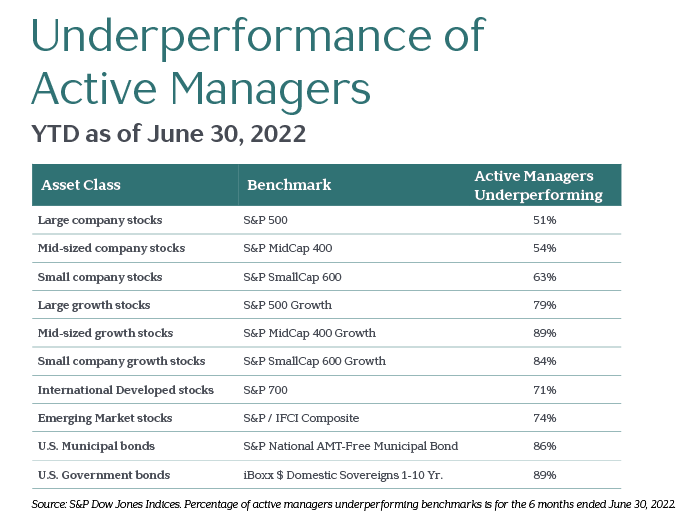

The most recent SPIVA scorecard for mid-year 2022 suggests most active managers, across a wide range of asset classes, failed to outperform their index benchmarks in the first six months of 2022.

There are two interesting subplots here. First, the best results for active management were achieved in the largest, most liquid part of the stock market. (“Best” is a relative term considering less than half outperformed.) It has long been a common argument of active managers that indexing works for large cap U.S. stocks, but not in less efficient markets, such as international or emerging markets, where the “opportunistic landscape” demands an active approach. These results refute that long-espoused theory.

Secondly, some of the highest failure rates for active management came in the bond category. This suggests that, on average, active managers failed to deliver on the promise of successfully navigating big swings in interest rates, as we’ve seen this year.

Time Heals Few Wounds

To be fair, six months doesn’t tell us much about any fund manager’s performance. There is too much noise in short-term returns to draw meaningful conclusions about whether such performance was because a manager was unskillful or simply unlucky.

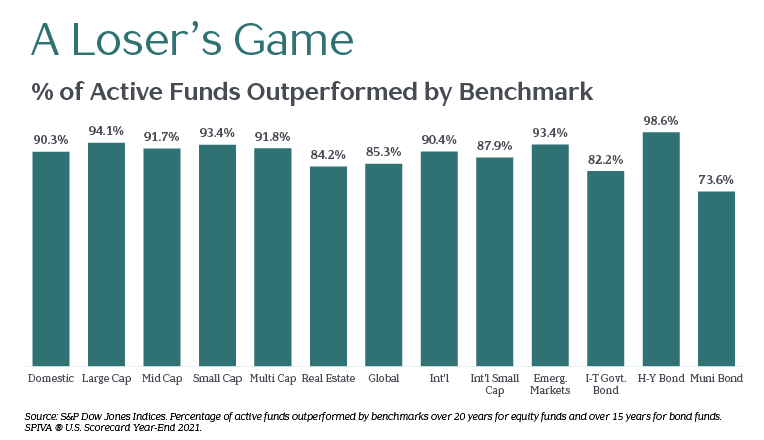

These results, however, simply underscore what longer time frames have already revealed. In evaluating stock funds over 20 years and bond funds over 15 years, the most recent SPIVA scorecard also found an alarming rate of active underperformance.

Consistency You Can Count On

The bottom line is, active managers are no better at protecting investor assets in volatile bear markets than they are at delivering outperformance in bull markets.

Over the past six months, they failed to outperform the benchmarks they were tasked with beating. And the longer-term track record of active management has remained consistent—consistently disappointing, that is—across years, asset classes, and various geographic borders.

Since Vista’s beginning, we’ve espoused the virtues of indexing—broad diversification, low costs and taxes, and reliable performance. Our belief in these important tenets of investing have only grown stronger over the years.

We don’t know what markets will do tomorrow, next quarter, or next year. But we believe that consistently and sensibly embracing risk, remaining invested, and diversifying broadly via low-cost index funds is the best way to have a successful long-term investment experience. We’ll take this over a loser’s game any day.