Tempted to invest in Bitcoin or other cryptocurrencies to jump-start your portfolio in tumultuous times?

Don’t do it.

We know, it can be hard to ignore the allure of a fast-moving fad. What began as a curiosity has rapidly grown into a seemingly unstoppable movement.

There are now over 18,000 cryptocurrencies in circulation, including nonfungible tokens and other blockchain-based technologies. An industry’s worth of newly coined terms are now common lingo.

Fidelity Investments recently estimated roughly 80 million U.S. investors already owned or had invested in a form of cryptocurrency, and big names like ARK’s Cathie Woods and Apple CEO Tim Cook have touted Bitcoin as the latest, greatest buy.

Investors can now invest, trade, and/or transact in crypto through online platforms, brokers, and payment companies. Select retailers have been experimenting with accepting the more popular coins as if they’re cash.

The government has taken notice as well. The Department of Labor issued a compliance release largely opposing the idea of allowing investors to buy Bitcoin in their 401(k)s, something certain custodians offer, citing crypto’s volatility, valuation, and other regulatory concerns.

Despite all this attention, we cannot justify including it in our Vista portfolios. Here’s why:

Along with consumers’ growing comfort level with cryptocurrencies, we see a growing misperception that “familiar” equals “safe.” The truth is, despite the media frenzy, the total market value of the top five cryptocurrencies represents a tiny and tenuous half percent (0.5%) of the investable universe. Beanie Babies may have been as popular during their run-up.

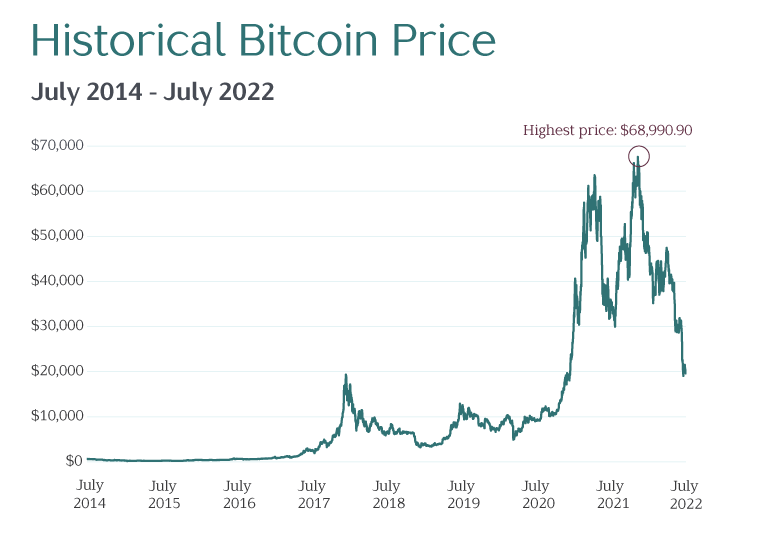

During their decade of existence, cryptocurrencies have taken holders on an incredibly wild ride. Unlike traditional markets, they trade 24 hours a day, 7 days a week, with no circuit breakers or closing bells to intervene. Bitcoin may have soared in 2021 as speculative enthusiasm washed over financial markets in general, but if you think U.S. stock prices have been volatile, consider that Bitcoin has taken investors on a ride 15 times more wild (per volatility measures) as that of the broader equity market.

This same volatility does not bode well for spending bitcoin or similar cryptocurrencies. From its November 9, 2021, peak, Bitcoin lost two-thirds of its value over the next seven months. Imagine if the value of a dollar bill in your wallet dropped to 30 cents just half a year later. Reliable currencies need stability to prosper as a medium of exchange.

In an attempt to manage this volatility, certain financial intermediaries have sought to tether crypto’s value to the U.S. dollar. Perhaps unsurprisingly, one of the largest such crypto lenders, Celsius Network, paused all withdrawals, swaps, and transfers of crypto due to “extreme market conditions.” Additionally, Stablecoin’s TerraUSD made headlines when it broke its $1 pegged value, and a panic-run on the proverbial bank ensued. Today, one TerraUSD is worth about a nickel. And Celsius Network? It has filed for Chapter 11 bankruptcy. So much for stability.

Unlike traditional bank accounts, there’s no deposit insurance ensuring crypto coins will remain liquid and accessible. When a crypto service platform collapses or gets hacked (as they notoriously have been), you’re left mostly on your own.

Even without these recent meltdowns, there have been plenty of reasons to avoid considering cryptocurrency as anything more than a humorous side bet.

We can value a stock (claim on company cash flows, dividends, profits) or bonds (interest payments, contractual obligation to return principal) based on the production metrics for its underlying holdings. Legal tender is backed by a central government with taxing authority. Real estate can be valued based on its rental income and/or appreciation potential. On a limited basis, even gold can be melted down and used for something other than a medium of exchange. None of this is the case with crypto.

The bottom line is, investing in crypto is an investment in nothing. To be clear, as we covered in Cryptocurrency Dreams and Blockchain Schemes, the underlying blockchain technology is fascinating and may be useful in other applications. But at the end of the day, a bitcoin is still nothing more than an intangible, computer-generated token with no intrinsic worth.

But don’t take our word for it. Bill Gates refers to crypto as “100% based on the Greater Fool Theory,” meaning the value is only sustainable as long as somebody else will pay as much or more for it than you have. Warren Buffett’s longtime partner, Charlie Munger, is even more blunt: “Crypto is an investment in nothing,” he’s said. “I just avoid it as if it were an open sewer, full of malicious organisms.”

When we evaluate cryptocurrencies across essential investor goals—earning a positive expected return, reducing overall portfolio volatility, and maintaining an appropriate degree of liquidity—crypto strikes out on all three.

In short, Bitcoin and other cryptocurrencies are a lot like Seinfeld’s catchphrase: It’s “a show about nothing.” Entertaining? Maybe. Worth including in your investment portfolio? Not so much.