Is it just me, or has there been even more than the usual volume of news lately?

Russia’s barbaric attacks and Ukraine’s brave resistance have rightfully taken center stage. But there are plenty of other headlines causing investors to pause: the Fed’s recent rate increase, continued upticks in inflation, supply-chain concerns, and choppy stock and bond markets.

The truth is, we have scant control over such events. And that can feel even more scary.

Fortunately, one of the most important factors driving investment success remains fully within your control. I’m talking about overcoming your own behavioral biases and maintaining your resolve as a long-term investor, particularly through times of stress and uncertainty.

Battling Behavioral Biases

We’re all as prone to panic when things are going badly as we are to chase after the shiny object when things are going well. That’s just our brain firing off neurochemical stimulants that trick us into “fight or flight” backsliding, or irrational exuberance, long before we apply any reason.

In the natural world, of course, such behaviors can be helpful. But these same behaviors tend to be harmful when it comes to investing.

First, there’s recency bias, which means we tend to give greater weight to the most current events. When our view of the future is clouded by the recent past, it’s easy to convince ourselves “this time is different,” despite past lessons learned.

There’s also hindsight bias. As we described in Don’t Let Behavioral Biases Dash Discipline, we tend to distort our own memories to the point where we recall past events as having been predictable when they were not. After conveniently forgetting that last time actually felt just the same in real time, we continue to feed our “this time, it’s different” false narrative, which further weakens our resolve to stick with our existing investment plans.

Last and perhaps most damaging, there’s loss aversion. Most of us are inherently wired to despise losing about twice as much as we enjoy winning. As such, when we start seeing red in our portfolios, we may grasp at any straw to stop the pain now, despite the long-term damage such moves inflict.

Market Performance: The Long and Short of It

From a practical perspective, we know markets deal out daily wild cards, rising and falling at a seemingly random cadence. We also know they have delivered strong returns over the long run, even if the timing and sources of return were erratic and unpredictable.

Logically, this can only lead to one conclusion: Your best bet is to hold a globally diversified portfolio constructed with your personal goals at the forefront, and to keep holding it through thick and thin.

If you’re still reading at this point, you’re likely nodding your head up and down in agreement. Still, we know maintaining such discipline is rarely, if ever, easy during times like this.

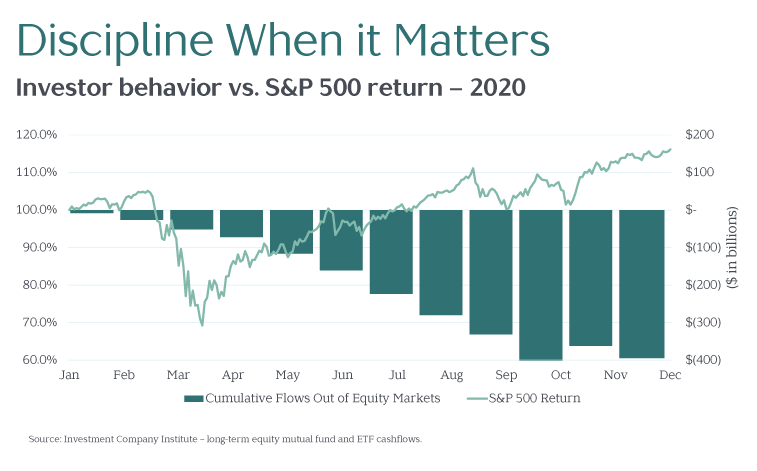

In fact, many of the behavioral biases described above lead investors to make the worst decision at the worst possible time, and 2020 was a prime example of how this played out in financial markets.

The chart below shows cumulative investor cash flows in or out of stock markets, juxtaposed against the return of the S&P 500. What’s clear is investors still fleeing stocks as markets were enjoying a swift recovery after the painful low in late March.

Becoming the Boss of Your Biases

In a world filled with uncertainty, following your gut reactions in volatile markets is unlikely to take you where you want to go. Instead, disciplined investors recognize the heightened angst for what it is: part of investing and part of being a human being. This won’t eliminate the behavioral symptoms, but by identifying their source, you stand a much better chance of overcoming them.

And by the way, having an investment advisor with the same mindset can help a lot. By providing an objective perspective, acting prudently, and communicating frequently and candidly, we help strengthen your lines of defense.