Oh, what a year it was …

As COVID-19 shifted from epidemic to pandemic, and unemployment reached levels comparable to the Great Depression, investors faced waves of fear and uncertainty—not only for our personal health, but for the state of the economy and financial markets.

Over the 33 days from February 19 to March 23, the S&P 500 Index was down -34% and international stocks, small cap stocks and value stocks each dropped in similar measure. Many investors fled the equity markets as COVID cases continued to rise and businesses continued to struggle.

Then, seemingly out of nowhere, a huge market rally began in late March. Just four months after the big drop—and even as the pandemic raged on—most markets reached pre-pandemic highs by August. Calendar year returns for most asset classes finished above their historical averages.

While 2020 was unprecedented in so many ways, there was one constant: The same, simple (if never easy!) investment approach we’ve long embraced remained as essential as ever.

Below are three timeless lessons we believe 2020 markets reinforced (yet again):

Lesson #1: The Importance of a Plan

In the absence of a disciplined strategy, many investors tactically dart in and out of the market, trying to take advantage of (or fearfully avoid?) the heightened volatility. And let’s not downplay how uncomfortable it was to be an investor in early March. Stocks fell 9% in a single trading day, only to rise 9% the following day, only to fall more than 11% the next. That kind of turbulence is jarring.

Unfortunately, because markets stabilized and recovered (as they’ve done every time in the past), not every investor can say the same.

As we described here, the results for traditional active managers weren’t pretty. Even high-profile money managers were advising to hold off on buying stocks amid the frightening uncertainty. We’re “not rushing to invest” said Jonathan Gray, president of private equity giant Blackstone, in an April 25th forecast.

“We’re certainly not in the ‘V’ camp,” Gray said. “We’ve been debating what the shape is. I think it’s an elongated recovery.” Of course, by the time of his late April pronouncement, the S&P 500 had moved sharply higher—nearly 3x its historical long-term annual return in just over a month.

Blackstone’s Gray serves as an example of how difficult it is, even for a $600 billion global asset manager, to successfully predict the near-term moves of a market that never stops shape-shifting.

In fairness to Mr. Gray, he wasn’t alone. Investors collectively stashed more than $580 billion into money market funds (that’s a lot) in the month of March, according to the Investment Company Institute. Spooked by market losses, those who fled to the perceived safety of cash had plenty of company.

What were we doing? Sticking to the same investment plan we built with each of you when you became a Vista client. A plan built precisely with times like 2020 in mind. Did we know the exact cause or timing of the market downturn? Or exactly when markets would recover? Of course not. But a prudent, well-crafted investment plan incorporates, before a dime is ever invested, the inevitability of such market turbulence.

Having a solid investment plan to depend on in turbulent times is job one. The next essential step is to actually adhere to it.

Lesson #2: Stay Disciplined During the Storms

Sticking to the plan when times are tough may be what most separates investors from speculators. Revisions to a plan should be considered based on real-life changes (job status, marriage, death of a spouse, etc.) but rarely in response to current market conditions. The emotional temptation to “get out until the storm has passed” too often proves to be very expensive.

We know from history markets tend to deliver their best returns in dramatic fits and starts. Missing even a few days in a rising market can be costly. This was particularly so in 2020, when $100,000 invested in the S&P 500 Index grew to $118,000. Every investor who held the S&P 500 for the full year earned that return. In contrast, here’s what happened if you missed the best-performing days:

$100,000 Invested in the S&P 500 Index

January 1–December 31, 2020

Unfortunately, there’s no way to predict which handful of days are going to be the important ones, which means you’re best off taking the good with the bad.

The financial columnist Jason Zweig once wrote, “the problem with investing in stocks is the letter ‘T.’ If people shopped for stocks like they did for socks, they’d be better off. You buy socks when you need them; you buy more when they’re on sale.”

Last spring, we went shopping for socks: dispassionately rebalancing client portfolios out of top-heavy bonds into underweighted stocks. We were buying more stocks when we needed them (your investment plans and asset allocations prescribed such action) while stocks were on sale (trading at historically low valuations).

Remember, the news was no brighter at the end of April than it was at the market’s bottom in late March. But stocks were 30% higher.

In other words, by the time it feels comfortable getting back into a rising market, you’ve likely missed out on a huge share of the recovery. Again in 2020, markets showed us they almost always reward discipline but rarely reward comfort.

Lesson #3: Keep Your Bonds on the Safe Side

The stock side of your investment portfolio tends to generate all the attention. After all, it’s where an investor’s highest risks and highest expected returns are found. This is why the best role a portfolio’s non-stock portion can play is to counterbalance that risk with “boring,” but far more dependable bonds.

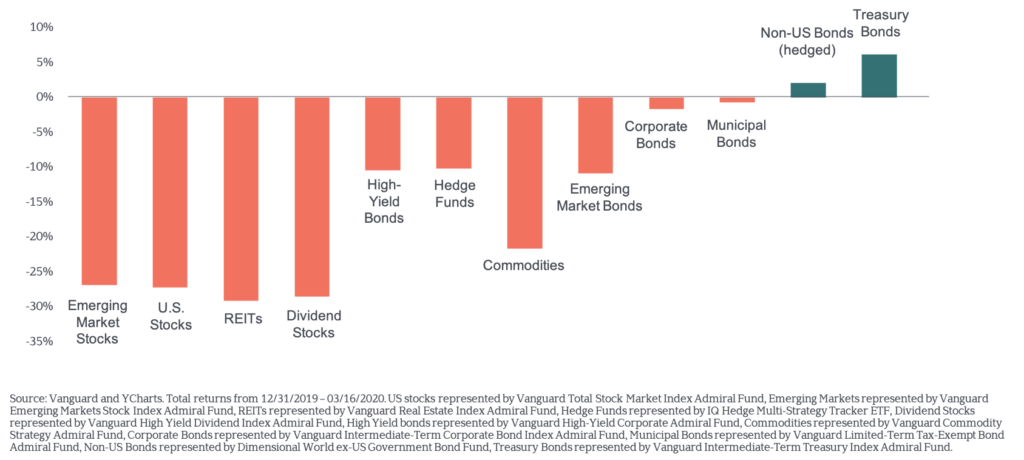

Trying to stretch for return among both your stocks and bonds can leave you nowhere to hide when the markets play rough. This “picture” from the depths of 2020 says it all.

Safe Bonds Can Provide Ballast

YTD Performance, January—March 2020

The graphic above—the same one shown in our March webinar—displays then year-to-date returns for a variety of asset classes. Many of these are held in a typical Vista portfolio, while others such as hedge funds, commodities, and high yield bonds are often hyped as better “alternatives” to low-yielding bonds, but intentionally omitted from our portfolios.

The takeaway? While low bond returns are often bemoaned when stock markets are surging, there’s no better friend in times of turbulence and pessimism. And when it comes to bonds, as 2020 proved true again, the safer the better.

The Road Ahead

We can’t tell you what markets have in store in the years ahead. But we can confidently say, successful investing doesn’t require advanced knowledge of the future. And it sure doesn’t have to be complicated to be effective:

- Build a plan based on your personal objectives.

- Spread your wealth across a global mix of stocks, bonds, real estate and cash.

- Diversify broadly within each asset class.

- Use low-fee, low-turnover funds to keep a lid on costs and taxes.

- Rebalance whenever a part of your portfolio becomes unwieldly.

Simple, yes. Easy, no. And yet, we’re optimistic sticking to these principles will serve you well in the years to come