With mortgage rates at historic lows, homeowners need only turn on the news to be bombarded with ads encouraging them to refinance.

Get a mortgage rate you can live with! Let your home be the investment you deserve! What could you do with a lower mortgage payment?

What could you do, indeed?

While low mortgage rates may be alluring, some quick math can help you determine whether refinancing your mortgage can be a smart money move.

The Allure of Low Rates

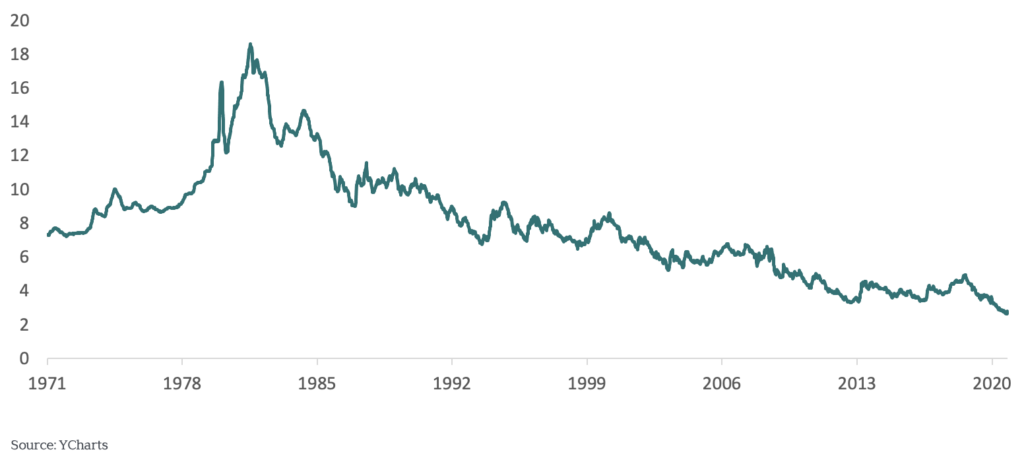

From a staggering peak of 18% in 1981, 30-year mortgage rates have trended downward in recent decades, settling in at today’s 2.8%.

30-Year Mortgage Rate (%)

Keep in mind, today’s low rates are generally only available to those with high credit scores—760 and above. If your score is lower due to excess debt or missed payments, take steps to improve it before trying to refinance.

If your credit score affords you today’s lowest rates, refinancing is sure to be tempting. Yet, temptation must be weighed against financial goals.

Homeowners who have paid down an existing loan for 15 years might find a lower 30-year payment enticing. But many folks wish to be debt-free by a certain age, so delaying that goal for another ten or fifteen years simply to lower a monthly payment makes little sense.

The traditional rule of thumb suggests a refinance is only worth investigating if you (1) obtain a rate 0.5% lower than your current rate, (2) plan to stay in your home long enough that the benefit outweighs the cost to refinance, and—critically—(3) can stick to your payoff goals.

Simple enough, but how do you navigate the numbers to determine if the rate reduction is worth the cost? A simple breakeven analysis can offer some clarity.

The Beauty of Breaking Even

Let’s say you’re 50 years old with fifteen years remaining on a 30-year $500,000 mortgage at 4%. The remaining term aligns with your goal to be debt-free when you retire at age 65.

You’re considering a new 15-year mortgage at 2.50%. With this loan, your monthly payment would be $366 less. So far, so good.

But don’t forget closing costs, which commonly run 1% or more of the loan amount. With estimated closing costs of $5,000, the breakeven on this mortgage is the cost ($5,000) divided by the monthly savings ($366/month).

In this case, the breakeven is 13.6 months, meaning you’ll come out ahead if you stay in the house for 14 months or more.

If you’re confident you won’t be moving before then, you’ll end up saving nearly $65,000 in interest in this example and reach your goal of being debt-free in 15 years.

Additional Benefits

While lowering one’s monthly payment may be the most common reason to consider a refinance, there are additional ways to take advantage of today’s low rates:

- Locking in a better fixed rate. If you currently have an adjustable-rate mortgage, and plan to remain in your home, refinancing to a fixed rate will eliminate the risk of rates going up when adjustments occur.

- Tapping into home equity for cash. If you’re short on funds for a remodel and have equity in your home, you may be able to access additional cash via a refinance. Doing so may reduce capital gains taxes resulting from selling investments in your portfolio.

- Eliminating mortgage insurance. If your home value has increased or mortgage balance has decreased, a lower loan-to-value ratio may allow you to eliminate mortgage insurance.

- Consolidating more expensive debt. This includes paying off any lingering, higher interest credit card debt, a home equity line or a mortgage on a second home or rental property..

We Can Help

If you’re considering a refinance, your Vista advisor can help you determine whether a new mortgage will save money and help move you closer to your financial goals.

We’re also able to introduce you to an independent mortgage broker who can help find the best loan for you.