Even if you’ve never seen the holiday classic, “It’s a Wonderful Life,” you’ve probably heard the premise. Among many life-affirming lessons, George Bailey learns not every blessing or curse ends up being as fortunate or ill-fated as expected.

Similarly, you might already have seen our take here and here on how there’s no telling what positive or negative impact a presidential election may have on your investments. To recap:

Just because your preferred presidential candidate wins or loses doesn’t mean the market is certain to rally or retract. Accordingly, decisions on how to invest should be separated from political preferences.

This goes for near- and long-term decisions.

The Wide-Angle View on Washington

It’s not that politics don’t impact market pricing. Clearly, different administrations will prioritize and pursue very different positions, with huge financial implications.

The problem is guessing how markets will respond to what may seem like “obvious” good or bad news.

There are so many global participants, with so many varied goals, interests, and perspectives, it’s incredibly tough for any one data point to be “the cause” of the market’s performance. At the risk of being flippant, who’s in the Oval Office is just one of the many variables that can move markets. Other variables include valuations, interest rates, employment, and technological changes, to name just a few.

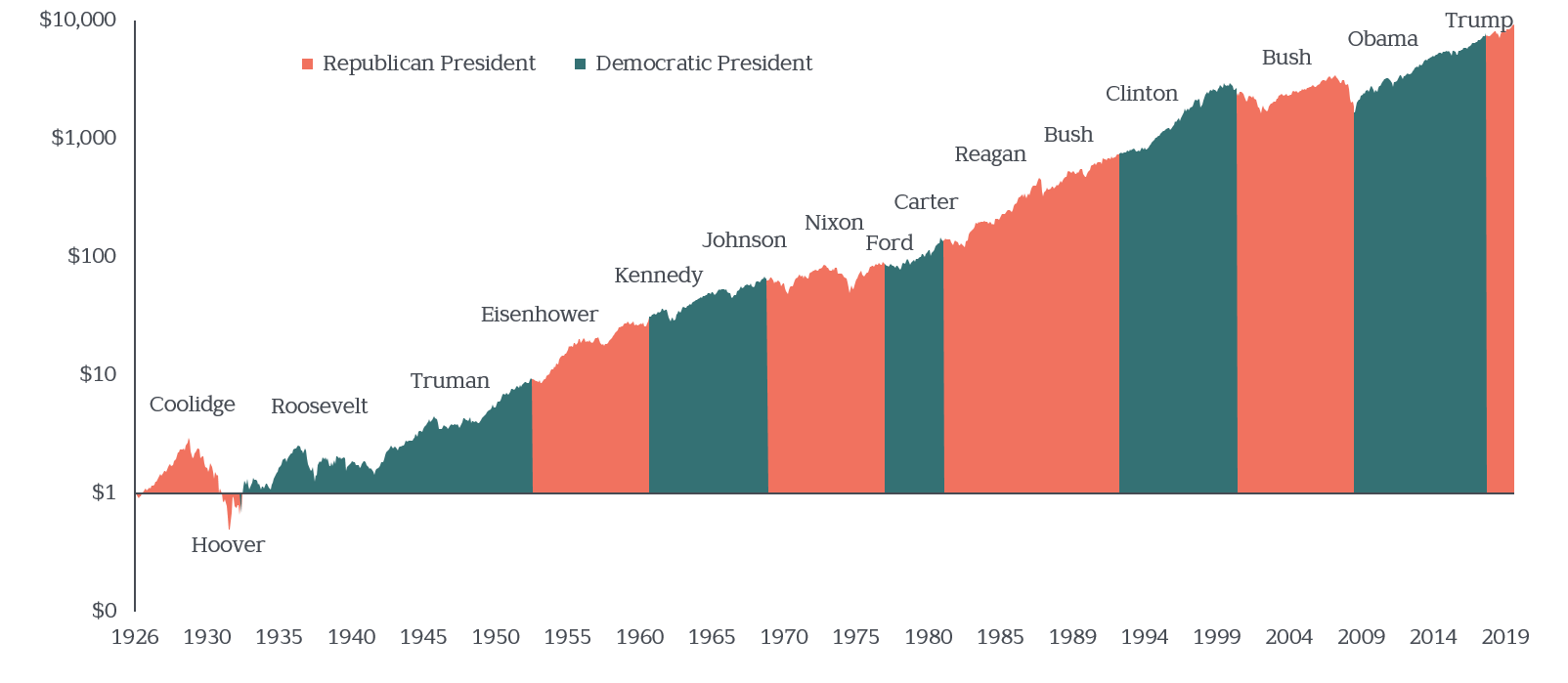

Making investment decisions based solely on the outcome of an election, even a presidential one, is unlikely to help you get ahead. Below is the latest version of a chart we’ve shown you before, now updated through 2019. It illustrates how one person or party hasn’t seemed to ultimately impact the market’s mountainous growth. Markets have rewarded investors under both Republican and Democratic administrations.

Exhibit 1: Elections and the Growth of $1

January 1926—December 2019

In case you’re wondering, the data looks essentially the same if you instead chart it according to who controls Congress. House divided or not, there’s still no clear connection between market performance and the party in power.

Election Year Close-Ups

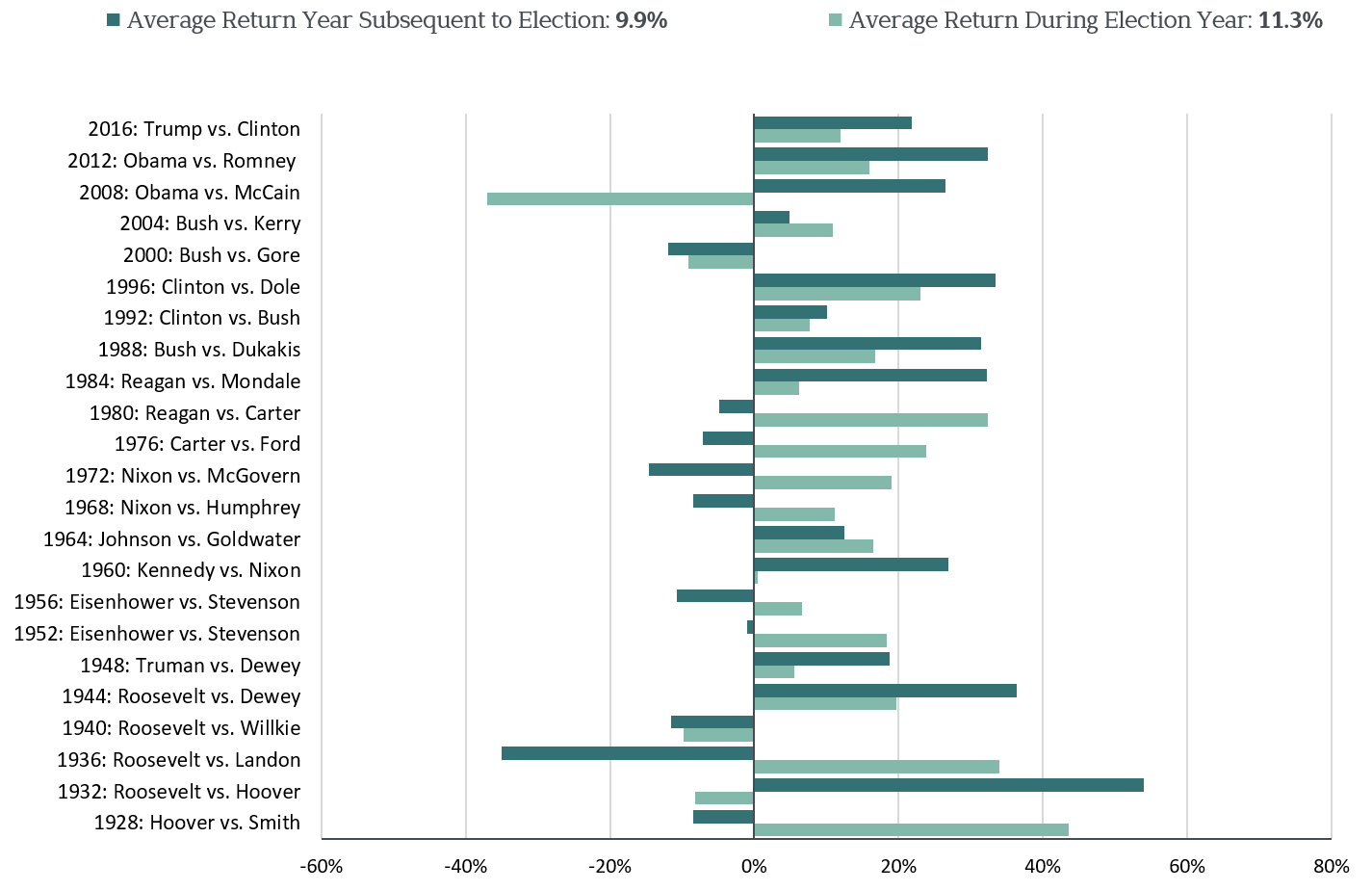

What does history tell us about what to expect in the months closely surrounding a presidential election? The short answer for investment purposes: Not much.

The following chart informs us that the U.S. market, as measured by the S&P 500 Index, has delivered slightly higher returns in the year of a presidential election, compared to the year following. It’s easy to see, however, the walk has been random.

Exhibit 2: Returns During & After Election Years

1928—2017

Reading the Tax-Planning Tea Leaves

You also may be wondering whether we should brace for higher taxes should the Biden/Harris ticket prevail. Are there precautionary actions worth taking now?

We don’t advise tying investment decisions to too many “what if?” tax speculations. After all, tax rates have changed frequently in the past, and market prices are driven by a global mix of investors (who themselves are subject to a variety of tax rates, including no impact at all for tax-exempt investors).

It may be worth remembering, too, initial tax proposals by any party have a way of changing dramatically before they become law. Most recently, we saw a 2017 tax bill proposing FIFO accounting (first-in, first out) for realized capital gains. To the relief of many investors, enacted law included no such provision.

If ordinary income and capital gain tax rates do increase next year, that should make what we’re already doing—favoring tax-friendly index funds, committing to low turnover (trading), and using tax-efficient asset location—even more valuable.

Should We Expect a Wild Ride?

So, will investors hunker down and give themselves a breather during the fall elections? Or will the uncertainty add to volatility through November? At the risk of jinxing ourselves, it’s hard to imagine more market volatility than we’ve already seen in 2020!

The historical record is mixed—some election years have seen higher daily price swings, some lower. It’s reasonable to expect the closer we get to November, the louder the rhetorical volume is likely to become. But, remember, we believe investors should always be prepared for volatility. (That’s one of the reasons we prefer only the safest bonds when a plan calls for portfolio ballast.)

To borrow a lesson from George Bailey, remember that markets have a way of ultimately prevailing past the pesky setbacks and daily drama to deliver wondrous returns over time. The hardest part is maintaining the patience and temperament to harness them.