While doctors have long prescribed regular checkups, adequate rest and nutrition, strong social ties, and exercise for optimal wellness, proper healthcare need not compromise financial well-being.

For recent retirees too young to qualify for Medicare and the newly unemployed, insurance premiums can be painful—but this doesn’t have to be the case.

Under the Affordable Care Act (ACA), these individuals might be surprised to learn they qualify for a healthcare subsidy that can take the sting out of healthcare costs.

Who is Eligible?

Currently, 11.4 million people are enrolled in health plans through the Affordable Care Act. Of these, about 9.6 million (84%) receive subsidies that cover the bulk of their premiums.

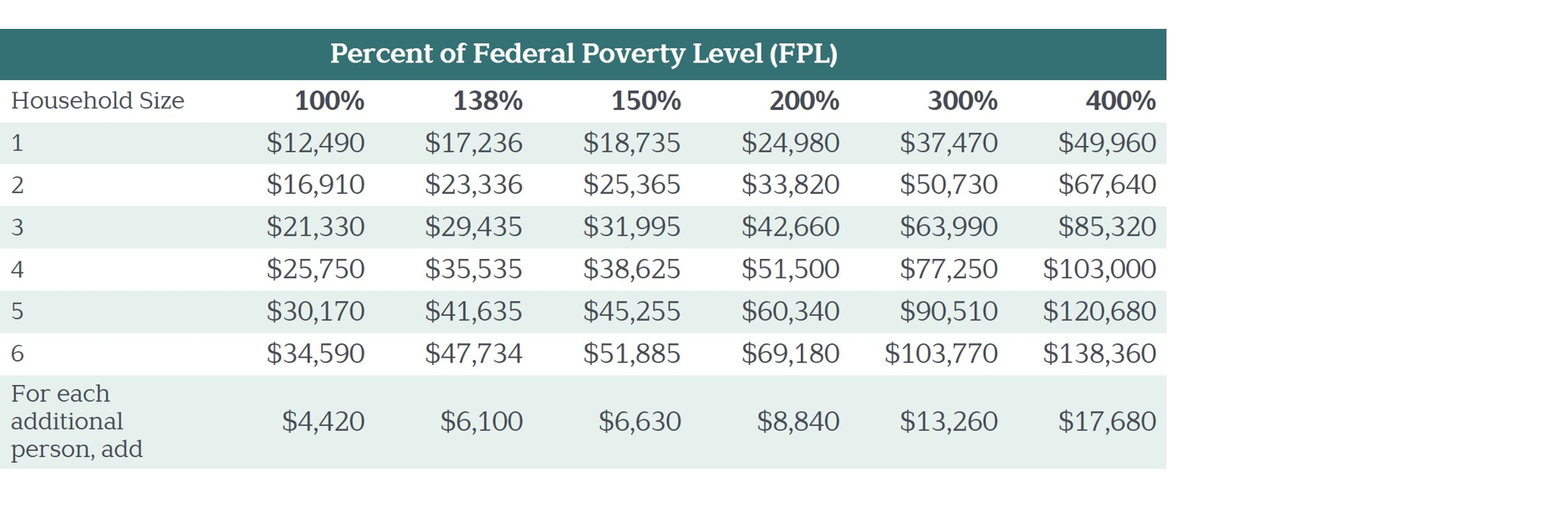

To receive a healthcare subsidy, individuals and families must earn between 100% and 400% of the Federal Poverty Level (FPL), as shown below.

It’s important to note that eligibility is based on an estimate of income the year in which subsidized health insurance coverage is received (more on this later), not on income reported on the previous year’s tax return.

Newly Unemployed or Retired?

Open enrollment on the Affordable Care Act Exchange runs from November 1 to December 15, but some states have expanded this window to help people obtain coverage during the coronavirus pandemic.

Under federal guidelines, a “life-changing event” that has occurred in the past 60 days might qualify individuals for a special enrollment period.

These events include job loss, retirement, marriage, divorce, birth or adoption, or a recent move to a new ZIP code or county.

How Do Subsidies Work?

This is where things get a bit complicated.

A health insurance subsidy is a tax credit based on estimated (not actual) income. At tax time, if estimated income matches actual income, no problem.

If estimated income exceeds actual income, the subsidy that should have been received will be paid as a tax refund or credit.

But if estimated income is less than actual income (perhaps due to an unexpected bonus or raise, a Roth conversion, or capital gains), an enrollee may need to pay back some or all of a subsidy come tax time.

Ouch.

An Additional Word of Warning

Under the Affordable Care Act, subsidies can be paid directly to insurance companies each month, or the insured can pay the full premium and receive a subsidy “true up” in the form of a tax credit or refund in the subsequent year.

Most people choose the advanced payment option because they need the subsidy to fulfill monthly health insurance payments.

Be forewarned, though: If you underestimate income on a subsidy application, you risk receiving an entire year’s subsidy based on an incorrect income estimate—a prescription for pain at tax time.

Boost Your Well-Being

Fortunately, a little planning—even making deductible contributions to a traditional IRA or an HSA to reduce modified adjusted gross income—can help reduce the chance of payback pain.

If you think you might qualify or be close to qualifying for a healthcare subsidy, talk with your Vista team.

We’ll help you assess your situation and keep you on the path to wellness—both physical and financial.