The difference between preparing for a scary market and actually experiencing one is like gazing at stormy seas versus plunging into their chilly depths.

If 2020 was your first bear market, you were finally granted the “opportunity” to dive in and test your real-life appetite for stock market risk. And even if you were an investor through the 2007–2009 global financial crisis, you may have forgotten the pain from that period, now more than a decade ago.

So, how have you been doing so far?

Simple Investing in Difficult Markets

As we’ve long said, our investment strategy is relatively simple: Buy, hold, and maintain a globally diversified stock and bond portfolio. Structure it to reflect your personal objectives and tolerance for risk. Protect it from costs and taxes. Rebalance, as needed, to stay on target.

But we’ve also long emphasized: These “simple” steps aren’t so easy.

This is one reason seasoned advice remains so fundamental. Just as we did last time (and the time before that), we spent much of this spring’s pandemic-fueled market downturn furiously rebalancing portfolios. This meant bravely selling out of the comforting arms of high-quality bonds and into the stock asset classes that had suffered the most bruising losses.

In a sense, we merely did what we said we were going to do—selling high, buying low, and adhering to the initial plan we put in place. But when words like “unprecedented,” “record unemployment,” and “imminent Depression” color almost every conversation, even the most sensible portfolio moves seem not only questionable, but downright rash.

Investing = Expecting the Unexpected

Had we told you in mid-March to expect a dramatic stock market rally by June, you would have been right to ignore this (or any other) prediction. And yet, rally it did.

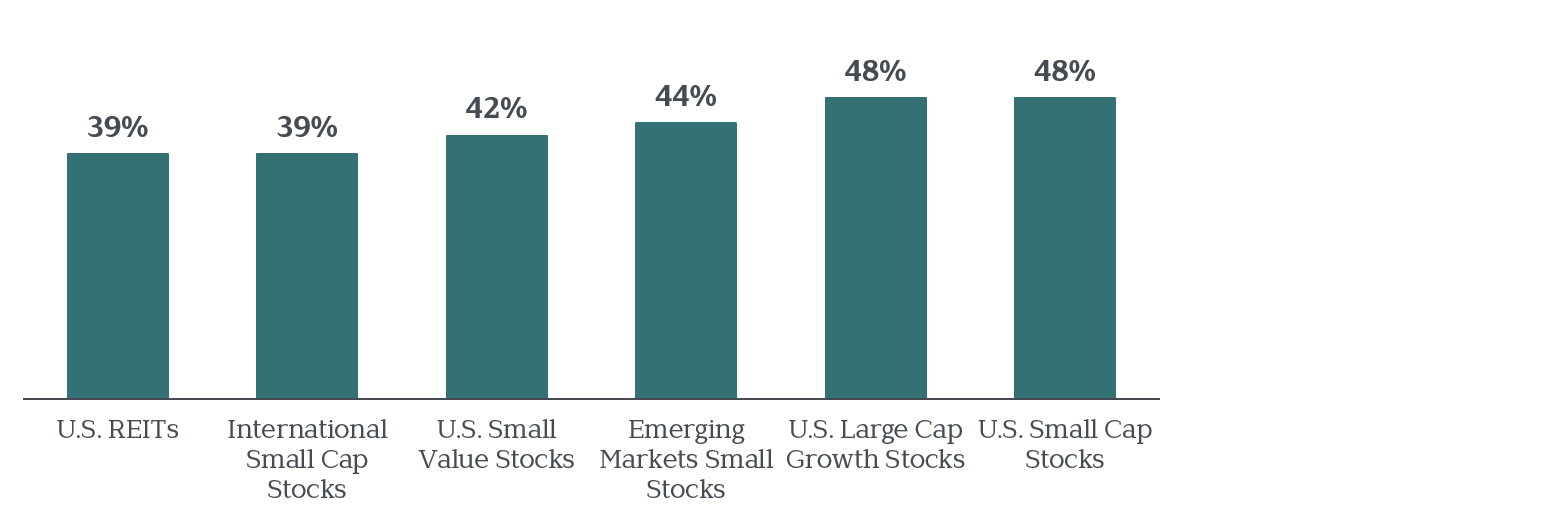

Below is a performance table for familiar components of our stock portfolios. While most risky asset classes in a Vista portfolio have appreciated at least 30% since the lows of March, these select slices have performed the best.

Exhibit 1: Asset Class Returns

March 23—June 30, 2020

Investing for the Long Haul

Especially for those who stomached rebalancing into the asset classes that had performed the worst earlier this year, we applaud you for adhering to the investment plans we developed together. Your trust and confidence are what allow us to do the simple, but not easy, work of successful long-term investing.

While we’re delighted the markets so swiftly rewarded our shared resolve, we know they are unpredictable. Recent returns don’t guarantee smooth sailing in the future. More choppy water may well lie ahead.

But remember, your positions in the stock market aren’t all meant to be spent tomorrow, next month, or next year. Your investments exist to fuel your and your family’s aspirations in the decades ahead.

Taking this long view may not eliminate the emotional turmoil volatile markets can create. But it can help you endure the downturns, celebrate the recoveries, and earn your fair share of whatever returns markets are generous enough to offer.

And that, in our view, is the best way to protect and grow your family’s wealth for the remarkable days on the horizon.