Summer in the Northwest. That glorious season of hiking, swimming, and indulging in all things outdoorsy—including the quintessential neighborhood BBQ.

Perhaps this scene sounds familiar: Beer in one hand, tongs in the other, your neighbor confidently rattles off a list of hot stocks to own as he absentmindedly checks the char on the steaks. He mentions Amazon, up a whopping 45% this year. And Netflix, up 104%.

Feeling uneasy, you start to wonder, “Why don’t I own Netflix?”

Hold the Phone

Believe it or not, humble index fund investors already have exposure to today’s market winners.

It’s true. Index funds—the low-cost, broadly diversified powerhouses of a balanced portfolio—hold all of today’s hottest stocks. Think Amazon, Apple, Google, Microsoft, and Facebook.

Even better, because index funds hold virtually all publicly traded stocks, tomorrow’s winners will be in there, as well. Investors don’t need to pick which stocks will perform best to be successful.

Picking stocks, as we’ve said many times, is a losing proposition.

What’s in an Index Fund?

Consider a Vista client with a diversified 65/35 portfolio worth $3 million.

Whether he realizes it or not, he holds many of today’s hottest stocks in his index fund—$24,000 worth of Apple; another $17,000 of Google; $14,000 of Amazon; $10,000 of Facebook; and $3,000 of Netflix.

Not only is he invested in one of the most effective tools for building and maintaining wealth, but he owns the very stocks that everyone—including your neighbor—is talking about.

Why Own Anything Else?

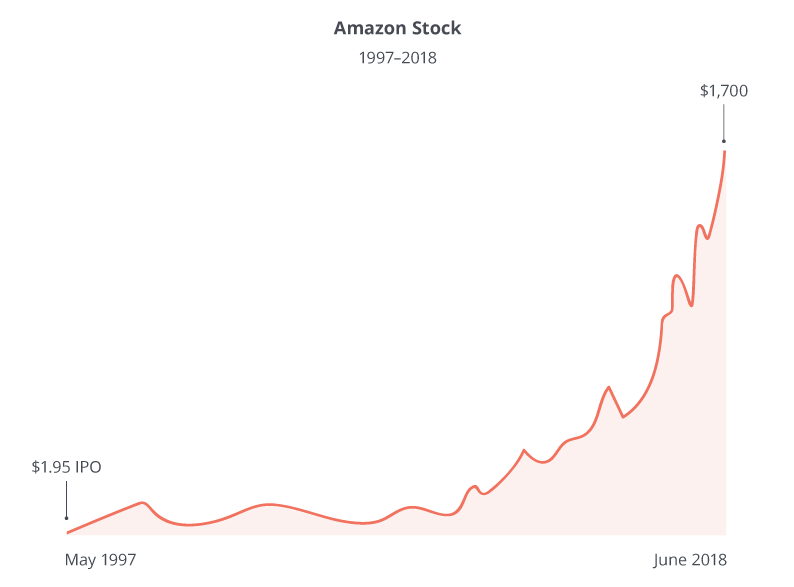

With companies like Amazon and Google providing eye-popping returns over the past decade, why diversify?

While research shows that a few top performers such as Amazon do, in fact, produce a large part of the market’s long-term returns, these stocks are incredibly difficult to find—even for seasoned pros.

By owning all stocks through a diversified portfolio, investors get their best chance for owning tomorrow’s winners and capturing the market’s top performers.

A Winning Portfolio

Built with index funds from Vanguard and asset class funds from Dimensional, Vista’s portfolios contain 12,000 companies diversified across 44 countries around the globe.

So, the next time someone mentions a hot new stock, you can reply, “Oh, Netflix? I already own that,” and get back to enjoying the rest of your summer.