With standard deductions nearly doubling under the new tax law, far fewer taxpayers are expected to itemize in coming years.

Given this change, how should taxpayers approach charitable giving?

You might consider “bunching” several years’ worth of charitable donations into a donor advised fund (DAF). This approach lets you have your cake (get a tax deduction for charitable gifts) and eat it, too (take advantage of the increased standard deduction).

Why Bunch?

Taxpayers who normally fall short of itemizing may benefit from using the bunching strategy.

Rather than waiting until tax time to add everything up to see if it’s more beneficial to take the standard deduction or to itemize, you can proactively bunch multiple years of charitable donations in one year to exceed the standard deduction threshold.

Accordingly, you would itemize in the bunching year and take the standard deduction for subsequent years. Under the new tax law, this approach would yield higher deductions and greater tax savings.

Bunching, however, leaves open a big question. What happens to charities that rely on a steady stream of donations to operate every year?

Enter the donor advised fund.

What’s a Donor Advised Fund?

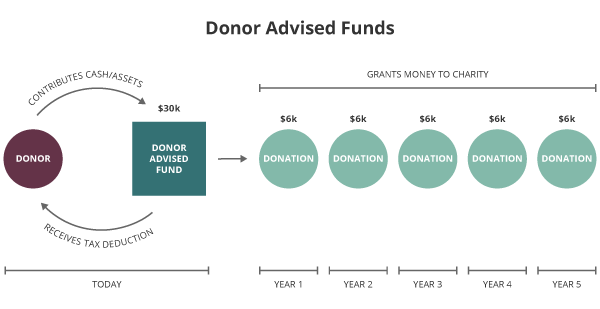

Donor advised funds allow taxpayers to make a charitable contribution, receive an immediate tax benefit, and then later (sometimes years later) release grants from the fund to charity. Like a charitable investment account, a DAF gives you the flexibility to donate funds at your own pace.

Bunching and DAFs: A Winning Combination

In the context of tax strategy, bunching several years of charitable donations into a donor advised fund makes sense.

Consider the Smiths. Under both previous and current tax law, taxpayers can elect to claim the standard deduction or itemize deductions – whichever is greater. The Smiths’ itemized deductions usually include a donation of $6,000 per year to their favorite charity and $20,000 per year in state and local taxes.

Under the new tax law, the standard deduction for a married couple filing jointly increased from $12,700 to $24,000. Additionally, the deduction for state and local taxes was capped at $10,000. This means that the Smiths need another $14,000 of itemized deductions to crest the new $24,000 standard deduction amount.

The Smiths can take their original annual charitable contribution of $6,000 and bunch it for, say, 5 years. Accordingly, the Smiths will contribute $30,000 to a DAF in 2018. Combined with their state and local tax deductions of $10,000, they will now have itemized deductions of $40,000, which exceeds the standard deduction of $24,000.

They can now itemize and receive the upfront tax deduction for their contribution. Using this approach, over the next five years, their deductions will total $136,000 compared to $120,000 if they had taken the standard deduction of $24,000 over all five years.

Just how valuable is an extra $16,000 in federal tax deductions for the Smiths? Assuming they are taxed at a rate of 30 percent, this bunching strategy will save them $4,800—more than enough to buy one fine cake.

For tax years 2019 through 2022, they will take the standard deduction but can still release funds from their DAF to their favorite charities.

Let Them Eat Cake

Supporting worthy causes is a gratifying experience. By planning in advance and bunching charitable donations into a donor advised fund, you can enjoy giving to favorite charities and maximizing tax benefits under today’s tax laws—always a great reason to celebrate with cake.