Most active investment managers don’t achieve their main objective—delivering higher returns than market averages. In fact, roughly 90% of US, international, and emerging market mutual funds underperformed their respective benchmarks over the past 15 years.

But that doesn’t stop investors from trying. To find the next “market-beating” fund, many turn to the small list of recent “winners.” Unfortunately, past performance has proven to be a poor predictor of future success in active investing. A new study from The Vanguard Group highlights what we’ve long said—past winners don’t repeat.

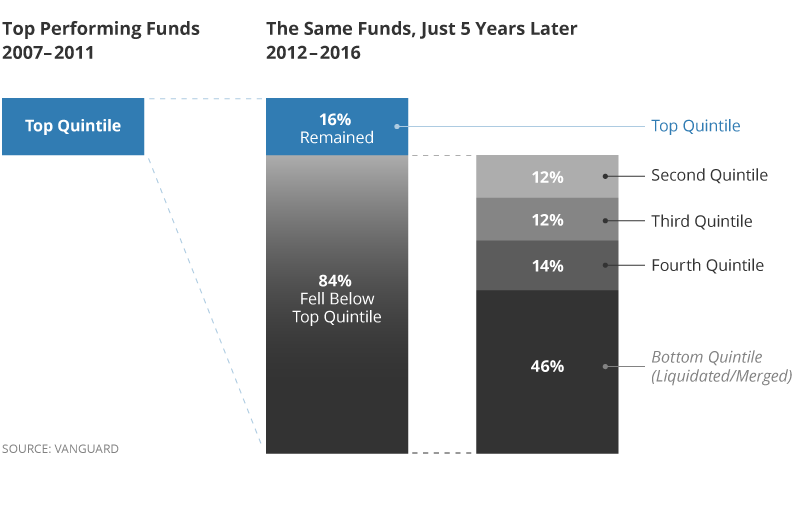

Using Morningstar’s mutual fund database, Vanguard analyzed the most recent five-year performance (from 2012 to 2016) of all the actively managed stock mutual funds that performed in the top quintile over the previous five-year period in the U.S. (from 2007 to 2011). Vanguard then ranked funds by performance quintiles, or five equal groups of 20%, to once again answer the question—do winners repeat?

The graphic above displays Vanguard’s findings. Of the winning funds from 2007 to 2011, just 16% remained in the top 20% in the subsequent five-year period. In a result suggestive of pure randomness, an almost equal number of funds fell to the 2nd quintile, 3rd quintile and 4th quintiles, respectively, of the performance rankings. Notably, 21% of past winners fell to the bottom of the performance rankings, while 25% went out of business (“liquidated/merged”).

In other words, past winners were more than twice as likely to fall to the bottom in the next period or go out of business altogether than to remain top performers.

The results of Vanguard’s research reaffirm the well-documented lack of consistent performance among actively managed funds. An earlier and separate review of the best twenty U.S. stock funds during the 1983-1993 decade, for example, found that sixteen failed to even match the index benchmark (much less outperform) in the subsequent ten years. Ten years might seem long enough to deduce that winning managers had above-average skill, but no, 80% of the winners from one decade became losers in the subsequent decade!

Remarkably, such long odds don’t stop investors from trying to outperform the market. Vanguard estimates that 85% of the global equity market—and more than 95% of the global bond market—is still actively managed in an attempt to beat itself.

But the tide is turning. More than $255 billion poured into The Vanguard Group’s index mutual funds in 2016, a clear sign of the shift away from money managers who try to handpick winners.

When it comes to active investing, we know past performance isn’t a good predictor of future results. It is precisely why index funds have anchored our portfolios since first opening our doors in 2001, allowing us to control those few factors we can in an ever-uncertain investment world.