With broad market indices recently hitting record highs, many investors have expressed fear of investing available cash before a market correction.

Are those fears justified? Is it better to invest right away—“plunge”—or is it better for investors to tiptoe into the market over time, aka “wade?”

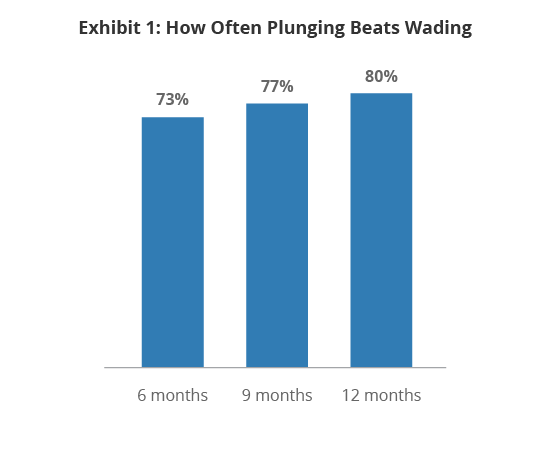

While the future is uncertain, the historical record is clear. From a return standpoint, plunging has beaten wading about three-quarters of the time. As legendary investor Warren Buffett has said, “The best time to plant a tree was 20 years ago. The second best time is today.”

Another Way to Plant the Tree

While plunging is most likely to provide the best investment outcome, it may not deliver the best experience for every investor. Indeed, despite the evidence, some investors may prefer a more gradual approach to becoming fully invested. For those who don’t plunge, is there an optimal approach to wading?

To answer this, think of wading as an insurance policy. Since getting invested over a protracted timeframe means holding more cash, wading provides some protection against a sudden stock market decline. As financial author William Bernstein noted, wading “allows the investor to digest the market in many small bites, rather than one big gulp.”

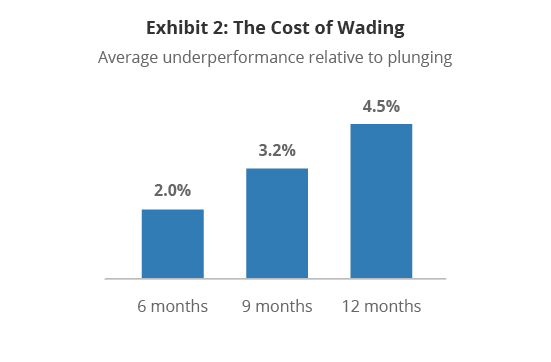

But just as a $2 million life insurance policy costs more than a $1 million policy, wading comes with an expected opportunity cost in the form of lost stock returns.

Research on Wading

To determine the optimal wading strategy, we used historical stock market data for a balanced stock/bond portfolio to quantify both the cost of, and protection provided by, this “insurance.” We evaluated three different wading strategies—investing equal amounts over six, nine, and twelve months—and compared them to a plunging strategy, as well as against each other.

Consistent with other studies, our research showed that—first and foremost—plunging is still the best bet for maximizing returns. Investors looking to maximize their investment outcome for the long term should get fully invested immediately. Exhibit 1 shows how often plunging beat wading, based on the average performance for each strategy over all observed periods.

Next, we looked at the cost of wading. We found that the longer an investor wades, the higher the cost in terms of foregone return. Exhibit 2 shows the average outperformance of plunging, relative to wading, for the three wading strategies. The longer you intend to wade, the higher the cost you should expect to pay for that insurance.

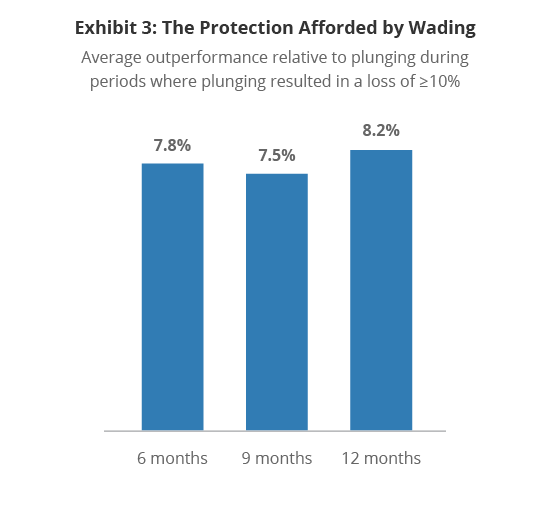

Lastly, we wanted to understand the protection provided by wading during times when an investor would want this insurance policy most.

Keep in mind, the data above reflects the average result for all rolling six-, nine- and twelve-month periods since 1973. In our experience, however, investors aren’t so concerned with protecting their portfolios in periods when plunging results in low, but positive, or slightly negative returns. No, we believe investors’ reluctance to plunge stems from a desire for protection against a large market drop, say 10% or more, immediately after becoming invested.

When we focused our research on just those historical periods when plunging resulted in a loss of 10% or more, we found the protection provided by wading over six, nine and twelve months was very similar. In other words, wading over twelve months didn’t provide much additional protection than wading over nine months. And, interestingly, wading over nine months provided less protection than wading over six months.

The takeaway? Since the cost of protecting one’s portfolio via a wading strategy is higher the longer one wades, yet the protection provided by wading in the times it might be wanted most is similar, we believe wading over six months is likely to provide the most cost-effective protection.

Plunge…or Wade with Purpose

After reviewing the data, Warren Buffet’s advice stands—plant your tree today. Investors looking to maximize returns should plunge and get fully invested immediately.

For those who just can’t bring themselves to plunge, history suggests wading in equal parts over the course of six months provides the most cost-effective protection.