Investors have many reasons to despise international stocks today.

They’ve not just underperformed the popular Standard & Poor’s 500 Index of large cap U.S. companies by more than 7% per year since 2008. No, in those nine years, $1 invested in large international stocks has actually shrunk to 98 cents, meaning an international “lost decade” could be near.

Forgotten the Lost Decade? That was the stretch from 2000 through 2009 during which the S&P 500 recorded a total return of negative 9.1%.

Fortunately, for most of that period stocks in international and emerging markets—just as U.S. shares are doing today—helped globally-diversified investors earn healthy returns.

How times have changed. International stocks’ recent struggles, combined with a strengthening U.S. dollar and the “Buy American, Hire American” political environment, have only increased investors’ concerns about investing overseas.

Giving up on international stocks, however, would be a mistake. And because they play such a prominent role in a Vista portfolio, we believe it is important to remind folks why we’re just as committed as ever to international stocks.

#1: Hindsight is not foresight

Wasn’t it obvious at the end of 2007 that international stocks were set to underperform those in the U.S.? Today, we might think it should have been obvious; in truth it was anything but.

Back then, international stocks were on a roll, having delivered annualized returns of 24% over the preceding five years. Even better, investors willing to venture into emerging markets—a subset of international stocks—were rewarded with gains of 40% per year. The U.S. stock market, meanwhile, had posted the worst performance of any developed economy in two of those five years.

The outlook for U.S. stocks didn’t look much better, either. An outdated workforce, colossal government debt and trillions more projected to be spent to keep Medicare and Social Security solvent were all stories dominating that year’s headlines.

In spite of those real challenges, however, it would have been unwise to give up on U.S. stocks (we didn’t). It would be just as unwise to overlook the stocks of international companies today.

#2: Don’t judge a book by its cover

On the heels of poor performance, it can be tempting to dismiss the merits of a company stock simply because it is “international.” Indeed, by focusing on a portfolio’s asset classes, it’s easy to lose sight of the thousands of underlying individual businesses. Those are the real assets.

Consider two companies: Hershey and Nestle. Hershey is headquartered in Pennsylvania, while Nestle is based in Switzerland. Which is the better investment?

It’s hard to know. Both companies make chocolate and sell candy all over the world. Hershey and Nestle are both multi-billion dollar companies with strong and mature business lines. Each faces similar risks—changing consumer preferences, intense competition, a complex and changing regulatory environment, and fluctuating commodity (sugar) prices, to name a few.

Because their risks are similar, each is likely confronted with comparable costs when seeking to finance its operations either through the issuance of equity (stock) or debt (bonds). The flipside of this “cost of capital,” of course, is an investor’s expected return.

From this perspective, Hershey and Nestle likely have similar expected rates of return. It would, therefore, be foolish to doom Nestle to underperform

Hershey simply because the Swiss candy maker is “international.”

We believe the same holds true for the 9,665 other unique international businesses owned in a typical Vista portfolio.

#3: Diversification: A better, more reliable experience

While the first two reasons are unquestionably theoretical, an evaluation of the empirical evidence confirms global portfolio diversification has provided a better long-term investment experience.

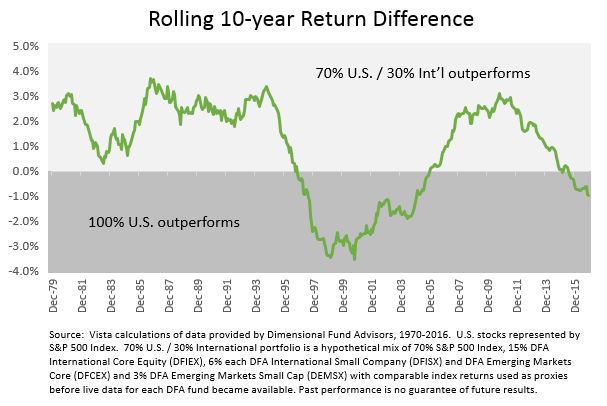

The graphic below evaluates two simulated portfolios over rolling 120-month (10 year) periods since the start of 1970: a 100% U.S. stock portfolio, as measured by the S&P 500 Index, and a globally-diversified one with 30% devoted to the same mix of international developed and emerging market (including small cap and low-priced value) stocks we favor in client portfolios.

Each point on the graph reflects whether a globally-diversified portfolio or a 100% U.S. stock portfolio delivered better performance over the preceding ten years.

As displayed above, returns were higher for the globally-diversified mix in 71% of all 445 rolling 10-year periods since 1970. Average 10-year returns were also higher for the global mix (12%) than for the domestic-only mix (11%), while volatility was lower.

In other words, despite the recent advantage for U.S. stocks, nearly a half century of data tells us that by consistently owning international stocks we should expect a better, more reliable investment experience over the long-haul.

The short-run isn’t looking too bad, either. Since the start of the year, international small cap stocks are up 6%, while those in emerging markets have risen nearly 12%.

What’s not to love about that?