In December 2015, The Wall Street Journal declared the coming year would bring “more gloom, more volatility and few gains” for stocks.[1] Indeed, the market’s swift decline to start 2016—January was one of that month’s worst ever—had many convinced a recession was looming. Stoking those fears, The Wall Street Journal then suggested “there’s more pain ahead for U.S. stocks.”[2]

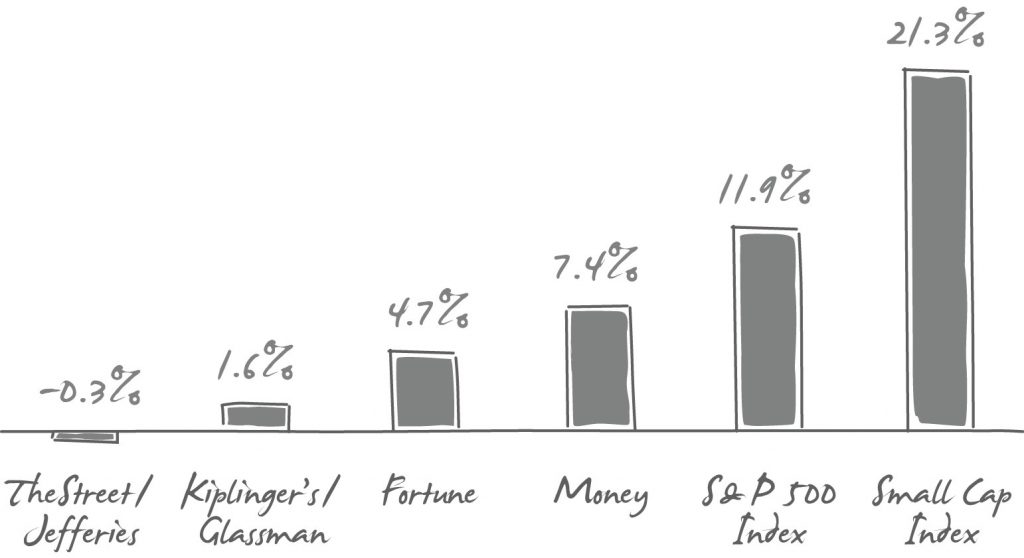

The only pain, however, was felt by investors who shifted their portfolios in response to such dire warnings. By year’s end, S&P 500 Index had risen 12% while small cap stocks had surged 21%—a great year by any measure.

The Wall Street Journal wasn’t alone in their off-target prediction. Most financial media outlets offered a bold forecast or two at the turn of the calendar, and many missed the mark badly.

For its annual Investors Roundtable, Fortune convened six Wall Street experts to help readers find stability—and profits—in what was sure to be a rocky market.[3] These “smart investors” recommended eight stocks to own in the coming year. Ultimately, winners RPM International (+21%) and Atmos Energy (+20%) were weighed down by Novartis (-15%) and Disney (-7%). The collective return of the experts’ concentrated portfolio? 4.7%. Less than half that of the diversified S&P 500 Index.

To trump the market in 2016, long-time Kiplinger’s Personal Finance columnist James K. Glassman again offered his ten best picks for the coming year.[4] Glassman relied on high-profile managers such as Fidelity’s Will Danoff to help bolster his list, ensuring readers that “a well-chosen 10-stock portfolio can balance out big losers with impressive gainers.” Truer words were never written, as losers Xerium Technologies (-53%) and Twitter (-28%) nearly fully offset the gains from TAL Education Group (+55%) and Old National Bancorp (+38%). Despite the small cap focus of Glassman’s “ten best,” his recommended list earned just 1.6%—a whopping 20% below that of the Russell 2000 small cap index.

Money assembled an all-star cast of fund managers, including those at the helm of Oakmark Select and Ariel Appreciation. Each had outperformed their peers over the previous five years, so “follow the manager’s advice,” boasted Money, “and you may prosper, too.”[5] Despite the managers’ focus on U.S. value-oriented stocks, which thrived in 2016 (+18%), the twelve stocks selected by Money’s “top pros” returned just 7.4% for the year.

The “highest conviction Buy-rated” stocks for 2016, according to Jim Cramer’s TheStreet, were a group of seventeen U.S. stocks selected by leading global investment bank, Jefferies.[6] TheStreet assured readers the wide mix of stocks represented some of the most “compelling single name stories” in the market. Ingersoll-Rand (+43%) and AT&T (+27%) delivered on the hype, while the performance of Manitowoc (-58%), Stericycle (-34%) and Wisdom Tree (-29%) was far less convincing. While the U.S. total stock market index delivered 13%, Jefferies’ 17 favorites collectively returned -0.3%.

If the mere existence of a tabloid prediction didn’t serve as caution enough, Cramer’s TheStreet provided an unequivocal warning to readers with its “9 Large Cap Stocks to Sell Before 2016.” In a telling and ironic twist, these nine stocks—all of which carried TheStreet’s proprietary “Sell” rating—surged an average of 62% from recommendation date through December 30.[7] That’s right—the average return of the stocks TheStreet warned against grew more than any single one of the “17 favorite” stocks recommended in the previous article.

What’s the takeaway for investors? Attempting to pick individual stocks or shift one’s portfolio in response to expert predictions is a loser’s game. The most sensible way to protect and grow wealth is by getting diversified, minding costs and taxes, and staying disciplined—even when the financial media’s experts tell us more pain (or gain) is on the way.

- Browning, E.S. “2016 Forecast for Stocks: More Gloom, More Volatility and Few Gains. The Wall Street Journal. December 13, 2015.

- Scholer, Kristen. “Morning Moneybeat: Here’s What the Markets Will Be Watching This Week.” The Wall Street Journal. January 25, 2016.

- Brown, Joshua. “Where 5 Smart Investors Are Putting Their Money in 2016. Fortune.com. December 9, 2015.

- Glassman, James. “James K. Glassman’s 10 Stock Picks for 2016.” Kiplinger’s Personal Finance. January 2016.

- Bigda, Carolyn. “12 Great Stocks for 2016.” Money. January 7, 2016.

- Kulikowski, Laurie. “Jefferies Picks 17 Favorite U.S. Stocks for 2016.” TheStreet. December 26, 2015.

- Kulikowski, Lauire. “9 Large Cap Stocks to Sell Before 2016.” TheStreet. December 19, 2015.