Older long-term care insurance policies did not account for long periods of low interest rates. As a result, these policies have compensated by drastically increasing their annual premiums—often by 50% or more. What do you do if a premium increase occurs? Options vary by state and insurance company, but here are five possible choices:

1) Keep the policy, pay the new premium.

If it’s still affordable and you need the insurance, this is generally the most appealing option. Why? Even with the premium increase, your old policy will likely still cost much less than a newly issued policy with comparable benefits.

2) Keep the current premium, reduce the benefit period.

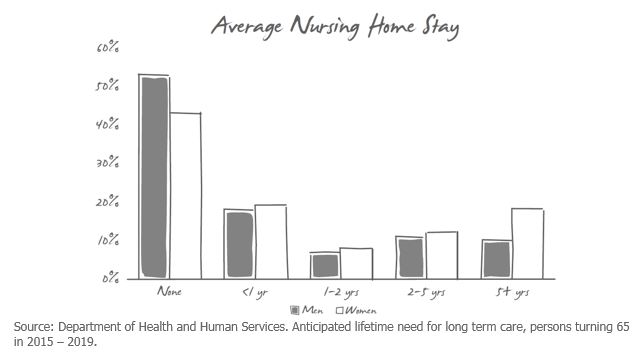

If the current benefit period is five years or longer, consider reducing it. Why? Data shows the average long-term care insurance claim is less than three years. With the odds against a lengthy insurance claim, you may be paying for coverage you’ll never use.

3) Keep the current premium, reduce the inflation rate.

If you’re in your 70s or 80s, consider reducing the inflation rate. Why? The policy has already benefited from inflation adjustments and, since you’re now closer to the point when a claim might occur, inflation is less of a risk.

If you’re in your 60s, be cautious about reducing the inflation rate. Those in their 50s should avoid an inflation reduction as decades of rising healthcare costs could prove financially devastating.

4) Keep the current premium, reduce the daily benefit.

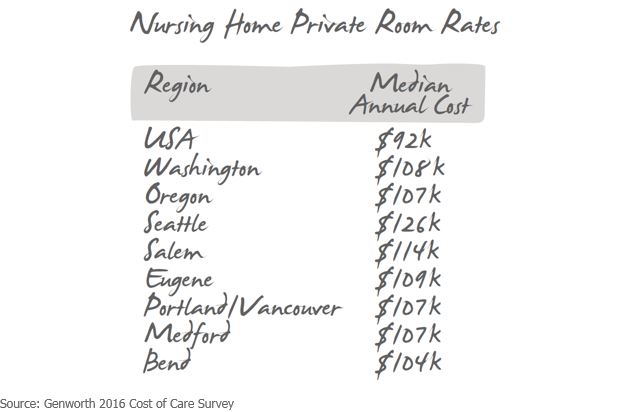

Short of canceling the policy, this is the option of last resort. Why? Most people only purchase enough insurance to cover the average cost of care. Before reducing your daily benefit, compare your coverage to the current cost of care in your area. Keep in mind, these costs are for nursing home private room rates; costs for in-home care are typically higher.

5) Cancel the policy.

Canceling the policy is most appropriate if your situation has changed and you no longer need the coverage. If you still need coverage but can’t afford the new premium, contact your insurer to see what other benefit might be reduced to maintain the policy.

You have more choices than simply paying the higher premium or canceling the policy. Odds are one of the available options above will provide an acceptable level of coverage at a price you can afford.

Adapted from “5 Ways to Handle a Long-Term-Care Insurance Rate Increase” by Michael Kitces. Journal of Financial Planning. April 2013