Anyone who’s purchased a car knows the party most prepared to walk away from the deal has the advantage. It is the motivated buyer, or seller, who is most often forced to make the biggest concession.

Consider two car shoppers: Frank wants a convertible, a canary-yellow Ford Mustang with several specific features, and he wants it today. Bob also wants a convertible, but he’s not too picky about the color, indifferent as to the make and model, and happy to wait a few weeks (or more) before making the purchase.

Who’s more likely to negotiate the better deal? In shopping for cars, Bob has the upper hand. It’s no different in investing.

Those who demand immediacy risk incurring higher costs. Index funds, for all their benefits, run this risk in seeking to closely track the performance of a benchmark, such as the S&P 500 Index. When index sponsors such as Standard & Poor’s or Russell Investments revise, or “reconstitute,” their list of holdings (e.g., when Google replaced Burlington Resources in the S&P 500), index fund managers must quickly buy and sell specific stocks. This happens just a few times per year, but as you might guess, trading the same stocks at the same time as every other fund increases costs, ultimately reducing returns.

Earlier this summer, markets witnessed the collision of two events—reconstitution day and high volatility. That first trading day after “Brexit,” June 24th, coincided with the day Russell Investments revised the holdings within the Russell 1000, Russell 2000 and other widely-benchmarked indices. As in past years, markets witnessed 5-10 times the normal trading demand for the stocks in transition. But this year, financial markets were also reeling, with U.S. stocks falling nearly 4%.

Clearly, this was not a good day to go car shopping for a canary yellow Ford Mustang with all the bells and whistles.

It is during these times that a patient, flexible trading approach can add significant value. Dimensional Fund Advisors (DFA) uses just such an approach. Rather than track commercial indices such as the S&P 500 or Russell 2000, DFA targets entire asset classes, often including a greater number of stocks than are held in other indices. The goal is to harness the returns of entire segments of the market—say, small cap value or emerging market small cap stocks—rather than strictly adhering to an index sponsor’s definition.

This flexibility allows Dimensional to avoid trading at a disadvantage, to delay transactions or even substitute similar securities for those which are difficult-to-trade (think: index deletions and additions on reconstitution day). Without the need to “get the deal done at any price,” DFA’s traders can be patient and seek to enhance portfolio returns.

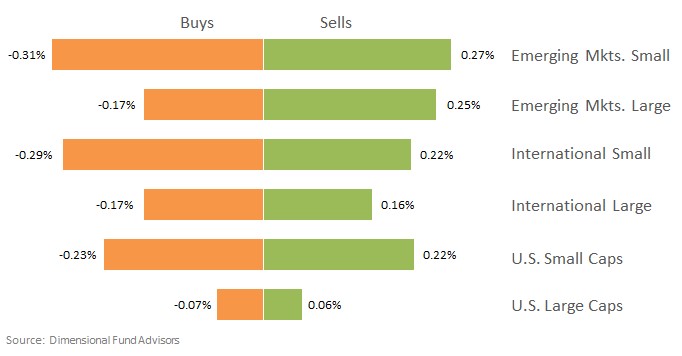

The graphic below shows the results of over $160 billion worth of Dimensional’s trades spanning three years and across 40 countries. The bar graphs reveal that, on average, DFA pays lower prices when buying stocks and receives higher prices when selling relative to other market participants’ trades. DFA’s advantage has been greatest in less-liquid parts of the market, particularly small cap and emerging market stocks. These small differences really add up over time, confirming the value of a flexible approach.

Trading Flexibility Pays Off

Dimensional Avg. Trade Price Differential, 2010-2012

How does this benefit Vista clients? We often favor low-cost, broad-market index funds in the most liquid parts of the market (i.e., large cap U.S. stocks) and utilize Dimensional funds in parts of the market where it clearly has paid to be patient.

Sometimes, it is OK to be particular and demand immediacy, like Frank. Other times, it’s best to walk away from the negotiating table, like Bob. A flexible approach gives shoppers their best chance of finding just what they’re looking for—higher returns.