You can’t open a newspaper or magazine without seeing ads promoting the latest “hot” mutual fund. These ads, often featuring a sharply-dressed, middle-aged fund manager, read something like this: “Meet Chuck. His fund just outperformed the S&P 500 Index for the fifth year in a row.” The implication, of course, is that Chuck will continue his winning ways and by investing now you can benefit from his market-beating wisdom.

The promotions clearly work, as funds with stellar recent performance attract new money from investors who shift assets from poor-performing funds. This pattern of behavior is not surprising as investors naturally seek to maximize returns. By following this trend, however, investors ignore the most important advice contained in the advertisements’ fine print: past performance does not necessarily predict future results.

A recent study by The Vanguard Group highlights just how costly ignoring these eight simple words can be.

Using Morningstar’s mutual fund database, Vanguard analyzed the performance of all the actively-managed stock mutual funds in the U.S. from 2005-2010. Vanguard then ranked funds by performance quintiles, or five equal groups of 20%.

The top 20% of performers were then followed in the subsequent five-year period from 2010 through 2015 to answer the question—do winners repeat?

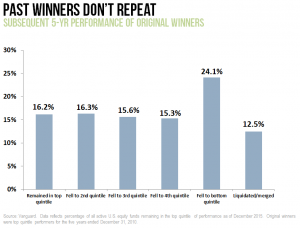

The graphic above displays Vanguard’s findings. Of the winning funds from the previous five-years, just 16% remained in the top 20% in the subsequent period. In a result suggestive of pure randomness, an almost equal number of funds fell to the 2nd quintile, 3rd quintile and 4th quintiles, respectively, of the performance rankings. Notably, 24% of past winners fell to the bottom of the performance rankings, while 12.5% went out of business (“liquidated/merged”).

In other words, it was more than twice as likely for a past winner to fall to the bottom in the next period, or cease operations altogether, as it was for it to remain a top performer.

The results of Vanguard’s research reaffirm the well-documented lack of performance persistence among actively-managed funds. An earlier and separate review of the best twenty U.S. stock funds during the 1983-1993 decade, for example, found that sixteen failed to even match the index benchmark (much less outperform) in the subsequent ten years. Ten years might seem long enough to deduce the winning managers had above-average skill, but no, 80% of the winners from one decade became losers in the subsequent decade!

This is precisely the type of evidence which led Vista to widely adopt the use of index funds when we first opened our doors in 2001. Very few firms embraced our approach fifteen years ago, but as we like to say, taking the unconventional route is a simple decision when you’ve got the evidence on your side.

Today, the tide is turning in our direction. More than $236 billion poured into The Vanguard Group’s mutual funds in 2015, a clear sign of the shift away from money managers who try to handpick winners.

Wall Street fund companies and their giant marketing budgets, however, aren’t taking this this lying down. Indeed, today’s financial publications are full of new ads promoting smart guys like Chuck and his market-beating fund. Feel free to ignore these ads—except for the very important words in fine print at the bottom.