It’s getting hard to avoid this “uncertain market.”

Every time we listen to the radio, watch TV or open our email, it seems we’re bombarded with ways to “protect ourselves from the volatile market.” Clearly, the Wall Street marketing machine has kicked into high gear, promoting the latest in whiz-bang financial products promising stability amidst uncertainty.

There’s just one problem: The market today is no more uncertain than it’s ever been.

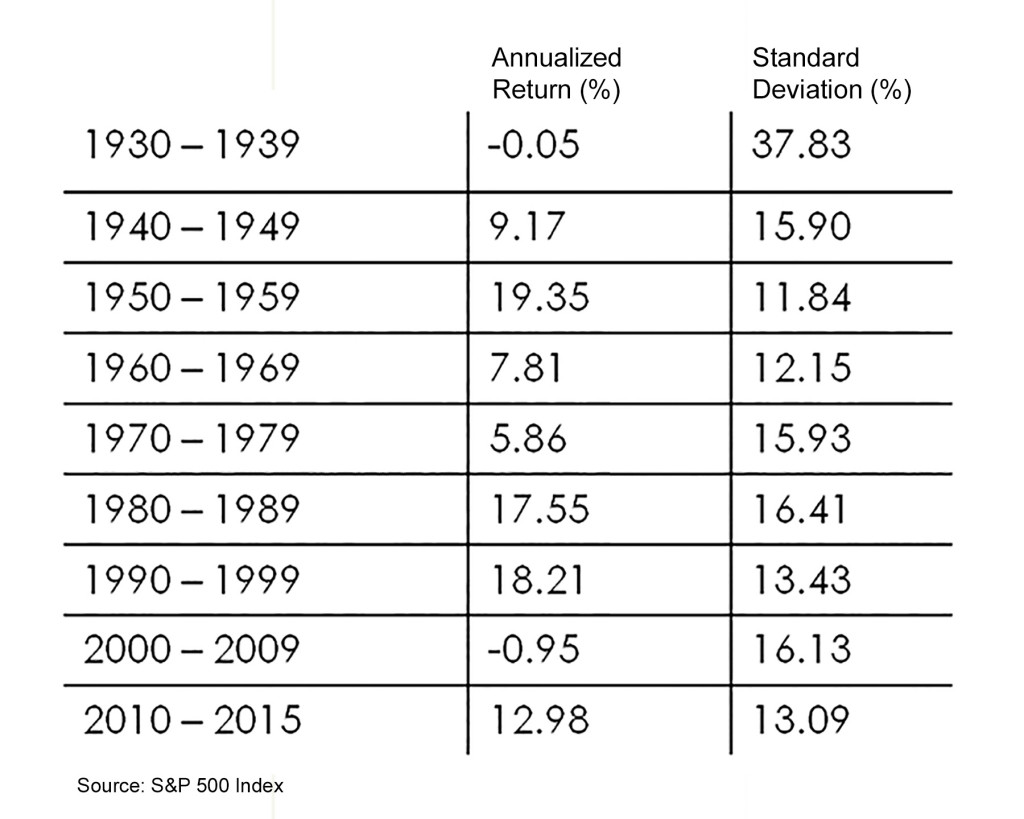

While we’re only six full years into this decade, volatility—one measure of uncertainty—has been mild relative to history.

The graphic below displays the annualized returns of large company U.S. stocks, by decade, along with the accompanying standard deviation (volatility) of those returns. Stock volatility from 2010 through 2015, at just over 13%, was lower than all but only two previous decades in history. (Remember, for any level of return, a lower standard deviation is better.)

We think a discussion of whether markets today are more or less certain than those of the past risks missing the more important point: Volatility is exactly what we should expect in well-functioning capital markets, as investors digest and act upon new (and often conflicting) information. Uncertainty is part of investing, and the chance to earn a commensurate return is the reward for bearing such risk.

Let’s pretend for a moment, however, markets are more volatile than normal. What’s the appropriate strategy? In promoting the latest “low volatility” product creation, Wall Street implicitly yells “do something!” when a review of the evidence suggests a smarter approach is to stay disciplined and simply do nothing.

In 2015, plunging oil prices and shock waves from China both contributed to stock volatility. Yet, 75% of actively-managed U.S. stock mutual funds underperformed the buy-and-hold investor who was content to simply buy a share of American business, sit back and relax.1

A turbulent year for the bond market, highlighted by the first Fed rate increase in years, proved not to be an environment for active bond managers to shine, either.2 Of the actively-managed funds seeking to outperform a broad basket of intermediate-term bonds, 93% failed to do so.

Results like these suggest, yet again, the best way to deal with uncertainty is to focus on those few factors within our control—our asset mix, the costs we pay and the taxes we face. Oh, yes, and our ability to remain disciplined amidst all the noise.

_________________________

1, 2 S&P Dow Jones Indices. SPIVA ® U.S. Scorecard, Year-end 2015.