Early on the morning of February 2, about forty thousand revelers gathered at Gobbler’s Knob, awaiting the emergence of arguably the country’s most famous forecaster: Punxsutawney Phil, the groundhog.

According to legend, if Phil sees his shadow, the U.S. is in for six more weeks of winter weather. If Phil doesn’t see his shadow, we can expect an early spring.

That same morning, just a few hours’ drive east of Punxsutawney, at CNBC’s headquarters in New Jersey, a far less festive group of forecasters assembled. They performed a similar analysis, but instead of Phil’s shadow, evaluated something known as the “January Barometer.” It states the performance of the S&P 500 Index in the month of January predicts the market’s direction for the entire year.

This January was a particularly poor month for stocks, with the S&P 500 falling nearly 5%. That ranks as the ninth worst January on record, and has amplified the attention paid to the alleged predictive power of one month’s return. Unlike CNBC’s forecasters, we would caution investors from making investment decisions based solely on one month of performance.

This is not to say stock markets around the world don’t face challenges, because they do: stress in the energy sector, an economic slowdown in China, and geopolitical risks in the Middle East, to name a few. Investors continuously factor these issues into their investment decisions, which is why prices are lower. These issues could very well continue capturing our attention throughout the year.

But it would be unwise to conclude the market’s performance in January tells us anything about returns for the rest of the year.

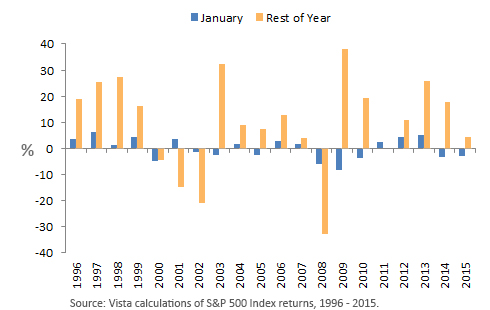

January Stock Returns vs. Rest of Year

The graphic above shows the return for the U.S. stock market for both January and the rest of the year in each of the past 20 years. Remarkably, in nine of the twenty years, stocks posted a negative return in January. But in only three of those years did stocks also decline over the remaining eleven months. To be sure, January has not been a good predictor of returns for the rest of the year.

Incidentally, Punxsutawney Phil didn’t see his shadow this year, implying we should expect the lousy weather to end soon. The January Barometer, however, shouldn’t guide our expectations for future stock returns.

Market performance in the coming months will be a function of whether company earnings turn out to be different from what investors already expect, and thus have already incorporated into prices. The U.S. stock market’s performance in January will have nothing to do with it.