It’s been fifteen years since the Oscar-nominated film O Brother, Where Art Thou? was released. Loosely based on Homer’s Odyssey, the satirical tale follows three escaped convicts as they run from the law in search of buried treasure.

For nearly the same length of time, value stocks—those bargain-priced shares which often pay higher dividends—have underperformed growth stocks. As a result, investors who favor value stocks almost certainly feel like they’re on an unrewarding investment odyssey of their own.

How can this be? Aren’t value stocks supposed to deliver higher returns than growth stocks?

Yes—in theory. Academics have long pointed out that investors should rationally expect to be compensated for the risk of owning stocks. The higher a company’s perceived risk, the higher rate of return investors should expect. In demanding higher returns, investors pay lower prices for a company’s stock, relative to its earnings, cash flow or other fundamental measure. Paying lower prices, the theory goes, paves the way for higher future returns.

Historically, the evidence supports the theory. Since 1927, large cap value stocks in the United States have returned 11.1% per year while large cap growth stocks have delivered 9.4%. Among small caps, the performance advantage of value has been even greater. Small cap value stocks have returned 14% per year while their growth counterparts have returned 9.2% per year.[1]

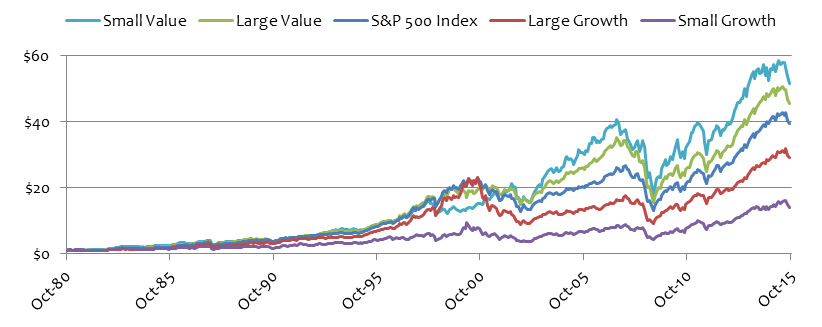

Compounded over the past 35 years, the performance advantage of small caps would have led to a nearly four-fold difference in the ending value of $1, as illustrated below.[2]

Recently, however, this hasn’t been the case at all. Value stocks have underperformed growth stocks in dramatic fashion. In fact, since November 2005, value stocks in the United States have returned less than 7% per year, while growth stocks have returned just north of 9% per year.[3] Internationally, this underperformance of value stocks has been similar.

O Value, Where Art Thou? Should this prolonged absence of any premium cause investors to now question the value of value stocks?

Hardly. A “disappearing” value premium, even over a ten-year stretch, is nothing new. In fact, since the late 1970’s, 27% of all rolling ten-year periods have seen a negative value premium.[4] Said differently, if at any point in the past 35 years you’d evaluated stocks’ performance over the previous decade, 30% of the time you would have found that growth stocks had outpaced value stocks. It happens.

This is just one of the reasons why a properly-diversified stock portfolio includes not only value stocks, but growth stocks, publicly-traded REITs, as well as developed- and emerging-market international stocks. Even the steeliest of investors may lack the emotional fortitude to adhere to a concentrated strategy which remains out of favor for so long.

Ironically, it is this uncertain investment journey in the absence of the value premium which may set the stage for its eventual return. As returns languish, investors sell, prices fall and the opportunity for disciplined investors to earn the premium is restored.

This reversal of fortune can be swift and unexpected, like in the movie O Brother, Where Art Thou? Just as occurs toward the film’s end—the convicts are set to be hanged by the sheriff, only to be saved by the bursting of a dam which floods their immediate surrounds—markets can turn in an instant and the value premium can return with force.

Consider, for example, the decade ended October 2000. Growth stocks in the U.S. had outperformed value stocks by 2.1% per year over the preceding ten years. Yet just seven months later, a look in the rear-view mirror provided a completely different picture of trailing ten-year performance: value stocks had outperformed growth stocks by 2.4% per year.

How can this be? Remarkably, in the five months from November 2000 through March 2001, value stocks outpaced growth stocks by a whopping 35%. In other words, we should be careful about extrapolating the recent past into the future—both can change quickly!

[1] January 1927 through December 2014; Fama/French Indices, with utilities.

[2] Growth of $1, October 1985 through October 2015. Russell 1000 Value and Growth Indices for large cap; Russell 2000 Value and Growth Indices for small cap.

[3] November 2005 through October 2015; Russell 3000 Value and Growth Indices.

[4] 10-year annualized performance difference, Russell 3000 Value Index minus Russell 3000 Growth Index.