Millions of Medicare beneficiaries, including many Vista clients, will likely face steep premium increases next year. The spike may be short-lived, however, as premiums are expected to go down again the following year.

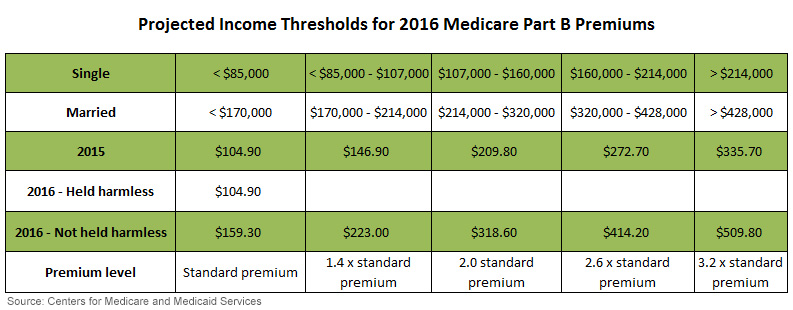

Medicare Part B, which covers physician and outpatient hospital services, requires beneficiaries to pay a premium representing one-quarter of the program costs. Premiums are set each year by the Department of Health and Human Services, with most beneficiaries paying the standard premium of $104.90 a month in 2015. Individuals with a modified adjusted gross income above $85,000 and married couples with a modified adjusted gross income above $170,000 pay higher premiums.

A recent analysis from the Center for Retirement Research (CRR) at Boston College noted a complication in the way Medicare premiums interact with Social Security benefits. Under the “hold-harmless” provision, Part B premiums may not increase more than the Social Security cost-of-living adjustments (COLA) for a given year. Due to low inflation, it is projected there will not be a COLA next year—marking the third time in 40 years without an adjustment. The 2016 COLA will be confirmed later this month.

The hold-harmless provision does not include beneficiaries who pay income-related premiums, new Medicare enrollees in 2016, or those who do not have their premiums deducted from Social Security payments. Approximately 70 percent of recipients are protected by the provision, leaving the remaining 30 percent to shoulder any increased premiums. The recent Medicare Trustees report projects this will push the standard premium for Medicare Part B to $159.30, a 52 percent increase for the year.

The CRR notes that higher-income participants could experience even larger premiums, as they would be subject to “multiples of $159.30 depending on their income level.” The chart below depicts projected multiple amounts of the standard premium for the five MAGI brackets—which are based on the most recent tax return. Medicare premiums for 2016 will be based on a 2014 tax return filed in 2015.

If higher premiums do go into effect, it’s unlikely to be permanent. Presuming inflation increases—and an associated COLA occurs—Part B premiums would likely decrease, as those sheltered by the hold-harmless provision could then incur premium increases. As a result, the Medicare Trustees estimate a standard Part B premium of $120.70 for 2017.