On August 18, U.S. stocks posted the first of what turned out to be six straight days of declines. That week, the S&P 500 Index dropped nearly 12%. While U.S. stocks have rebounded in the days since, the psychological impact of such swings can have a lingering, unnerving effect on investors.

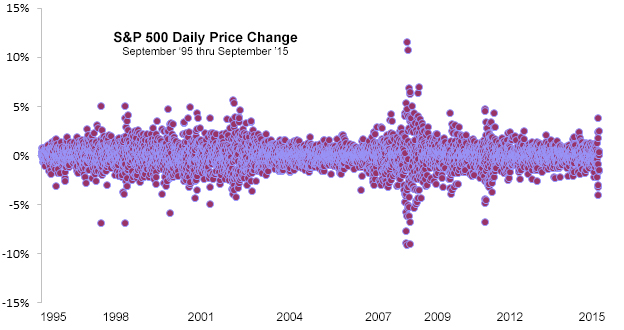

Students of stock market history understand such market turbulence is part of investing. In the graphic below, each dot represents the daily percentage change in the S&P 500 Index. This shows market fluctuation has clearly increased recently, yet appears normal relative to volatility experienced over the past 20 years.

Source: Morningstar 2015.

How can we interpret the periods of volatility? For starters, we must remember why stock prices move up and down. Prices move because investors are free to trade every minute of every day. In well-functioning markets, we should expect prices to move as investors digest and react (trade) to the constant stream of new, and often conflicting, information. The price of this liquidity? Occasional, and normal, bouts of volatility.

We should recognize, too, such fluctuations in price occur for all sorts of assets, even if prices aren’t regularly observable. Consider real estate. The fact we don’t see daily home prices streaming across a ticker tape may mask underlying price volatility, but it certainly still exists.

Suppose you own a home in one of the four Western states ravaged by wildfire this summer. Hundreds of thousands of acres went up in smoke, entire neighborhoods evacuated and thousands of homes were lost. What price would you have fetched, should you have required an immediate, 100% cash offer? Not in 30 or 60 days after inspections, back-and-forth negotiations, or the arrangement of mortgage financing—but all cash on the spot. How did fire conditions influence what buyers were willing to pay?

Similarly, what likely happened to prices of Portland and Seattle real estate the day after The New Yorker’s article profiling “The Really Big” earthquake forecast to hit the Pacific Northwest was published? It seems reasonable to think a forced seller that day may have experienced a little of the indigestion that has become routine for experienced investors in the public, highly-liquid stock market.

In accepting volatility as part of investing, a little perspective may help:

Risk and return go hand-in-hand—In the past 20 years, stocks have declined on 46% of all trading days and big losses of more than 1% occurred about every seven days or so. Yet $100,000 invested in the S&P 500 Index over this 20-year period grew to more than $420,000. Clearly, capturing this growth required discipline and patience.

Diversification is your friend—In volatile markets, investments which usually move in different directions can suddenly tumble together. That is why an allocation to safe bonds can be so important. High-quality government bonds are one of the rare investments that do well when stocks and other assets fall sharply, as we saw in 1998, 2003, 2008, 2011 and again recently. Safe bonds are the best shock-absorber for the bumpy ride stocks so often provide.

Ignore the hype—Experts touted in the financial press would have us believe active stock-pickers and market-timers shine during periods of heightened volatility. Yet through August, 66% of all U.S. mutual funds categorized as “large cap blend” by Morningstar underperformed the S&P 500 Index. Clearly, volatile or not, the market is no more or less predictable than it has ever been.

Having a mind-set that accepts volatility allows investors to remain focused on their long-term investment goals.