Don’t let the headline scare you—we’re not predicting a big market crash.

But we do want to provide some perspective on what’s become a hot topic in the financial press this year. On August 11, three major market averages—the Dow Jones, Nasdaq Composite and S&P 500 Index—each reached a record high. This is the 8th new record for the 30-stock Dow Jones Industrial Average this year; the S&P 500 Index of large U.S. stocks has reached an all-time record on nine occasions.

Despite the wealth these new highs have created, many investors remain nervous. Why? The new highs themselves. The 7-year bull market for U.S. stocks—the S&P 500 is up nearly 250% since March 2009—has many thinking returns have been too good for too long. Don’t today’s record levels increase the odds of negative future returns?

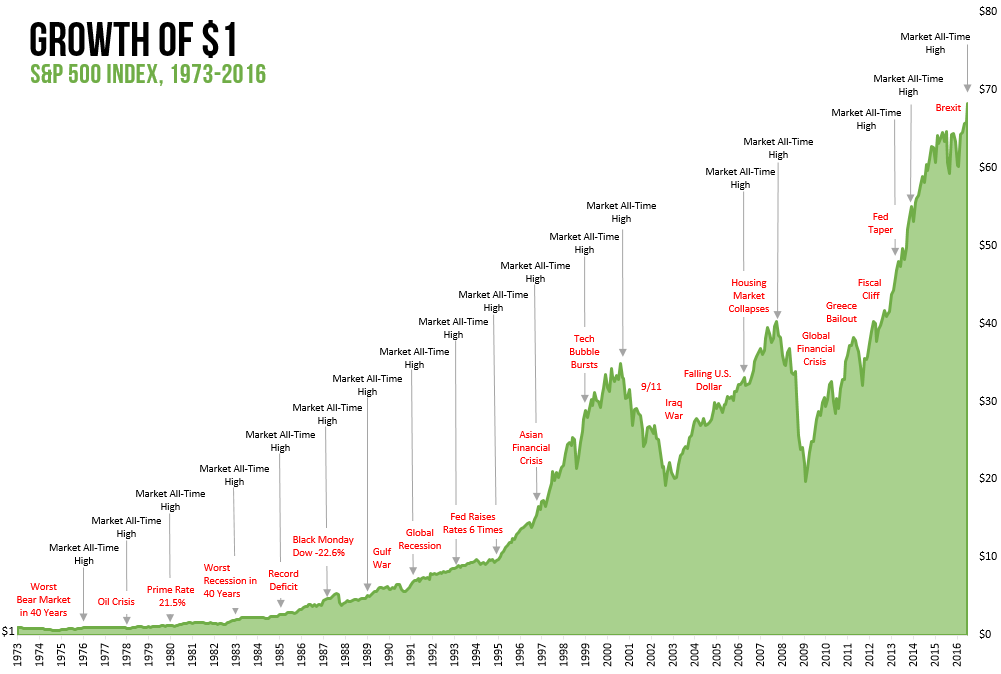

No. As we’ve written before, a new market high doesn’t tell us much about future stock returns. What we do know for certain, however, is that in the months and years following a new record, stock markets have gone on to reach even higher levels far more frequently than they’ve pulled back. Betting on a market crash after a new high, as the graphic below shows, simply hasn’t paid.

Besides, not all parts of the stock market are hitting new highs. Yes, both the price level and price-earnings ratio of the S&P 500 are above their historical averages. But significant portions of a well-diversified Vista portfolio aren’t anywhere near as pricey. For example, the stocks of small value companies in the U.S., international and emerging markets remain at, or near, their average valuations over the past decade.

New highs are reached because companies find ways to provide goods and services to the world’s growing population at a profit. Over time, these growing profits push stock prices to ever loftier levels. Remarkably, U.S. stocks have hit a new market high about every fourth month since 1926.

This is not to suggest we shouldn’t always be prepared for turbulence. Stocks have historically lost money in one of four calendar years, so market risk should be a part of every investor’s expectation. The best way to manage this risk is not by attempting to get out of stocks before they fall—a nearly impossible task that appears easy only with the benefit of hindsight—but by committing a portion of one’s assets to truly safe bonds.

So don’t worry too much about these latest market milestones. With time and patience, disciplined investors are almost certain to benefit from a new market high in the future.